How to Invest in Stocks: A Beginner’s Guide

Aug 02,2023

Making the first steps in the stock market with so many investment options can be challenging. However, purchasing stocks can be a powerful tool to make much of your investments.

In this article, we will dive into the idea of stocks, discuss their types and give some tips on how to begin investing in stocks and become successful in the market.

Key Takeaways

- Investment is the acquisition of assets aimed at generating profit.

- Stocks are shares of capital in a company. If you buy a company’s stock, you become an owner of part of this company.

- Stocks can be grouped into three categories: blue-chip, growth, and penny stocks.

- You can start stock investing through mutual funds, ETFs, or buying individual stocks.

- You can manage your stock portfolio without any assistance, hire a financial adviser, or use a robo-advisor.

What An Investment Is :

An investment is the acquisition of an asset to generate income as a result of the asset’s value growth in the future.

When investing, we always expect that the value of the acquired asset will increase and, thus, our investments will bring income.

Investing primarily aims to make your money work and generate income instead of just holding cash.

Investment of your funds has several advantages when compared to merely holding the funds in your bank account:

- Investment can bring you higher yield;

- Investments can protect your assets from inflation in times of economic recession;

- You can have passive income through the distribution of dividends;

- You don’t need large amounts of funds to start stock investing.

Understanding Stocks Investment

There are multiple ways to invest your funds; thus, you can invest in Forex, cryptocurrencies, or commodities.

However, if you are a beginner, stocks are the most straightforward asset to invest in.

Stocks are shares of capital in a public company. If you buy a company’s stock, you become an owner of part of this company.

There are two ways of getting a potential income from the stock investment:

- You can buy a stock at a lower price and sell it at a higher price, thus profiting from the price spread.

- You can get a share of the company’s profits through dividends, thereby receiving a stable income.

You can invest in three types of stocks: blue-chip, growth, and penny stocks. Let’s consider all of them in more detail.

Blue-Chip Stocks

These are stocks of the highest-quality companies in the market. Blue-chip stocks are a reliable and beneficial investment despite market fluctuations.

Among the most distinct characteristics of companies with blue-chip stocks are a long company history and sustained growth, their positions in the major market indexes, like the Dow Jones or NASDAQ, and the generous and steady dividends these companies pay to their stakeholders.

Blue-chip stocks are characterized by low volatility. The companies benefit from scale and profit significantly from multiple services and products. Though such companies are not immune to major economic downturns, their stocks remain rather stable even in times of market volatility.

Due to the long history and leader’s status, blue-chip stock companies guarantee transparency of financial operations in the stock market as well as generous dividends to their stakeholders.

In spite of all the advantages, blue-chip stocks are rather expensive, and they show very slow, though steady, growth.

Among the blue-chip stocks, you can find such renowned companies as Apple, McDonald’s, Visa, and IBM.

Many investors consider blue-chip stocks a good investment for most portfolios thanks to their lower risks and consistent performance.

Growth Stocks

As can be seen from the name, growth stocks show a fast price increase and outperform the market.

Growth stock companies are characterized by market-beating growth, higher earnings, and high price-to-earnings ratio. Their key feature is that they do not pay dividends.

They can be found in the tech sector; these are mostly young innovation-prone companies. Such companies as Tesla or Netflix can relate to growth stocks. Online retail and fintech companies like eBay, Rakuten, and PayPal are also examples of growth stocks sector.

Investing in growth stocks can be very profitable due to these companies’ rapid development and success. However, such stock market investments are considered very risky since growth stocks are very sensitive to business cycles and economic issues and are very volatile. Plus, such stocks are quite expensive and sometimes even overpriced when investors drive their share prices high.

Penny Stocks

Penny stocks are the most risky investments. These are mostly the low-cost stocks issued by new or small companies.

