Is Day Trading Gambling? Most Likely Yes

Oct 24 2023

In the world of finance, day trading has gained popularity as an exciting and potentially lucrative activity. With the rise of online trading platforms and social media influencers promoting their success stories, many people are enticed by the idea of becoming a day trader.

But is day trading really a reliable way of making money, or is it just a form of gambling? In this article, we will explore the realities of day trading and whether it can be considered a legitimate investment strategy.

Key Takeaways:

- Day trading is similar to gambling because traders rely on luck and speculation to make money.

- Gambling is not based on a market analysis or on a consideration of fundamentals, unlike trading.

- Long-term investing may be a better alternative to day trading as it is a more stable and secure way to generate long-term wealth.

What is Day Trading?

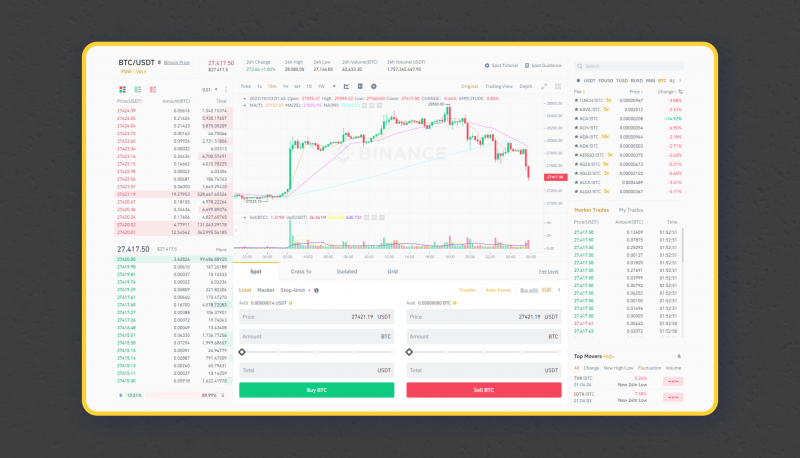

Trading refers to the buying and selling of financial assets (shares, funds, currencies, crypto, and so on) to make a profit. It involves analysing market trends, studying company fundamentals, and making intelligent decisions using research and analysis. Traders use various strategies and tools to manage risks and maximise returns.

What is Gambling?

On the other hand, gambling is a form of entertainment where individuals place bets or wagers on an uncertain outcome with the hope of winning money or prizes. It is primarily based on luck or chance and typically lacks any systematic or logical approach.

Unlike trading, gambling does not involve analysing market trends or considering fundamental factors – it is often seen as a recreational activity rather than a means of generating consistent profits.

The Reality of Day Trading

Day trading holds a certain allure for many individuals. The idea of working from home from your day trading laptop, making quick decisions, and earning substantial profits is undoubtedly appealing. Moreover, the image of the successful day trader portrayed in popular culture, with their fancy technology and extravagant lifestyle, adds to the mystique surrounding this activity.

However, the reality of day trading is often far from the glamorous image portrayed in the media. Numerous studies have shown that the majority of day traders struggle to generate profits over the long term consistently.

The odds of losing money as a day trader are quite high, with some estimates suggesting that as many as 95% of people who day trade end up losing money.

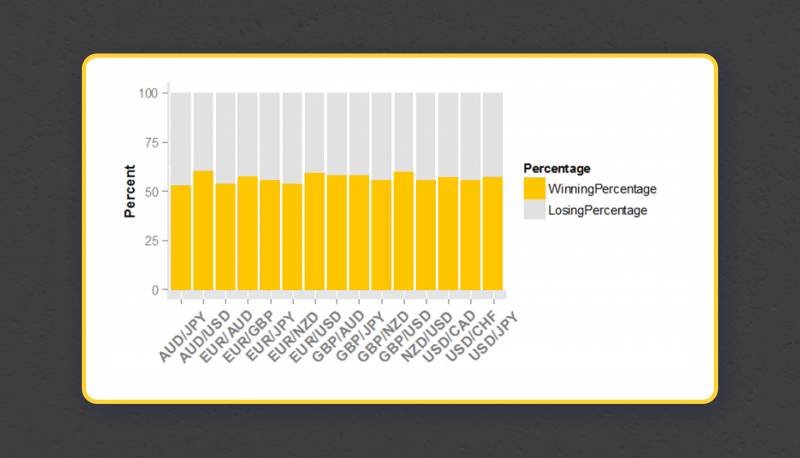

Also, the winning/losing percentage rate for almost all instruments is roughly 50/50. This means that, on average, there are as many losing trades as winning ones in the market, so making a substantial profit by trading can be hard.

Why Day Trading is Gambling

Day trading is often compared to gambling due to the similarities in risk and uncertainty involved. Both activities involve making speculative bets on the outcome of certain events, whether it’s the movement of stock market prices or the roll of a dice.

Unpredictable Outcomes

One reason why day trading is compared to casino gambling is the element of chance. Like in gambling, traders base their decisions on probabilities. They analyse charts and indicators to try to predict the future movement of stocks or tokens, but ultimately, there is no certainty in the financial market. This unpredictability resembles the uncertainty found in gambling, where players place bets hoping for a favourable outcome but are aware that luck plays a significant role.

