What Is Return On Investment (ROI), And How Can You Calculate It?

Jun 20, 2023

Whether you’re investing in equities, futures, cryptocurrencies, or other forms of investments, the first question that often comes to mind is, “How much profit can I potentially make from this venture?” The financial benefits of an investment may take a long time to develop, or they may appear quickly.

This projected gain is your ROI, or, Return on Investment, which applies regardless of the time frame. It’s something that investors of all experience levels, from newcomers testing the waters of the stock market to the richest individuals and veterans of the volatile cryptocurrency market, continuously prioritize.

So, what’s ROI exactly, and how can you calculate it?

Key Takeaways

- Return on Investment measures the profitability of an investment, showing your gain relative to the initial outlay.

- There are several ROI types, including basic, annualized, and ROI derived from interest, capital gains, or dividends.

- The ROI formula calculation is as follows: (Net Profit/Cost of Investment) x 100.

- Despite its limitations, ROI is a crucial metric, assisting in decision-making and comparison of investment options.

What Is ROI?

Return on Investment denotes the financial gain relative to the cost incurred for an investment or related expenditures. Businesses often utilize ROI as a performance metric to evaluate the effectiveness of specific initiatives or investments.

For instance, if a business funds an advertising campaign, it would assess the resulting sales and use this data to calculate the ROI. If the revenue generated surpasses the campaign’s cost, the resultant profit signifies the ROI of the advertising initiative.

In an investment context, potential investors use ROI as a critical determinant before investing in a company. The anticipated ROI of a company serves as a crucial indicator of the profitability of the investment. Ultimately, investors seek to ensure their investments yield profit, thus underscoring the importance of accurately forecasting a company’s potential ROI.

Difference Between Basic And Annualized ROI

ROI is a key metric used to determine an investment’s financial gain or loss relative to its initial price. However, it’s essential to understand the difference between basic and annualized ROI, as these represent different aspects of investment performance.

- Basic ROI

Basic ROI is a straightforward calculation, measuring the total return on investment without considering the time frame. It’s calculated by subtracting the initial deposit from the final value, dividing the result by the initial investment, and multiplying by 100 to get a percentage. This measure is simple but fails to provide a time-adjusted return, which can be a crucial factor when comparing investments over different periods.

- Annualized ROI

On the other hand, Annualized ROI provides a more nuanced view of an investment’s performance over time. It factors in the investment’s holding period and provides a yearly average return, thus enabling fair comparison between assets held for differing lengths of time. The formula is more complex, involving exponential growth rates and time factors. Essentially, annualized ROI presents the compounded return per year, giving investors a clearer understanding of an investment’s growth rate.

In essence, basic ROI is a broad brush, a snapshot if you will, while annualized ROI paints a more detailed picture over time. Investors should use both when analyzing investment performance for a balanced perspective.

Types of ROI

Investment returns can materialize in different forms, such as interest, capital gains, and dividends. Understanding these different types of Return on Investment (ROI) can help investors better comprehend the performance and potential of their investments.

- Interest

Interest is a type of ROI typically associated with debt instruments, such as bonds or certificates of deposit. In this scenario, the investor essentially lends money to a corporation or government entity, which agrees to pay back the initial investment amount with an added interest over a specified period. The interest received constitutes the return on the investment, providing a steady income stream that is usually fixed or predetermined.

- Capital Gains

Capital gains, on the other hand, refer to the increase in the value of an investment over its purchase price. This form of ROI is common in assets like stocks and real estate. It is realized when the investment is sold at a higher price than its purchase cost. However, the downside is that this return is not guaranteed and is subject to the volatility and uncertainties of the market.

- Dividends

Dividends are another form of ROI predominantly associated with equity investments. When investing in stocks, investors become part-owners of the company. If the company makes a profit and decides to distribute a portion of that profit to its shareholders, these distributions are called dividends. Dividends provide a regular income stream to investors in addition to potential capital gains.

