Institutional Forex Liquidity Explained: Why Do We Need It?

Jun 23, 2023

Just as life is characterized by constant change, so is the world of finance, with money in perpetual motion across the globe. This continuous financial flow is powered by one crucial element: liquidity. Particularly in the Forex market, which is the world’s largest and most liquid financial market, institutional Forex liquidity is the underpinning force.

This piece will discuss the ins and outs of institutional forex liquidity and its role in shaping global economics.

Key Takeaways

- Institutional Forex Liquidity refers to the swift execution of large forex trades by institutional players with minimal price impact.

- Banks, prime brokers, market makers, and other financial figures are key institutional Forex liquidity players.

- Institutional players, through their high-volume trades, significantly influence currency exchange rates, market trends, and future trading system development.

Institutional Forex Liquidity From A to Z

Have you ever wondered how buying and selling different currencies (like dollars, euros, or yen) happens so smoothly in the Forex market? Well, that’s thanks to ‘Institutional Forex Liquidity.’

Understanding Institutional FX Liquidity

First, let’s understand what ‘liquidity’ means. Imagine you want to sell your old bicycle – if you can find a buyer easily, we can say your bicycle is ‘liquid.’ In Forex, which is all about buying and selling currencies, liquidity means trading a currency without making its price swing wildly.

But who always ensures someone is ready to buy or sell a currency? That’s where ‘Institutional Forex Liquidity’ comes in. This fancy term simply means the pool of money provided by big financial players like large banks and hedge funds. These big players always have prices for buying and selling different currencies, ensuring traders can trade whenever they want.

Now, why do we need this liquidity? There are three main reasons.

First, it promotes the price stability on the FX market. Large currency trades could make the prices jump up and down too much without plenty of buyers and sellers, which is bad for the market. More people will want to trade if the market is stable, making the market even more durable – a win-win!

Second, it helps everyone see the ‘real’ prices. In a market with many buyers and sellers, the prices you see more accurately reflect what the market thinks. Also, the difference between the buying and selling prices, known as the ‘spread,’ tends to be small, which is good for traders.

Lastly, it helps trades happen smoothly. If you want to buy or sell a currency, you can do it almost immediately because of high liquidity. Without it, you might face ‘slippage,’ meaning you might get a worse price than expected. This can make trading less profitable and more unpredictable.

Institutional Forex Liquidity is like the oil that keeps the Forex market engine running smoothly. It helps keep the market stable, shows the true prices, and allows quick trades. Whether you’re a big bank or a small trader, it’s a crucial part of a healthy FX market.

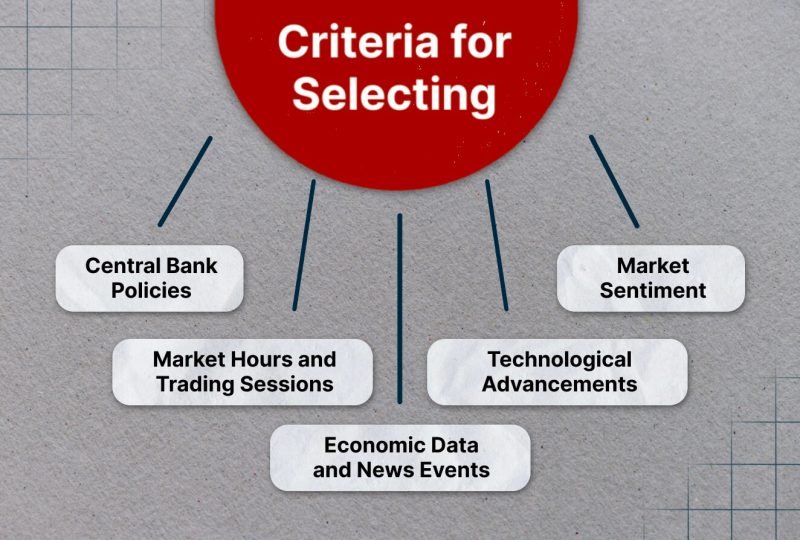

Key Factors Influencing Institutional Forex Liquidity

A variety of factors influence institutional Forex liquidity. It’s not static but rather a dynamic attribute of the FX market that varies according to market hours, economic events, central bank policies, market sentiment, and technological advances.

Market Hours and Trading Sessions

The Forex market is open 24 hours but is not always equally active. There are four main trading sessions: Sydney, Tokyo, London, and New York. When these sessions overlap, there’s more trading activity and, thus, more liquidity. For instance, the overlap between the London and New York sessions is usually the most liquid time of the day, when the largest number of traders are active.