Big Risks and Losses

Another similarity between day trading and gambling is the potential for significant losses. Both activities involve the risk of losing money. Day traders can experience sudden market downturns or make poor investment decisions that result in substantial financial losses. Similarly, gamblers can lose large sums of money in a short period if luck does not go their way. This shared risk factor adds to the perception that day trading is akin to gambling.

The Addictive Nature

Moreover, both day trading and gambling can be addictive. The thrill of making quick profits or winning big can lead individuals to develop compulsive behaviours. Some day, traders may become addicted to the adrenaline rush that comes with making high-stakes trades, just as gamblers can become hooked on the excitement of placing bets. This day-trading addiction further supports the comparison between day trading and gambling.

Short-Term Focus

Day trading and gambling are characterised by a short-term focus. In trading, the objective is to make profits from rapid price changes, often within minutes or hours. Similarly, gambling activities, such as casino games or sports betting, provide immediate outcomes and gratification.

Misleading Success Stories

As social media platforms have grown, it has become easier for self-proclaimed day trading gurus to promote their supposed success stories. However, it is important to approach these stories with caution. Many of these individuals may selectively share their wins while conveniently omitting their losses. Additionally, some may resort to exaggeration or even outright deception to attract followers and sell expensive courses or services.

Arguments on Why Day Trading is Different from Gambling

While both trading stocks and gambling involve risk-taking, there are key differences between the two. Trading is generally considered to be a legitimate and legal activity that contributes to the functioning of financial markets. It provides liquidity and facilitates price discovery. In contrast, gambling is often associated with addiction, negative social consequences, and legal restrictions in many jurisdictions.

Various Tools And Data Used

In day trading, professional traders use various tools and techniques for analysing market trends, identifying patterns, and predicting stock price fluctuations. This requires a deep understanding of technical analysis, fundamental analysis, and market indicators.

Traders also need to keep up with news and economic events that can impact the markets. Unlike gambling, where outcomes are random, day traders use these tools and information to make calculated decisions based on probabilities and trends. (However, results are still never guaranteed.)

Trading Strategies

Furthermore, experienced traders often develop and follow a trading plan or strategy. This plan includes specific entry and exit points, as well as guidelines for risk management. Day traders set goals for their trades and regularly review their performance to make necessary adjustments. This level of discipline and structure is not typically seen in gambling, where decisions are often impulsive and based on emotions rather than careful analysis.

Risk Management

Successful day traders understand the importance of managing risk and have strict rules in place to protect their capital. They use stop-loss orders to limit potential losses and take-profit orders to secure profits.

Profitable traders also diversify their instruments and use hedges to protect specific deals. These risk management techniques are not commonly employed in gambling, where the focus is often on maximising potential winnings without considering the potential losses.

Continuous Learning

Day trading demands constant learning and improvement. Successful day traders constantly educate themselves about new trading strategies, market trends, and changes in regulations. They attend seminars, read books, and participate in online forums to stay updated with the latest information. This commitment to learning sets day trading apart from gambling, where luck is often seen as the determining factor for success.

Are You a Gambler?

Day trading requires a high level of skill and expertise. Professional day traders possess in-depth knowledge of the markets, technical analysis, and risk management skills. They spend countless hours studying charts, analysing trends, and identifying potential trading opportunities. Unfortunately, many novice traders underestimate the learning curve involved and jump into stock trading or any other trading without acquiring the necessary skills. As a result, they make impulsive decisions that are based more on emotion than sound analysis, leading to losses.

In the realm of financial markets, individuals who seek immediate funds without adequate preparation often find themselves empty-handed. This is primarily because they mistakenly believe that they can predict market movements through just guesswork. Such behaviour is considered gambling in financial markets, and, unfortunately, it can result in the loss of all of your capital.

The Alternatives: Long-Term Investing

While day trading may not be a reliable way to build long-term wealth, there are alternative investment strategies that have been proven to be more effective.

One such strategy is long-term investing, which involves buying and holding investments for an extended period. This approach allows investors to benefit from the growth of companies over time and avoid the pitfalls of short-term market fluctuations.

The Power of Compounding

One of the key advantages of long-term investing is the power of compounding. By reinvesting dividends and allowing investments to grow over time, investors can harness the compounding effect to significantly increase their wealth. This method requires patience and a long-term perspective, but it has a proven track record of generating wealth for investors.

