The Stock Market Got A Big Boost From The Bond Selloff. The Fed Could Change That.

Mar 27, 2022

The Federal Reserve is speaking out forcefully against inflation—and the equity market is thrilled. Don't expect shares to be calmer if Powell & Co. follow through on their remarks.

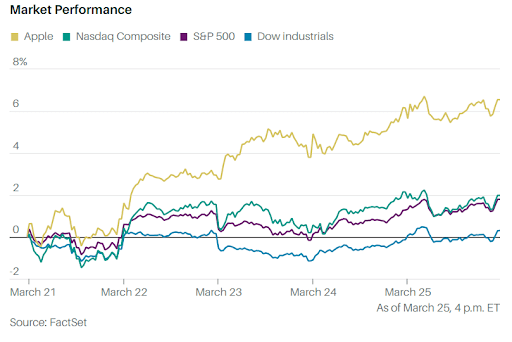

The S&P 500 climbed 1.8%, continuing its week-long run, while the Nasdaq Composite jumped 2%. The Dow Jones Industrial Average was the only unchanged index to end the week, up 0.3%. The S&P 500 has risen by 8.1% in the last two weeks, the most since April 2020.

Avoid looking for the "positive news" that fueled the week's advances — there was none, at least not in the usual sense. Russia's attack on Ukraine seems to be far from over. Fed Chair Jerome Powell and several central bank officials have discussed the prospect of a half-point rate hike at forthcoming meetings. And bonds continued to face significant losses, with the 10-year yield completing the week at 2.491%, its highest level since May 2019.

With government bonds on track to suffer their weakest year since 1949, investors seek other investments — and they may have landed on shares. In recent weeks, stock and bond values have stopped moving in lockstep, as they did in early 2022. Thomas Mathews, a market economist at Capital Economics, observes that stock prices have fallen when bond prices have increased following Russia's invasion of Ukraine.

Now that investors seem to have accepted a protracted battle — but one that will have less economic damage than anticipated — bond prices are falling, and equities are surging. "We believe the divergence between the two this month is due, at least in part, to an improvement in investor sentiment regarding the Russia-Ukraine war's effects, resulting in increased demand for 'risky' assets (such as equities) at the expense of 'safe' assets (such as Treasuries)," Mathews comments.

Sentiment could hardly have worsened more. For the first time since March 2020, the BofA Bull & Bear Indicator dipped to "extreme bearish" this week, signaling the market was poised for a recovery. Since 2013, according to Michael Hartnett, chief investment strategist at BofA Securities, the MSCI All-Country World Index has risen an average of 7.9% in the three months after such a reading. He does not believe the rally will extend much longer than that, though, given the high level of inflation, rising interest rates, and the possibility of a growth shock. "Q2 presents a compelling selling opportunity," he writes.

That is entirely feasible. However, that does not necessarily mean the market will crash. According to J.P. Morgan technical analyst Jason Hunter, the S&P 500 might remain range bound for the next six months. He argues that the S&P 500 had historically moved within a 10% to 15% six-month range when the Fed began hiking rates in 1983, 1994, 2004, and 2015 and might do so again. "We expect the S&P 500 will maintain its early-2022 price extremes as the market adjusts to the end of loose monetary policy," Hunter says.

Perhaps trading this market will prove to be more difficult than anticipated.