Economic Data and News Events

News can greatly influence Forex liquidity. Big economic news or events like changes in interest rates, employment reports, or political elections can cause more traders to buy or sell. This increase in trading can lead to higher liquidity. However, it’s also worth noting that significant news can lead to extreme market volatility, which may temporarily reduce liquidity as traders wait to see what happens.

Central Bank Policies

The policies of big central banks like the U.S. Federal Reserve (Fed) or the European Central Bank (ECB) can also influence liquidity. These banks often buy or sell their country’s currency to control its value. When they do, they add to the pool of money available in the market, increasing liquidity.

Market Sentiment

Market sentiment, or how traders feel about the market, can influence liquidity too. If traders feel confident and positive, they’re more likely to trade, increasing liquidity. On the other hand, if traders are nervous or uncertain, they might hold back from trading, which can reduce liquidity.

Technological Advancements

Technology plays a key role in the liquid market formation. With technological advances, trading has become faster and more accessible, which has helped increase liquidity.

Electronic trading platforms allow trades to be made instantly and at any time, while algorithmic trading can execute trades automatically when certain conditions are met. These advancements increase the number of trades being made, thus enhancing liquidity.

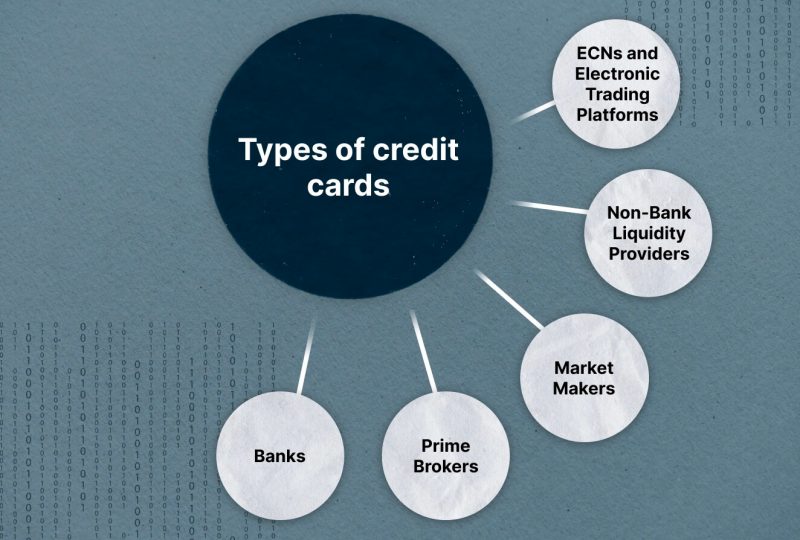

Who Are The Institutional Players In The Forex Market?

The Forex market, the world’s most liquid financial market, depends on various institutional players to ensure smooth operations. These players, known as Institutional Forex Liquidity Providers, comprise banks, prime forex brokers, market makers, and others. Let’s look at these vital contributors to the Forex market’s fluidity.

Banks

Banks, especially the large international ones, form the backbone of Forex market liquidity. Known as ‘Tier-1 Liquidity Providers,’ they deal in substantial volumes of currency for their own trading and on behalf of their clients.

The interbank market, where major banks trade with each other, represents the highest level of Forex trading. Some of the biggest players in this field include names like Deutsche Bank, Citigroup, and JP Morgan. They handle vast amounts of Forex transactions daily, contributing significantly to the overall liquidity of the market.

Prime Brokers

Prime brokers are another crucial component in the chain of liquidity providers. They offer services to other market participants, particularly hedge funds and high-volume individual traders, that need access to the Forex market.

A prime broker’s primary function is facilitating client trades, extending credit, and lending securities for short selling. By offering direct access to the interbank market and pooling multiple sources of liquidity, prime brokers help improve the overall market liquidity.

Market Makers

The market maker is an entity ready to buy and sell a particular currency pair at publicly quoted prices. They literally ‘make a market’ for a currency by offering to both buy and sell it, ensuring that trading can happen at any time.

They profit from the spread between the bid (buying) and the ask (selling) prices. Their constant presence in the market helps ensure a high degree of liquidity.

Non-Bank Liquidity Providers

With advancements in technology, the FX market has seen the rise of non-bank liquidity providers. These are firms like high-frequency trading firms or hedge funds that use advanced algorithmic trading strategies to provide liquidity.

They constantly buy and sell currency pairs, often profiting from tiny price movements over short periods. Despite not being banks, their high-frequency trading activities can contribute significant liquidity to the FX market.