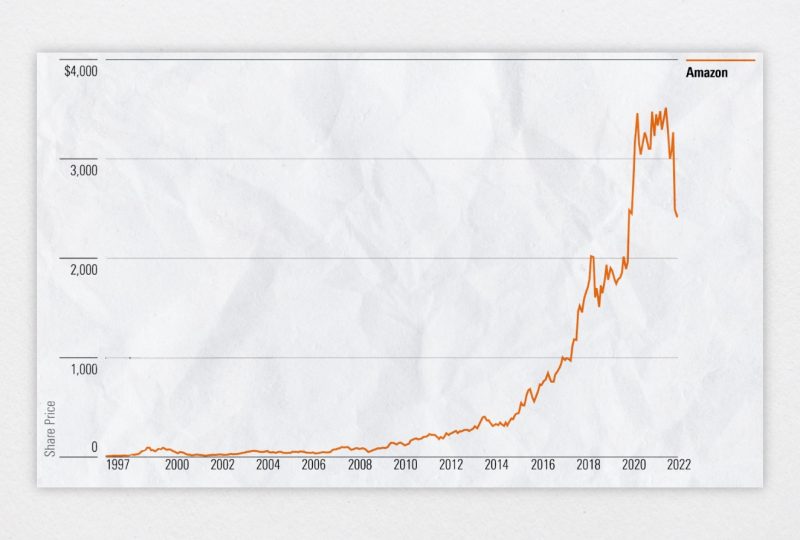

But that penny stocks are cheap does not mean they are bad. For example, Amazon was once a penny stock that cost $1.68 per share. One of the advantages of penny stock is that you can buy a cheap stock of a currently small and unknown company and, in some time, become the owner of a growth stock or even a blue-chip stock.

However, to trade penny stocks, you have to be highly professional and have a lot of experience in the industry.

Penny stocks are extremely risky and volatile assets. Plus, they are mostly considered illiquid, and the lack of transparency and sufficient information result in the fact that penny stocks are highly exposed to fraud and other illegal activity.

How to Start Investing in Stocks

If you are new to the stock market, investing in stocks can be overwhelming. Here are some steps you can take to start investing in stocks with minimum loss.

Step 1. Get Acquainted With Various Stocks and Funds

There are several ways to invest in stocks. They all have advantages, so spending time exploring investing funds and stocks and choosing the one that meets your investment objectives is worth the time spent.

Individual Stocks

Buying individual stocks can be a good option if you want to invest in a specific company or companies. This approach can be an excellent way to start investing if you have enough time and desire to investigate the market and do thorough research and evaluation of stocks on a constant basis.

Mutual Funds

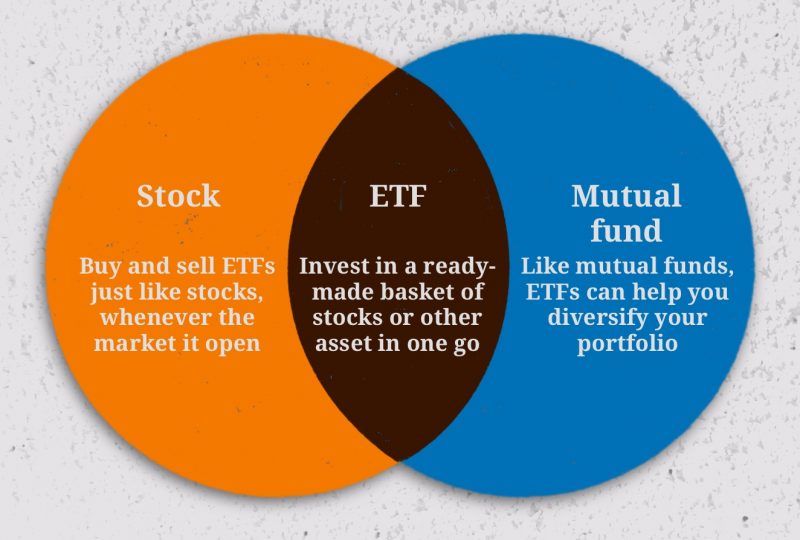

Mutual funds accumulate assets from different shareholders to invest in stocks. Mutual funds are managed by professional fund managers. They aim to produce income for the fund’s investors by distributing the assets available in the fund. If you buy a share of a stock mutual fund, you can profit from dividends, capital gains, and interest income.