How To Calculate ROI

Calculating the Return on Investment (ROI) involves determining the net profit from an investment relative to its original cost. This is commonly expressed as a percentage. The general formula to calculate ROI can be represented in two ways:

ROI = (Net Income / Cost of Investment) x 100

Or

ROI = (Current Value of Investment – Cost of Investment) / Cost of Investment) x 100

To illustrate this, imagine you invested $5,000 in company ABC a year ago and recently sold your shares for $5,500. The ROI for this investment would be calculated as follows:

ROI = ($5,500 – $5,000 / $5,000) x 100

This calculation results in an ROI of 10% for your investment in company ABC. However, this simplified example omits considerations such as capital gains taxes or transaction fees, which would be factored into the investment cost.

The beauty of ROI lies in its ability to provide a percentage figure rather than a specific dollar amount. This percentage facilitates comparisons across diverse investments, irrespective of asset class or currency, helping identity which offers the most attractive returns. This flexibility is a distinct advantage of ROI, empowering investors with a valuable tool for decision-making.

How To Interpret ROI

Interpreting ROI calculations requires specific considerations. Primarily, ROI is often presented as a percentage, making it easier to grasp than a simple ratio. Additionally, the ROI formula incorporates net profits, which can be positive or negative, reflecting the dual possibilities of gaining or losing money on an investment.

When the calculated ROI is positive, this suggests a profitable investment scenario, with the total returns surpassing the overall costs. Conversely, a negative ROI indicates a loss where total investment costs exceed the returns gained.

Both total returns and total costs should be included to enhance the precision of ROI calculations. Also, the annualized ROI should be utilized for a fair comparison of different investments, as it provides a standardized annual return figure.

It’s important to note that the ROI formula, while seemingly straightforward, depends on the accurate inclusion of all costs. For example, calculating the ROI for stock shares is relatively simple since costs are easily identifiable.

However, when calculating the ROI for a prospective business project, the task becomes more complex due to the high costs involved, like labor, equipment, and indirect expenses. Understanding these nuances is essential for effectively interpreting and utilizing ROI.

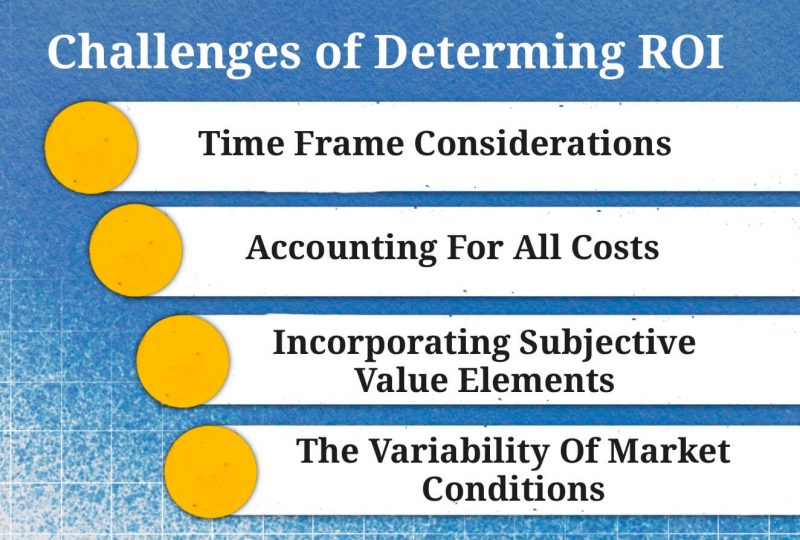

Challenges Of Determining ROI

While ROI is a powerful tool for assessing the potential value of an investment, it’s essential to be aware of the challenges that come with it.

- Time Frame Considerations

Selecting the appropriate time frame for analysis is a major challenge in determining ROI. The performance of an investment can vary significantly over different periods, and the choice between focusing on short-term gains or long-term stability can drastically affect the ROI calculation.

Annualized return on investment can help normalize these differences, but the subjectivity in selecting the right time frame for a particular investment remains a hurdle.

- Accounting For All Costs

Accurately calculating ROI depends heavily on the comprehensive accounting of all costs associated with the investment. While direct expenses, such as the purchase price or initial investment, are easy to identify, indirect costs can often be overlooked.