ECNs and Electronic Trading Platforms

Electronic Communication Networks (ECNs) and electronic trading platforms have revolutionized the Forex market. These platforms aggregate liquidity from multiple providers and offer it to traders. They work as intermediaries, matching buyers and sellers in the market, which helps enhance market liquidity.

Institutional VS. Retail Investors: Two Primary Market Participants

FX market participation comes in different shapes and sizes, primarily categorized into two broad groups: institutional and retail investors.

These two types of participants have different roles, impacts, and market operation modes, particularly regarding Forex liquidity.

As discussed above, institutional investors are the big players in the Forex market, including investment banks, hedge funds, and other large financial markets. They deal with massive volumes of currencies and are often called institutional FX liquidity providers. Because of their size and trading volume, they significantly influence the market liquidity and can even impact the currency exchange rate.

For instance, when a bank buys or sells a large amount of currency, it can cause the currency’s value to move. Such big trades can shift the balance between supply and demand. Additionally, institutional investors can be restricted by regulations in terms of ownership stakes, especially when it comes to securities like stocks.

On the other side of the spectrum are retail investors. These are individuals like you and me trading in the Forex market. Unlike institutional investors, retail investors deal with much smaller volumes of currencies. Therefore, their impact on the overall market liquidity and exchange rates is comparatively minor.

Retail investors typically trade through brokers and do not directly contribute to the liquid market in the same way as institutional investors. Their trades are usually aggregated by brokers and then executed in the interbank market, contributing to the market liquidity as a whole.

Moreover, retail investors do not have the same restrictions as institutional investors regarding ownership. This means they can freely buy and sell smaller, thinly-traded securities without significantly affecting the prices or violating any laws.

Can Retail Investors Invest Like Institutions?

While the FX market might seem overwhelmingly populated by institutional investors with vast resources, it’s essential to remember that retail investors can also participate. But can, and more importantly, should you invest in Forex like an institution?

Can You Invest Like an Institution?

Technically, the answer is yes and no. As a retail investor, you can adopt some of the strategies institutional investors use, such as trend following, swing trading, or even automated trading. You can educate yourself about the market, follow the news that affects currency prices, and learn to analyze trends.

However, there are limits. Institutional investors can access vast capital, advanced technology, and dedicated teams of experienced analysts and traders. They can also directly participate in the interbank market, which is generally beyond the reach of retail traders. Therefore, while you can emulate some institutional practices, the scale and scope of your activities will be far less.

Should You Invest Like an Institution?

This is a more complicated question. One thing to remember is that Forex trading, like any investment, comes with risks. Institutional investors can bear big losses because they have substantial resources. As a retail investor, you must ensure you can tolerate the level of risk involved.

Remember that Forex trading is not just about making profits; it’s also about managing risks and losses. When you’re trading financial markets, liquidity needs to be considered before every position is opened or closed. This is due to the fact that an illiquid market is frequently linked to higher levels of uncertainty. It may be more challenging to terminate your position if the market is volatile yet there are fewer buyers than sellers.

Thus, while adopting institutional strategies can be beneficial, it’s equally essential to tailor your approach to your own needs and circumstances. Understand your liquidity risk tolerance, financial goals, available capital, and time you can dedicate to trading. Your strategy should be a reflection of these factors.

The Role of Institutional Liquidity in Future Trading System Development

As the role of information technology in market trading grows, we are seeing major developments in many dimensions of trading, two of which are particularly noteworthy: stability and liquidity.

The forthcoming surge of institutional capital is expected to bolster market liquidity in the principal markets significantly. This influx, in turn, fosters enhanced confidence, further drawing in those seeking new avenues for capital growth. In the current trading environment, conducting high-volume trades without profoundly impacting prices is generally feasible. However, a keen understanding of liquidity’s exact influence on trading and adopting a strategy cognizant of this factor remains paramount.

While today’s market is saturated with myriad companies and financial institutions capable of satiating market needs, particularly in highly liquid markets like Forex and cryptocurrencies, the future will usher in the emergence and growth of novel asset classes. This development will augment the demand for liquidity from institutional organizations to sustain the smooth functioning of supply and demand market mechanisms.

The Bottom Line

Consequently, institutional liquidity plays an instrumental role in the stability of market relations between market participants. This stability not only directly influences the evolution of trading systems, which facilitate the buying and selling of assets, but it also impacts the overall trading process.

As we look to the future of trading system development, institutional liquidity continues to be a key factor, ensuring fluid market operations and fostering an environment conducive to the advent of new asset classes.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.