Understanding Indexed Universal Life Insurance (IUL)

Apr 24, 2022

Life is full of uncertainties, and while it’s uncomfortable to contemplate our mortality, it’s essential to prepare for the future to protect our loved ones. In today’s fast-paced world, forward-thinking and financial planning is crucial in ensuring the well-being of those we care about most.

One of the critical steps in safeguarding our family’s financial future is investing in life insurance. With various options available in the insurance industry, such as the increasingly popular Indexed Universal Life Insurance, it’s never been easier to find the right coverage that meets your unique needs.

In this article, we’ll explore the importance of IUL and delve into its benefits, guiding you through securing peace of mind for you and your loved ones.

Key Takeaways

- IUL offers flexible premiums, adjustable death benefits, and cash value tied to a market index.

- An underlying index, subject to floors, caps, and participation rates, determines IUL’s cash value.

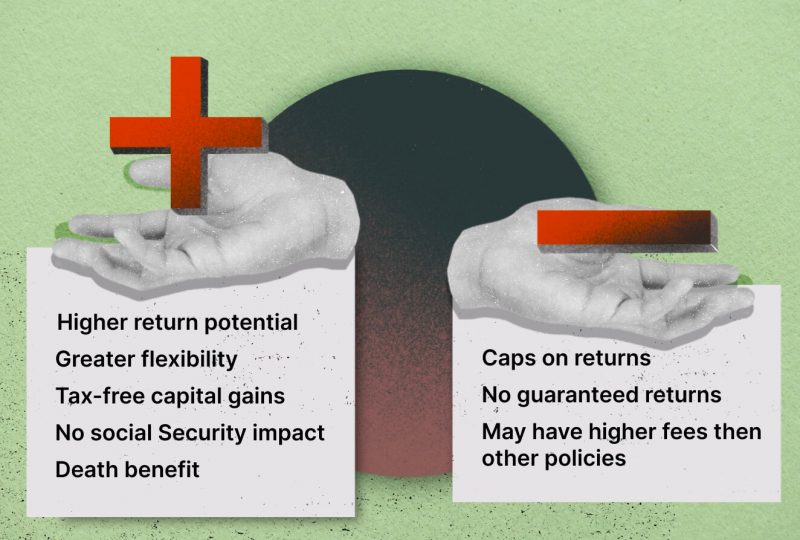

- IUL has pros and cons, including flexible premiums, investment flexibility, accumulation caps, and management fees.

- Choose between IUL and Whole Life by considering long-term goals, financial flexibility, and risk tolerance.

What Is Indexed Universal Life Insurance?

Indexed Universal Life Insurance, or IUL, is a specialized form of permanent life insurance designed to provide long-term financial protection and flexibility for policyholders. Unlike term life insurance, IUL remains active as long as the premium payments are up-to-date or until the policy reaches its specified maturity date.

A standout feature of IUL policies is their cash value component linked to a financial index such as the S&P 500. This means that the policy’s cash value will fluctuate in line with the performance of the chosen index. However, it’s important to note that insurance companies typically invest the funds in lower-risk assets like bonds and mortgages rather than directly in the stock market.

One of the critical advantages of IUL policies is the ability to borrow against the accumulated cash value through policy loans or to withdraw cash outright. Upon the policyholder’s death, beneficiaries receive a death benefit. However, it’s essential to know that any outstanding loans or withdrawals taken from the cash value will reduce the final death benefit payout.

IUL policies offer added flexibility, allowing policyholders to adjust their death benefits and premium payments within certain limits. This sets IUL apart from other universal life insurance policies and provides an attractive option for those seeking a more dynamic approach to securing their family’s financial future.

What Is “Index” In IUL?

In the context of Indexed Universal Life Insurance, an “index” refers to a market index that serves as a benchmark for the policy’s cash value component. Market indexes are essentially broad portfolios of investments, and their values are calculated using weighted average mathematics. These indexes play a pivotal role in determining the interest paid on the cash value of IUL policies.

The three most commonly used market indexes in the United States are the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite. It’s important to note that the funds allocated to the cash value component of an Indexed universal life policy don’t necessarily need to be invested directly in the associated index. As mentioned above, insurance companies often invest these funds in lower-risk assets, such as bonds, rather than stocks.

By tying the cash value growth to a market index, IUL policies offer policyholders the potential for higher returns while providing the security and flexibility of a traditional life insurance policy.