These may include transaction fees, taxes, and maintenance costs. Particularly in a real estate or a business venture, these costs can be diverse and challenging to track, potentially leading to an inflated ROI.

- Incorporating Subjective Value Elements

Calculating ROI becomes complicated when dealing with non-financial or intangible investments, like marketing campaigns or employee training programs. Such investments often yield returns that are hard to quantify, such as enhanced brand awareness or improved employee morale.

Assigning monetary values to these subjective elements for ROI calculation can be difficult and somewhat arbitrary, adding a layer of complexity to the process.

- The Variability Of Market Conditions

Market conditions can fluctuate significantly and unpredictably, impacting investment returns. This variability can pose a challenge when determining ROI, particularly for long-term investments. Economic downturns, industry disruptions, regulatory changes, and numerous other factors can all affect the value of an investment, making it challenging to predict ROI accurately.

Moreover, these factors can influence different types of investments, adding a layer of complexity when comparing ROIs across diverse investment options.

What is A ‘Good ROI’?

Generally, a yearly ROI exceeding 7% is perceived as satisfactory in the context of stock investments, paralleling the average annual return of the S&P 500 after adjusting for inflation.

However, remember that this is an average – there will be years where your return exceeds this figure and others where it falls short. Over time, though, returns typically stabilize around this ballpark figure.

Nevertheless, deciding the ideal ROI for your investment strategy goes beyond sticking to a universal benchmark. The S&P 500 might not align with your personal risk tolerance or the asset class you’re interested in investing in. To discern the ROI that fits your financial situation, it’s essential to ask yourself these questions:

- Am I comfortable with the level of risk involved in this investment?

- What are the implications if I lose my investing capital?

- Is the potential profit sufficient to warrant the risk of losing money invested?

- What other investment opportunities could I explore with this capital if I choose not to proceed?

Average ROI In The Stock Market

The stock market is renowned for its fluctuations, with investors experiencing numerous peaks and troughs. However, it’s reassuring to note that the U.S. stock market has historically delivered an average annual return of about 10%.

It’s important to note that this rate is subject to variations and might reduce to approximately 6% to 7% once adjusted for inflation. Nevertheless, this historical performance forms a key reference point for long-term investors.

An analysis of the S&P annual returns between 2017 and 2021 reveals that the average return during this period was a robust 17.04% or 13.64%, after accounting for inflation. This performance significantly surpasses the long-term average return of 10%.

Interestingly, this figure might have been even higher had the stock market’s overall performance not been influenced by the volatility spurred by pandemic-related disruptions in 2020. Despite these challenges, the overall returns during this period underscore the potential for robust gains in the stock market.

Bottom Line

Overall, ROI presents a straightforward and easily understandable measure of an investment’s profitability. Despite its simplicity, one must remain aware of its limitations. Notably, it does not factor in the holding period of an asset or the associated risks. Even with these considerations, the value of ROI as a critical evaluation tool cannot be understated.

It is a vital instrument for business analysts and investors in assessing and ranking various investment options. Its broad applicability across diverse investment avenues underscores its utility in informed decision-making, fortifying its role as an indispensable financial tool.

FAQs

Is ROI a profit?

ROI is not the same as profit. ROI is a measure that quantifies the return on an investment relative to the initial cost. It expresses the efficiency and profitability of an investment as a percentage. Conversely, profit refers to the actual financial gain earned from an investment after deducting all expenses and costs.

What is a good ROI for?

A good ROI varies depending on the investor’s context, investment type, and risk tolerance. In general, a higher ROI is desirable as it signifies greater profitability.

Is a 5% ROI good?

A 5% ROI might be considered satisfactory for certain low-risk investments or stable industries. However, a 5% ROI may be relatively low in more volatile or high-growth sectors.

How is ROI calculated?

ROI is calculated by dividing the net profit (or return) of an investment by the initial cost of the investment.

What assets give the highest return?

The assets that offer the highest return vary depending on market conditions, risk appetite, and investment horizon. Historically, investments in stocks, particularly those of rapidly growing companies or emerging sectors, have provided substantially high ROI. However, other investments like real estate, bonds, and commodities have also yielded attractive returns in certain market conditions.