Index Funds: A Passive Approach

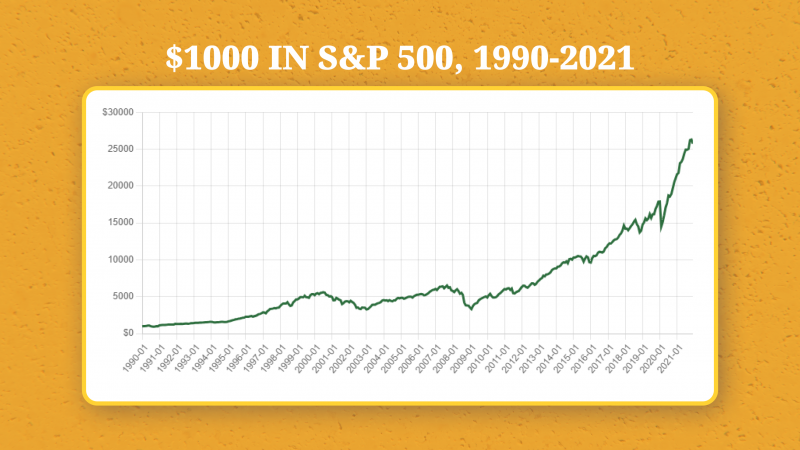

For those who prefer a more hands-off approach, index funds can be an excellent option. These funds track a specific market index, such as the S&P 500, and offer diversification across a broad range of companies. By investing in index funds, investors can capture the overall market return and reduce the risk associated with individual stock picking.

Notably, the S&P 500 index has delivered a compound average annual growth rate of 10.7% per year over the past 30 years. For example, if you invested $1000 in the S&P 500 index in 1990, you would have over $26000 in 2021.

Fast Fact

The average rate of return for day traders is 10%, but the failure rate is about 95%. Interestingly, the return rate is the same as the average stock index growth rate every year, so the odds of outperforming the market by day trading are incredibly low.

Dollar-Cost Averaging

Dollar-cost averaging is another strategy that can be employed in long-term investing. This approach involves investing a fixed amount of money at regular intervals, regardless of the market’s ups and downs. With consistent investing over time, investors can take advantage of market volatility and potentially lower their average cost per share.

How Not to Get Into Gambling When Trading or Investing?

It can be tempting to throw caution to the wind and take risky bets, but that’s not the way to achieve long-term success in trading or investing. So, how can you avoid gambling in the markets?

1. Have a Plan

First and foremost, it’s essential to have a solid trading plan in place. This plan should outline your entry and exit points, as well as your risk management strategy. By having a plan, you eliminate the urge to make impulsive and emotion-driven decisions.

A sound strategy is one of the most important elements of trading, without which your results will almost certainly be disappointing.

2. Manage Risks

Another crucial aspect of avoiding gambling when you trade is to focus on risk management. This means setting strict stop-loss orders and calculating the appropriate position size for each trade. By doing so, you ensure that your potential losses are limited and controlled. Remember, trading is not about hitting the jackpot every time; it’s about managing risk and preserving capital.

3. Keep a Diary of Your Progress

Additionally, it’s important to keep a journal of your trades. By tracking your trades, you’ll be able to identify patterns and learn from your mistakes. This will help you develop a more disciplined trading style and avoid falling into the trap of gambling.

4. Keep Up with the Latest Market Developments

Furthermore, it’s crucial to stay informed about the market and the assets you’re trading. This means conducting thorough research and staying up to date with financial events and news that may influence the market.

5. Join a Community

Lastly, it’s important to surround yourself with like-minded individuals who share your goals and values. Joining a trading community or finding a mentor can be incredibly beneficial in helping you stay focused and disciplined. When you’re around experienced traders, you’ll be able to learn from their strategies and avoid falling into the trap of gambling.

Last Thoughts

While day trading may seem enticing, be careful. The reality is that day trading is often more akin to gambling than a reliable investment strategy. The element of luck, misleading success stories and lack of consistency all contribute to the challenges faced by day traders.

Instead, long-term investing strategies such as holding investments, index fund investing, and dollar-cost averaging offer a more reliable path to wealth accumulation. By focusing on these tried-and-true approaches, individuals will have a better chance of succeeding long term and avoiding the pitfalls of day trading.

Remember, the key to building wealth lies in living below your means, investing early and often, and adopting a disciplined approach to long-term investing. By following these principles, individuals can set themselves up for financial success and achieve their wealth-building goals.

FAQs

Is day trading risky?

Yes, day trading can be very risky. It involves taking on large amounts of leverage and having very short-term positions, which can result in large losses if the market does not move in the trader’s favour. Additionally, day trading is often more akin to gambling than a reliable investment strategy, as the element of luck plays a large role.

How many trading days in a year?

Generally, there are 252 trading days in a year. This total includes the 251 regular trading days and one additional day when half-day trading is conducted. These 252 days are divided into 12 months, with 21 trading days per month on average. However, the number of trading days in a month can vary depending on holidays, weekends, and other special events.

Is it possible to make $100 a day trading cryptocurrency?

While it is theoretically possible to make $100 a day trading cryptocurrency, the likelihood of this is low. Cryptocurrency trading is a risky endeavour and requires careful research and planning in order to be successful. Additionally, the cryptocurrency markets are highly volatile and can change quickly, making it difficult to make consistent profits. As such, it is important to approach cryptocurrency trading with caution and to be aware of the potential risks involved with it.

Is day trading halal?

Whether day trading is deemed halal or haram (forbidden under Islamic law) is a matter of debate. This is because day trading is often considered to be a form of gambling, which is strictly forbidden in Islam. Additionally, because day trading implies taking on a certain amount of risk, it may also be seen as a form of speculation, which is discouraged in Islamic finance.