ETFs

Exchange-traded funds (or ETFs) are similar to mutual funds. They trace a particular sector, company, individual commodity, large and diverse collection of securities, or other asset. ETFs’ difference from mutual funds is that ETFs can be bought and sold on a stock exchange just like regular stocks. In other words, ETFs are a pool of different securities that are traded like stocks. ETFs provide greater diversification than owning an individual stock.

Step 2. Choose How You Want to Invest

There are various ways to buy stocks. Choosing one should be based on understanding how much effort and guidance you want to get in managing your investments.

Brokerage Account

If you have a basic understanding of investments, you can open an online brokerage account to buy stocks. Thus, you can choose and buy stocks independently and at your discretion.

Financial Advisor

If you lack some investing knowledge or you prefer to have more guidance for buying stocks, you can hire an advisor. The advisor can help you define your financial goals and buy and manage your investments for you. However, remember that financial advisors charge fees for their services. These can be a per-trade fee, a flat annual fee, or a percentage of the assets they manage.

Robo-Advisor

Robo-advisors are a simple and affordable way to invest in stocks. Robo-advisors distribute your money along different portfolios of ETFs, and ETFs, in turn, buy the assets and manage the investment portfolio for you. Though robo-advisors are more affordable than financial advisors, there are fewer options for guidance and investment advice.

Direct Stock Purchase Plan

A direct purchase plan can be a good option for buying a few stocks. Many companies offer such plans that enable you to purchase a company’s stock directly from the company without commissions. However, you may be charged other fees when selling or transferring your shares.

Step 3. Set Up Your Investment Goal

Before starting to invest in stocks, it is crucial to understand your goals and why you want to start investing in the first place. This will help you to create an investing strategy later on.

If you are unsure of your goals, it is better to review your financial situation and make a financial plan first. Decide what you want to invest for, be it a down payment on a house or retirement savings. Understanding the objectives will help you define how much funds you need to invest in stocks. Finally, consider how much risk you can take based on your current financial situation since investing is inextricably linked to possible risks, and you can lose your money as quickly as you can earn them.

Step 4. Decide On The Budget To Invest In Stocks

The stock market is a place both for experienced investors and for beginners. Though it might seem a safe place for investments, it is essential to remember that various factors can affect stocks, which may lead to the loss of your funds.

The general rule for stock investments is to refrain from investing the funds you might need for the next five years.

The stock market is expected almost certainly to rise in the long run; the short-term stock prices are very uncertain and exposed to various factors. For example, during the COVID-19 pandemic, the stock market dropped by more than 40%. However, it rebounded to an all-time peak within a few months.

Step 5. Define Your Investment Strategy

Your strategy is a set of parameters defining your market behavior. When defining your strategy, consider your financial goals, risk tolerance, and time horizons.

Commonly there are two main approaches to investing.

- Active investing. This strategy requires purchasing and selling your assets based on market conditions. This approach can be risky, so it works best for more experienced investors.

- Passive investing. This strategy is based on a buy-and-hold approach focusing on buying and holding investments as long as possible. A buy-and-hold approach is better for beginner investors.

Step 6. Manage Your Portfolio

At the final step, you can start managing your portfolio. This is easier with a human financial advisor or robo-advisor. In these cases, the advisors will manage your portfolio and keep you to the plan.

Managing your own portfolio means you have to make many investment decisions, such as when to sell a stock, when to buy or sell more stocks, or what to do if the market dips. You also will have to deal with the diversification of your portfolio by investing in different types of investment vehicles and industries. These decisions require profound knowledge and understanding of stock markets.

If you have selected an active investment strategy, you need to keep up with market news to make the best decisions.

Investment Practices You Should Avoid

Being a beginner stock market investor can be exciting and challenging. In pursuit of profit, it is easy to make a false step and opt for the wrong or even harmful investment strategy. Here are some common mistakes that novice investors should avoid to achieve future success in the stock market.

Investing All Your Assets

Investing all your available funds is a very bad practice that can lead to losing all your assets. Stock investing requires deep knowledge of the market, and if you are unsure about your trading skills, do not invest large amounts and always be ready to tolerate losses.

