What Is an Interest Coverage Ratio? How to Use This Financial Metric to Evaluate Company Health

Apr 29, 2025

In 2024, the average interest coverage ratio (IRC) in leveraged buyout deals dropped to just 2.3x. That was the lowest level seen since way back in 2007, and for many analysts, it set off alarm bells. It signaled that even heavily financed companies were feeling the pinch from rising interest rates and hefty debt loads.

But what is this ICR number really? Why does it carry so much weight when people talk about a company’s financial shape or its odds of stumbling on its debt?

Let’s break down what it is, how it works, and why it’s such a key piece of the financial puzzle today.

Key Takeaways:

- The interest coverage ratio basically shows if a company’s operating profits are enough to comfortably handle its interest payments on debt.

- A higher ICR suggests the company has more breathing room financially. It points to lower risk and means they’re likely managing their debt well.

- What’s considered a “good” ICR can vary a lot by industry, and factors like the company’s specific debt situation or unusual one-off events can change the picture.

What Is Interest Coverage Ratio?

At its heart, the Interest Coverage Ratio just tells you how easily a company can pay the interest it owes using the profits it’s making from its actual business operations. It answers a pretty crucial question:

“Can this business realistically cover its loan interest with the money it’s earning day-to-day?”

It’s a go-to metric for checking a company’s solvency because it zooms in on operational profitability, cutting out the noise from taxes or how the company is funded.

Why It Matters

Simple: if a company consistently earns way more than it needs for its interest payments, that’s usually a good sign. Lenders feel safer, investors feel more confident. It suggests they’re managing their finances well. Generally, a higher ICR means more financial breathing room and lower risk.

But if that ratio starts dropping low? If a company is barely earning enough to pay its interest, or worse, falling short? That’s a red flag. It could mean cash flow is tight, maybe their credit rating is at risk, or they could be facing real financial distress. This is why everyone pays attention, especially when money is expensive to borrow or the economy feels uncertain.

Context is Everything

Now, here’s the critical part: You absolutely cannot look at the ICR in a vacuum. A number that looks great for a software company might be alarming for a big utility company. What’s considered “good” or “safe” varies massively depending on the industry.

Plus, a company’s specific situation matters. How is their debt structured? Did they have a weird one-off event (good or bad) that skewed the earnings this quarter? The ICR is a clue, not the whole story.

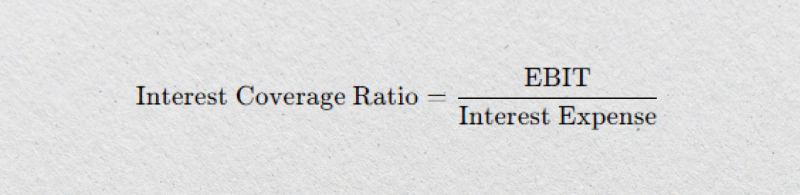

Interest Coverage Ratio Formula

Calculating interest coverage ratio ICR is actually pretty simple. You divide a company’s earnings (before interest and taxes) by its interest expenses for the same period.

The most common formula for interest coverage ratio looks like this:

Where:

- EBIT stands for Earnings Before Interest and Taxes.

- Interest Expense is the total interest the company owes on its debt over that period.

So, if a company has an ICR of 5x, it means its operating profit was five times bigger than its interest bill for that period.

Why EBIT? A Quick Look

EBIT shows you how profitable the company’s main business activities are before factoring in financing costs (interest) and taxes.

Using EBIT gives a clearer view of whether the core operations are generating enough cash to handle the debt, without getting sidetracked by the company’s tax situation or how it’s structured financially. It’s a standard approach that makes it easier to compare different companies more directly.

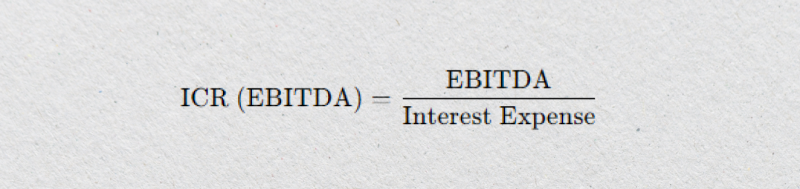

Quick Note: EBIT vs. EBITDA

Sometimes, especially when looking at companies with lots of physical stuff – factories, machinery, buildings (think manufacturing or utilities) – you’ll see analysts use EBITDA instead of EBIT. That ‘DA’ stands for Depreciation and Amortization.

The formula then becomes:

Using EBITDA usually gives a higher, more optimistic ICR. But be careful – while it shows cash flow before those non-cash charges, it doesn’t reflect the real cash needed down the line to replace aging assets.

Stick with EBIT for the standard view unless there’s a specific reason to use EBITDA. (And always check if “adjusted” earnings are being used – find out what was adjusted.)

