More Women Are Taking Charge of Their Finances

July 10, 2022

Paula Polito, a wealth management executive at UBS, has long advocated for women to take an active role in their financial lives and become "more financially smart," as she described it in a recent interview. However, nothing appeared to alter for years.

In order to better understand the patterns and determine whether there were any indications that more women were taking charge of their money five years ago, she and her colleagues looked to concrete data.

At first, she was disappointed by it. She believed that millennials will be a force for change since they are direct and technologically aware. According to Polito, vice chairwoman of global wealth management at UBS: "We found out that it was not the case. Millennial women weren't going to be the ones to drive change."

It's also upsetting that, according to the women she met with who had experienced divorce or widowhood, "a big majority of them felt regrets that they hadn't been more financially active and that they had to deal with financial surprises."

She continues, "We can tell ladies to pay attention. That is our message. Nevertheless, it didn't appear to be getting through. She published a powerful piece in Barron's just one year ago about "the cost of women's passivity."

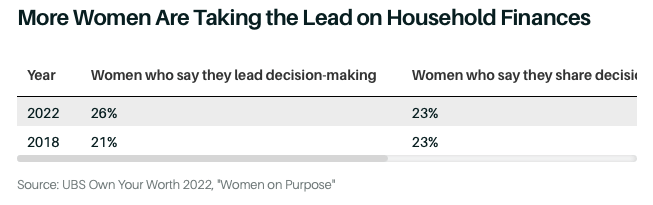

The patterns now seem to be changing, according to this year's "Own Your Worth" report, which polled 1,400 high-net-worth women. A significant finding is that, from 21% in 2018, the proportion of women who say they lead financial choices has increased to 26%. Moreover, although 51 percent of women still defer to their husbands when making financial decisions, this percentage is down from 56 percent from four years ago.

“I'm optimistic," Polito declares. "I genuinely believe we are progressing more than we have. I enjoyed seeing the numbers change.”

What Has Modified

Polito says the pandemic — and the social problems it brought to light — prompted more women to take the reins of family finances, with the goal of creating positive change and helping specific causes they care about.

According to Polito, the pandemic and the societal issues it brought to light encouraged more women to take control of the family budget in order to affect good change and support certain causes that they are passionate about.

According to Polito, "women throughout the pandemic were faced with a significantly larger load than ever before, between employment and taking care of the family, and in the end they began — particularly millennial women — to act with more conviction." Many people expressed a desire to live a life that is more deliberate, using their time, resources, and skills to accomplish goals that are more meaningful to them.

According to this year's poll, 90% of women think that having money will enable them to accomplish their larger objectives. According to the research, the great majority (94 percent) contributed money or given their time in the last 12 months, and more than two-thirds (69 percent) picked careers that matched their ideals. “Even the traditional abdicators, the women who would defer to their partners and spouses, were exercising more influence over the donations made on behalf of their families ”, according to Polito.

Not Everyone Can Lead

Polito clarifies that it is common for one partner to take the lead on financial problems in households. As long as you are aware of the situation, you may defer to your husband, she explains. You don't have to handle everything by yourself.

She also has advice for males, saying that they should learn more about the subject so that they may join the conversation and include women more. So they may also contribute to breaking this long-standing chain.

This also applies to financial advisers. According to Polito, there is perhaps an unconscious prejudice in our industry that the spouse should be in the lead. However, advisers frequently have more they can do to ensure that there are women in the room.

Years ago, she recalls questioning a male customer about his wife's absence from their sessions. He informed her that his wife was ignorant about "stocks and bonds."

Polito asserts, "You must change the story." Understanding their financial condition, including their liquidity, legacy, and tax situation, should be the focus of these discussions.

Advisors may then focus on issues like what are the best goods and services, how should we build the portfolio, and what type of risk-management techniques are required.

Finding an advisor with whom women feel comfortable having these discussions is crucial. You don't necessarily need a female advisor if you're a woman, according to Polito. "Each person must decide what type of counsel they wish to have. However, I believe that sometimes women can relate to female customers in a different manner than males can and are sometimes better at asking different questions.”

It's critical to have these long-term financial planning discussions now when the market is suffering. As her client had said, "It's not just about stocks and bonds," Polito clarifies. “Given the difficulties we are having with the current volatility, it is crucial to keep your financial priorities in perspective.”