The Manufacturing Economy Is Slowing. Blame Covid

Feb 01, 2022

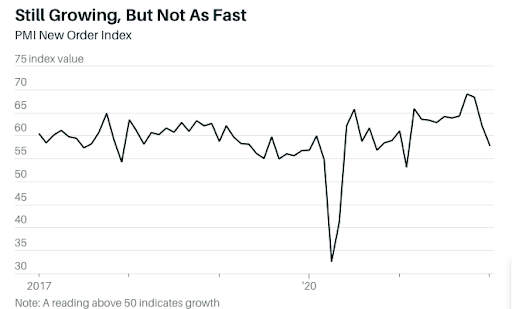

In January, a key indicator of industrial activity in the United States revealed a slowdown. The manufacturing sector in the United States is expanding, but Covid and inflation continue to hang over everything.

The Purchasing Managers' Index, or PMI, from the Institute for Supply Management, came in at 57.6 in January, down from 58.8 in December. Economic forecasters anticipated a rating of 57.5.

The figure is consistent with predictions. A value of 50 implies that the manufacturing sector is expanding, indicating that the data is accurate. New orders, a proxy for future demand, came in at 57.9, higher than the total result but lower than the previous month's figure of 62.1.

Both figures indicate a slowing of growth.

Demand, on the other hand, is insignificant. "The manufacturing sector in the United States continues to operate in a demand-driven, supply chain-constrained environment," PMI survey chair Tim Fiore stated in an ISM press release. He stated that things are improving.

"January marked the third consecutive month with signs of improvement in labor resources and supplier delivery performance," Fiore stated, despite continued shortages of some supplies owing to Covid-19 and the Omicron version.

Prices have also remained persistently high. The PMI price index increased to 76.1 in January from 62.8 in December, reversing a recent downward trend. However, rising prices are partially a result of Covid. Customers' stockpiles continue to be depleted, and output is hampered as a result of workers who test positive remaining at home.

Industrial stocks have been unfazed by the reading. Immediately following the release of the PMI data, the Industrial Select Sector SPDR ETF (XLI) was flat, falling marginally from its pre-report level. The S&P 500 and the Dow Jones Industrial Average are both down 0.6% and 0.3%, respectively.

Caterpillar (CAT), a major industrial business, saw its stock rise 0.6 percent. Rockwell Automation (ROK), Eaton (ETN), and General Electric (GE) all had their shares decline by 1.6 percent, 1%, and 1.2 percent, respectively.