How to Calculate the Interest Coverage Ratio

Okay, let’s walk through a quick example. Say you’re looking at these figures for a company’s last year:

- Revenue: $10 million

- Operating Expenses (salaries, materials, rent, excluding interest/tax): $7.2 million

- Interest Expense: $600,000

- Tax Expense: $400,000

1. Find the EBIT:

EBIT = Revenue – Operating Expenses

EBIT = $10m – $7.2m = $2.8 million

2. Calculate the ICR:

ICR = EBIT / Interest Expense

ICR =$2.8m / $600,000 = 4.67x

What does this mean? An ICR of 4.67x means the company earned $4.67 in operating profit for every $1 it had to pay in interest. On the surface, that looks pretty comfortable. They seem to have their interest payments well covered by their operational earnings for that year.

But the number itself is just the starting point. Next, we need to figure out how to interpret that 4.67x and what it really means in different situations.

General Zones: What the Numbers Might Suggest

Here are some general guidelines that analysts often use to understand the ICR better:

- ICR Comfortably Above 5x: Generally, this looks pretty solid. The company’s earnings are way more than it needs for its interest payments. They likely have cash to reinvest, handle unexpected bumps, or maybe even borrow more if a great opportunity arises.

- ICR Somewhere Between 2x and 5x: This is often considered a reasonably healthy zone. The company can meet its interest obligations. However, there’s limited flexibility. If profits dip or interest rates climb sharply, things could get tight. It’s comfortable, but maybe keep an eye on it.

- ICR Dipping Below 1.5x (and heading towards 1x): Now it’s starting to look dicey. The company’s earnings barely cover the interest cost. If revenues falter or debt increases, they could easily find themselves struggling to pay the interest purely from operations. This zone often signals potential cash flow issues.

- ICR Below 1x: This is a serious red flag. The company isn’t earning enough from its operations to cover its interest payments. It’s likely having to dip into cash reserves, sell assets, or borrow even more just to pay the interest on its existing debt. If this keeps up, the risk of defaulting becomes very real.

Industry Matters A Lot

A “good” ICR for one type of business might be terrible for another. Why?

- Businesses needing lots of expensive equipment or property (manufacturers, utility companies, real estate developers) often carry more debt as part of their normal operations. Their typical ICRs might naturally be lower.

- On the other hand, tech or service companies often have lower fixed costs and less need for heavy borrowing, so you’d expect their ICRs to be higher.

Always check how the company’s ICR stacks up against its peers in the same industry. Don’t just use a generic benchmark.

Is a High ICR Always a Good Thing?

Not necessarily. While safety is good, an extremely high ICR could suggest the company is being a bit too cautious with debt. Maybe they’re missing out on sensible opportunities to borrow and invest for growth because they’re keeping their debt levels super low.

Debt isn’t always bad; using it smartly can help a business expand. The goal isn’t just to have the highest possible ICR, but to find a healthy balance – enough of a safety cushion to handle interest payments comfortably, while still using financing effectively to grow the business.

Comparing ICR with Other Coverage Ratios

While the Interest Coverage Ratio tells you a lot, it’s even more useful when you look at it alongside a couple of other key ratios. Each one gives you a slightly different view of how well they’re handling their debt.

- Debt Service Coverage Ratio (DSCR)

DSCR takes a wider view than ICR. It asks: Can the company cover all its debt payments – meaning both the interest and the principal repayment – using its income? This is important for banks and lenders trying to figure out if a company is likely to pay back the entire loan, not just the interest.

ICR just looks at covering the interest part. DSCR looks at the whole debt servicing package (interest + principal).

A DSCR of exactly 1.0 means the company earns just enough to cover its total debt payments. Below 1.0 means they’re short, and above 1.0 means they have some surplus after paying debt costs. (You’ll often see lenders use a debt service coverage ratio calculator for this when assessing loans.)

- Current Cash Coverage Ratio

This one gets straight to the point about cash. Instead of using accounting profit like EBIT, it uses the company’s actual cash flow from operations to see if it can cover interest payments. This often gives a more conservative, real-time picture.

(Cash Flow from Operations + Cash Paid for Taxes & Interest) / Cash Paid for Interest.

EBIT can sometimes be boosted by non-cash items (like gains on asset sales) or reduced by non-cash expenses (like depreciation). This ratio cuts through that and focuses purely on the cash available to pay interest. It’s particularly handy when looking at companies with big non-cash expenses or those potentially facing a cash squeeze.

Limitations of the Interest Coverage Ratio

Like any single financial metric, ICR has blind spots. Relying on it too heavily without looking at the bigger picture can sometimes lead you down the wrong path. Keep these points in mind:

- It Ignores the Principal: ICR completely ignores the fact that the company also has to pay back the original loan amount (the principal) eventually. A company could look great on ICR but still face cash flow issues when a big principal payment comes due.

- It’s Based on Profit, Not Always Cash: Since ICR usually uses EBIT (an accounting profit figure), it might not reflect the actual cash sitting in the bank. Things like depreciation can reduce EBIT but don’t use up cash immediately. This can sometimes make a company look healthier cash-wise than it really is.

- It Looks Backwards (Especially on Interest Rates): ICR reflects the performance from the previous quarter or year. However, it doesn’t predict how a sudden spike in interest rates may affect the company, particularly if it has variable-rate debt. It’s more of a retrospective analysis.

