15 Chip Stocks That Are Real Bargains. They Just Keep Getting Cheaper

Feb 24, 2022

The larger market correction in recent months has been particularly hard for chip firms, with the PHLX Semiconductor Index down around 16% so far in 2022.

Advanced Micro Devices (AMD) and Nvidia (NVDA) are among the high-profile decliners, but the suffering has been more widespread. II-VI (IIVI) is the index's sole component with a positive year-to-date return.

That is not to say that demand for chips has decreased—quite the contrary. Due to persistent global shortages and supply chain disruptions, chip stocks have taken a battering in the market, despite robust demand for the items they create.

It's an opportunity to get a deal that has only improved since Barron's last examined the issue.

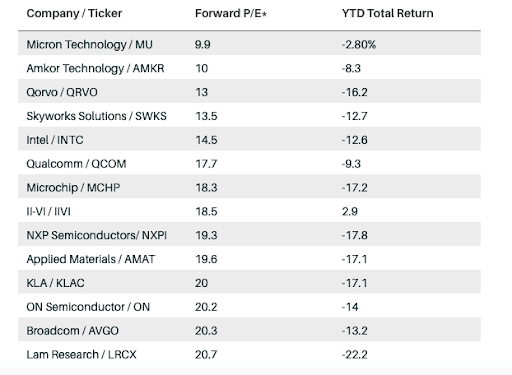

When we conducted a filter in December to identify the Sox's 14 cheapest stocks in terms of projected price/earnings ratios, the average for the index as a whole was 30.5 times.

The 14 cheapest chip stocks on that screen, as shown below, are currently down an average of 12.7 percent year to date.

Circling Back

That is better than the wider than broader Sox and the recent 16 percent loss in the Nasdaq Composite. II-VI, which was priced at 18.5 times anticipated earnings, was the only winner on that list, having returned 2.9 percent year to date. This is far from a home run.

While this is hardly causing celebration, it is positive news for bargain hunters. The average forward P/E ratio has decreased to 27.5 times the expected 2022 per-share profits following the decline.

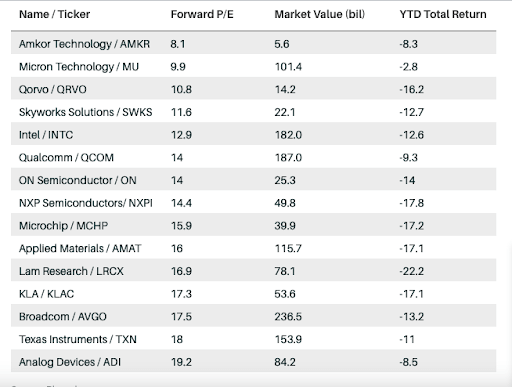

The table below lists the 15 cheapest semiconductor stocks based on their recent prices.

Chips at a lower price

The fifteen lowest price-to-earnings ratios in the PHLX Semiconductor Sector Index to 2022

Amkor Technology (AMKR) and Micron Technology (MNC) exchanged positions but remain the two cheapest chipmakers. Both stocks have performed better than their counterparts, recently fallen 8.3 percent and 2.8 percent, respectively, year to date. Qorvo(QRVO) and Skyworks Solutions remain fourth and fifth, respectively, in the rankings.

Intel (INTC) shares, which were ranked fifth on both screens, were down 12.6 percent year to date. Intel's analyst day last week made it quite obvious that the company's years-long turnaround strategy would be costly. Despite this, Raymond James analyst Chris Caso raised the company to Market Perform from Underperform on Wednesday, stating that his decline thesis had been validated.

Qualcomm (QCOM) is in sixth place, down 9.3 percent despite the company's quarterly earnings above projections.

ON Semiconductor (ON), NXP Semiconductors (NXPI), Microchip (MCHP), Applied Materials (AMAT), Lam Research (LRCX), KLA (KLAC), and Broadcom (AVGO) all maintained their positions on the list despite suffering double-digit declines.

Analog Devices (ADI) and Texas Instruments (TXN) are new entrants, respectively, following falls of 8.5 percent and 11%. The earnings report issued by Analog Devices last week was an encouraging omen since it featured a better-than-expected projection. Despite Texas Instruments' better-than-expected January earnings, Caso, the Raymond James analyst, downgraded his rating from Outperform to Market Perform earlier this month, noting the company's expenditure plans.

It's critical to remember that a screen serves as a starting point for investors looking for neglected opportunities. A cheap stock may be such for a reason, but an expensive stock may have significant upside potential if its growth prospects improve. Nonetheless, with the recent correction, it may be simpler to identify deals.