How Does IUL Work?

Indexed Universal Life Insurance is a versatile and customizable life insurance policy that offers adjustable premiums, a cash value component linked to a market index, and the potential for a more significant return on investment. Let’s break down the key elements and characteristics of IUL to make it easily understandable.

Choosing An Index And Allocating Premiums

When you take out a universal life insurance policy, the insurance company helps you select an index for all or part of your policy’s cash value account segment and your death benefit. A portion of your paid premium covers the cost of insurance based on the insured’s life. After deducting any fees, the remainder is added to the cash value.

*Insurance premiums are the regular payments made by policyholders to their insurers. The premium paid is considered income to the insurance firm.

Cash Value Accumulation

The cash value portion of an IUL policy is less volatile than the stock market. Instead, it’s tied to the performance of an underlying index, such as the S&P 500 or the Nasdaq composite. The insurance company uses the index’s rate of return to determine how much the account should be credited.

Floors, Caps, and Participation Rates

The cash value within an IUL won’t mirror an index’s exact gains and losses due to floors, caps, and participation rates:

- Floor: A floor is a minimum rate credited to your cash value, protecting you from losses. For example, a 0% floor means your cash value won’t decrease even if the index performs poorly.

- Cap: A cap limits the cash value gains to a certain percentage, even if the index performs above that threshold. For instance, if your cap is 10% and the index increases by 12%, the cash value tied to that index will only increase by 10%.

- Participation rate: This is the portion of the index’s return credited to your account. It can range from 25% to above 100%. If the IUL has a 100% participation rate, you will earn all the interest your investments gain up to your cap.

Flexible Premiums and Death Benefit

IUL policies offer the flexibility to adjust your premiums and death benefit amount if needed. If your account accumulates enough value, you could use those funds to pay your premiums. If you decide to underpay or even skip a premium, the cost of insurance charges and policy expenses will nonetheless be pulled directly from your cash value account every month.

Segment Period and Earnings

Cash value earnings are only credited to your account at the end of the selected segment period. While the floor cannot be changed throughout your policy, your insurer may adjust the cap and participation rate in response to market conditions.

Potential Risks and Policy Lapses

Sometimes, you may be required to pay more premiums than expected. If the index performs poorly, the subtraction of monthly policy charges could cause the cash value to drop, and your policy could lapse without an infusion of more premium.

If your cash value falls too much, the insurance company could issue a “premium call,” meaning you need to put in more money to avoid a policy lapse. If your policy lapses, you lose all the money you put in, plus the death benefit.

Example of Cash Value Calculation

Let’s say your selected index for your IUL policy gained 6% from the beginning to the end of June. The 6% is multiplied by the cash value. The resulting interest is added to the cash value. Some policies calculate the index gains as the sum of the changes for the period, while other policies take an average of the daily gains for a month. No interest is credited to the cash account if the index goes down instead of up.

The gains from the index are credited to the policy based on the participation rate. For example, if the gain is 6%, the participation rate is 50%, and the current cash value total is $10,000, $300 is added to the cash value (6% x 50% x $10,000 = $300).

Drawbacks of Indexed Universal Life Insurance

Indexed Universal Life Insurance offers a unique combination of permanent life insurance coverage, a death benefit, and a cash value component linked to a market index. However, it also comes with some drawbacks.

- Caps on accumulation percentages: Insurance companies may set a maximum participation rate of less than 100%, limiting the potential for cash value growth.

- Better for larger face amounts: Smaller policy face values may not offer many advantages over standard Universal Life insurance policies.

- Based on a variable equity index: No interest is credited to the cash value if the index goes down. While some policies offer a low guaranteed rate over a longer period, IUL policies primarily aim to profit from upward movements in the index rather than outperforming it.

- Growth does not include stock dividends: As the insurance company only buys options in an index, you’re not directly invested in stocks and don’t benefit from stock dividends paid to shareholders.

- Management fees: Insurers charge fees for managing your money, which can reduce your policy’s cash value.

Indexed Universal Life VS. Whole Life Insurance Policies

While Indexed Universal Life (IUL) and Whole Life insurance policies offer potential cash value and permanent coverage, they have critical differences in premium payments and cash value growth. Understanding these distinctions can help you choose the most suitable policy.