- One-Off Events Can Skew It: A big, unusual gain (like selling off a division) or a big one-time cost (like restructuring charges) can make EBIT, and therefore the ICR, look unusually high or low for a period. It might not reflect the company’s normal operating performance. (Sometimes analysts use an “adjusted” EBIT to try and smooth these out.)

- It Misses Other Financial Pressures: A company might have a decent ICR but still be under stress from other factors the ratio doesn’t capture, like customers paying late, major supply chain problems holding up inventory, or needing to spend big on new equipment.

The interest coverage ratio is an excellent starting point for understanding how well a company is handling its debt interest through its operations. But it’s definitely not the whole story.

Real-World Applications and Use Cases

The interest coverage ratio (ICR) plays a vital role in real financial decisions across industries. From boardrooms to investment desks, ICR is used to evaluate risk, negotiate terms, and guide strategic moves.

Banks Deciding on Loans (and Credit Ratings Too)

When a bank or lender is sizing up a loan application, you can bet they’re looking closely at the ICR. A strong ratio signals that the company can comfortably handle its debt payments. That usually translates into better deals – maybe lower interest rates, more flexible terms, or bigger credit lines. On the flip side, a low ICR? That can mean facing stricter loan conditions, higher borrowing costs, or even getting turned down flat.

Credit rating agencies also rely heavily on ICR when deciding if a company’s rating should go up, down, or stay put. A falling ICR can really hurt a company’s rating, making all its borrowing more expensive.

Investors Checking for Stability

Whether you’re looking at buying shares or lending money via bonds, the ICR gives you a quick snapshot of a company’s financial resilience. A healthy ratio suggests lower risk because the company’s earnings easily cover its interest costs. For bond investors, this is especially critical – they need assurance that the company can keep making those regular interest payments, even during challenging economic times.

Dealmakers Doing Due Diligence (M&A)

When one company considers buying another, checking the target’s ICR is a key step. It helps the buyer figure out if the company they’re eyeing is managing its debt okay, or if there’s a potential “debt bomb” hiding beneath the surface. If the target’s ICR looks shaky, the buyer might offer less money, insist the target cleans up its finances before the deal closes, or even just walk away.

Companies Managing Their Own Finances

It’s not just outsiders looking at ICR. Smart CFOs and finance teams keep a regular eye on their own company’s ratios. It acts as an early warning if they see it starting to slip. ICR might prompt them to look at cutting costs, refinancing debt on better terms, or maybe putting ambitious expansion plans on hold until things look more stable.

Tools for Interest Coverage Ratio Analysis

Whether you’re a financial analyst, business owner, or investor, interest coverage ratio calculation and tracking don’t have to be complicated. A range of tools — from basic spreadsheets to advanced financial platforms — can streamline the process.

- Spreadsheets (Excel, Google Sheets)

Most professionals still rely on spreadsheets for financial modeling. You can easily set up a template to pull in numbers from the income statement, calculate EBIT or EBITDA, track interest expenses, and figure out not just ICR, but also DSCR or cash coverage ratios.

- Online Interest Coverage Ratio Calculators

Loads of websites offer free ICR calculators. Just plug in the EBIT (or EBITDA) and interest expense, and you get the ratio. Some even let you see historical trends or compare the number to industry averages.

- Accounting Software & Business Dashboards

If you’re running a business, your accounting software (QuickBooks, Xero, NetSuite, etc.) might already calculate key ratios like ICR for you. Many systems include financial health dashboards that pull live data, automatically track important metrics, and can even flag significant changes or potential risks, helping you stay on top of things.

- Pro Investment Platforms

For serious analysts and professional investors, high-end platforms like a Bloomberg Terminal, S&P Capital IQ, or Morningstar Direct are the go-to. These services provide deep financial data, including historical ICR trends, detailed peer comparisons, and analysis of how earnings changes or refinancing impact the ratio.

Conclusion

In a financial landscape shaped by rising interest rates, tighter credit conditions, and increasing corporate debt, the ICR is more relevant than ever. It offers a clear, focused snapshot of whether a company can meet its most basic financial obligation — paying interest on its debt.

Unlike many financial metrics, ICR is easy to calculate, intuitive to understand, and powerful in what it reveals. Whether you’re:

- Assessing a potential investment,

- Evaluating a loan applicant, or

- Managing your own company’s capital structure,

…this ratio helps you quickly separate financial stability from potential risk.

But like any ratio, it doesn’t tell the whole story. It should always be viewed alongside other indicators like the debt service coverage ratio, cash flow metrics, and industry benchmarks.

FAQ:

What is a good net interest coverage ratio?

A good net interest coverage ratio is typically 2.0, 3.0, or above, meaning the company earns at least twice what it needs to cover interest payments. However, what’s considered “good” can vary by industry and business model.

Is a higher or lower interest coverage ratio better?

Generally, a higher interest coverage ratio is better, as it indicates greater capacity to pay interest expenses from operating earnings. A very high ratio, however, may also suggest underutilised leverage.

What does a high ICR mean?

A high ICR means the company generates significantly more earnings than needed to meet its interest obligations. This is a positive sign of financial stability and lower default risk.