Why Stocks’ Next Rally Could Be Coming Soon

Dec 14, 2021

Stocks look to be nearing the end of a tumultuous period caused by news that the Federal Reserve is withdrawing assistance for markets and the economy. A steady surge is expected to begin quickly, according to history.

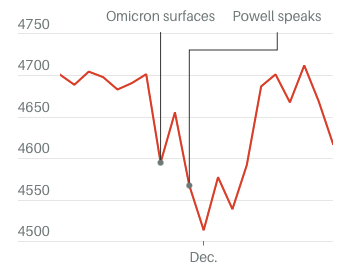

As of 1 December the S&P 500 had slid 4.1 percent from its record high on Nov. 18, only to rebound 4.4 percent on Friday to a new closing high of 4712.02. It was falling back on Monday, with a 0.6 percent decline by mid-afternoon.

The Fed aims to prevent inflation by shifting away from the robust initiatives to boost growth it put in place after the epidemic wrecked the economy in 2020. Not only is the central bank already slashing its monthly asset purchases by tens of billions of dollars, but Chairman Jerome Powell just hinted that much more cutbacks are on the horizon. In a matter of months, the Fed will stop buying Treasury bonds, from $65 billion per month as recently as November.

This situation might cause bond prices to fall, raising rates and making borrowing more onerous for families and companies. Not only would this hinder economic development, but it would also mean less money pouring through financial markets, reducing the amount of capital available to bid on stocks and other risky assets. After the Fed's bond-buying program is over, it will focus on lifting short-term interest rates.

However, it appears that the stock market has already factored in such changes. "Once supply chain implications became obvious this past spring, and inflation comparisons began to accelerate, the market began to discount impending Fed tightening," Scott Chronert, Citigroup's global head of the exchange-traded fund, in a research note Friday. "Selling the uncertainty ahead of a hawkish Fed change can often lead to buying on the alleviation of that uncertainty."

Given the market's conduct throughout the previous four interest-rate rises, buying activity will likely build up in the coming months. According to Credit Suisse research, gains in the S&P 500 from a year before an initial rate hike to six months later have averaged about 15%. The average income from the same starting position to 12 months following a first-rate hike is 18 percent.

Double Trouble: The S&P 500 was already under pressure from Omicron when the Fed's JeromePowell signaled a more hawkish stance.

That isn't to say that investors should mindlessly invest in stocks: more volatility may be on the way. According to Credit Suisse, the market normally increases just a little in the months leading up to an initial rate hike. Those few months are when investors are still appraising the economic damage that tighter monetary policy may cause.

This is especially true in today's world. The bond market is already reflecting the possibility that the Fed would make a mistake by raising rates too frequently and too soon, stifling economic development.

The Federal Reserve isn't used to attempting to quell inflation. The Fed has been trying to raise inflation by implementing loose monetary policy since the 2008-2009 financial crisis and certainly during the pandemic-ravaged 2020. It is now attempting to keep inflation low, and investors wonder whether this will harm economic demand.

However, one thing is certain. The stock market turbulence is likely to be short-lived and the bull market is likely to continue to develop if the Fed does not tighten policy too aggressively.