Having no Understanding of the Stock Market

If you have decided to trade individually without a basic understanding of the stock market, you may lose all your assets. Before opening an investment account, investigate the stock market and thoroughly research available trading strategies and possible risks. Some exchanges have demo programs where you can try trading stocks without the risk of losing your funds. Remember to always keep up with the market news. Having a good understanding of how the stock market works will help you not only save your money but also gain profit from stock investments.

Being Very Emotional

Beginner investors tend to act impulsively and immediately respond to the slightest price movements in the stock market, which often results in trading mistakes and funds loss. To avoid failure, set the loss limit you are ready to tolerate. For example, you will sell your stocks only if their price falls by 20%.

Buying Stocks in One Sector or Company

If you buy stocks of only one company or a sector, the risk of losing a lot of funds is very high. For example, if you buy only oil company stocks, you will risk your investments if the oil prices decrease. Diversifying your investments by investing in stocks of various companies and industries is a good practice that can minimize the risk of losses.

Best Stocks For Beginner Investors

As a new investor, it can be wise to start from small yet determined steps and expand your investments as your skills develop.

When selecting stocks for investments, it is essential to consider the factors that impact stock prices. Here are some unobvious factors that can significantly affect stock prices:

- The monetary policy of central banks. If the interest rates are low and the asset buyback program is expanded, the stock prices increase. On the contrary, higher interest rates and reduced asset buyback programs lead to decreasing stock prices.

- Macroeconomic indices. Inflation and unemployment rate, as well as the gross domestic product index, can influence the decisions made by central banks and investors’ sentiments, which in turn impact the stock prices.

- Raw material price. They can significantly impact the companies’ profit, resulting in an increase or decrease in companies’ expenditures, leading to stock price fluctuations.

- Weather and geopolitical issues. The weather conditions can significantly affect agricultural goods, such as grain or corn, while raw materials, such as metals, are exposed to geopolitical turmoils.

Besides the factors influencing the stocks, it might be helpful to analyze some companies that proved profitable for a significant period.

Over the past 30 years, various industries and sectors have risen to new heights while others have declined. According to the Kiplinger research, the following companies became the best long-term investments in the stock market and turned out to be the most profitable stocks:

- Apple. Starting from its foundation, the company had its ups and downs, and now its stocks are one of the most profitable investments.

- Microsoft. Another legendary company that was going to be forgotten after the sales of computers decreased. However, Microsoft rerouted its activity from computers to innovative cloud solutions, and its stocks are now highly profitable.

- Amazon. The company is another example of a small company that developed into a company with the stocks annualized gain of 31.1%. Besides, most of the best stocks get their returns by paying generous dividends.

An interesting fact: The stocks of Coca-Cola, Amazon, and Altria (Malboro’s parent company) are considered the most profitable stocks of all time.

The stocks of these companies have proved to be a profitable and reliable investment that can bring both short-term and long-term benefits. Investing in these stocks can be a good option both for experienced investors and those who make their first steps in the industry.

Conclusion

Stocks market growth rapidly and providing thousands of opportunities for experienced investors and for the beginners in the market. Learning how to invest money in stocks can be challenging but in fact it is a matter of figuring out your investing goals, defining your budget and understanding trading strategies. Moreover, wise stock market investments can be very beneficial.

FAQs

Do I need a lot of money to start investing?

No. Many brokers have no requirements for minimum initial investment, and you can start with a small amount. However, take into account possible expenses such as trading fees, income tax, and transaction fee.

What are the risks in stock investments?

The risk of investments depends on the asset type. Some asset classes are riskier than others. The common risk is that your investments will not increase with time. There is also a risk of losing money invested in the market in case of investment mistakes. To avoid possible risks, try to set clear investing goals, select a suitable trading strategy, choose a risk management strategy and set up your risk tolerance.

What are the best stock market investments for beginners?

Most experts claim that ETFs and mutual funds are best options for beginner investors, since with their help you can purchase a significant piece of the stock market in one transaction.