Premium Payments

- Whole Life Premiums: With Whole Life policies, you receive a premium schedule when establishing coverage. As long as you pay these premiums on time, your coverage is guaranteed, and your cash value will grow, as illustrated. However, Whole Life premiums are typically higher than IUL premiums for the same face value at the beginning of your policy.

- IUL Premiums: IUL policies offer flexible premiums, allowing you to even temporarily skip premiums if you have sufficient cash value in your policy. However, if you pay too little into the policy or your cash value decreases, you may need to pay higher premiums later to keep up with the insurance costs.

Cash Values

Whole Life and IUL policies can potentially provide cash values, but these balances grow differently.

- Whole Life Cash Value: A Whole Life policy guarantees your cash value growth. You know exactly how much you’ll have available at any given time, assuming you make the scheduled premium payments. This feature is helpful for those who plan to use the cash value for critical goals like a specific retirement date or a child’s first year in college. Dividend-paying policies may provide additional value, but dividends are never guaranteed, and some don’t offer dividends.

- IUL Cash Value Accumulation: The cash value growth in an IUL policy is subject to caps and floors and is based on the performance of a specified market index, such as the S&P 500. With good results, it may be possible to accumulate a significant amount of cash value or stop paying premiums for some time. However, if your cash value fails to grow, you may need to pay higher premiums to keep the policy in force.

- Interest Crediting: Policies may offer different options for growing your cash value, so the crediting rate depends on what you choose and how those options perform. A fixed segment earns interest at a specified rate, which may change with economic conditions. An indexed segment is linked to the performance of a market index, typically subject to both caps and floors.

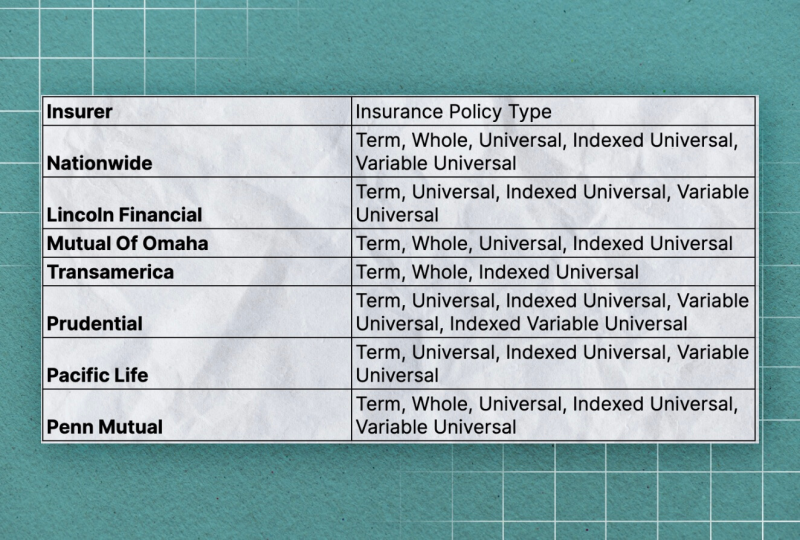

Top 7 Indexed Universal Life Insurance Companies

Below is the list of the top 7 life insurance companies that also support indexed universal life insurance, so take a look to pick your reliable firm.

FAQs

- How much money can I put into an IUL?

Unlike retirement accounts like a 401(k), contributions to an IUL insurance are unlimited. You may invest as much as you desire into the contract and watch it increase.

- How does money grow in an IUL?

You may increase the value of your IUL by investing in the stock market through an index fund that tracks the S&P 500 or the NASDAQ. Instead of depending just on non-equity earning rates, the growth of an equity index account is tied to the growth of an entire market or market segment.

- Can you take money out of IUL?

An IUL policy’s cash value may be withdrawn at any time, however, there are circumstances under which doing so may result in a taxable event.

- Is an IUL better than a 401k?

The IUL, in contrast to regular 401(k)s, is funded using non-qualified funds, sometimes known as post-tax monies. This means the money you put into an IUL plan has already been taxed, and your funds won’t be charged any more.

The Bottom Line

Among variable life insurance options, Indexed Universal Life Insurance has always been a viable choice for people seeking permanent life insurance with a cash component that earns interest and a death benefit. However, it is more expensive than term life insurance, and its performance depends on the chosen index.

Therefore, it’s crucial to carefully consider the advantages and disadvantages of IUL policies and determine if they align with your financial goals and risk tolerance.