Invest $100 and Make $1,000 a Day: Best Strategies to Grow Your Money

Oct 31, 2023

Investing $100 and turning it into $1,000 a day may sound like a lofty goal, but with the right strategies, it’s actually achievable. Whether you’re looking for long-term growth or quicker returns, there are many ways to make your money grow – from traditional investment options to riskier ventures.

In this article, we will explore proven strategies recommended by experts for investing $100 with the potential to make $1000 a day. Some may bring less, others more, but combining various options will give you the best chance of achieving your goal.

Key Takeaways:

- Currently, a variety of opportunities exist for earning money.

- One can make profits with traditional strategies like savings accounts or by using more risky methods like crypto or futures trading.

- In today’s competitive job market, acquiring valuable skills and expertise increases your chances of earning more money.

How to Invest $100 and Make $1,000 a Day

Investing $100 with a goal of earning $1,000 a day may seem like an unattainable feat. After all, that’s a 1,000% return on investment. Even the most successful companies take years to reach such levels. However, this does not mean that it is impossible. It simply means that riskier investments must be made in order to achieve such high returns.

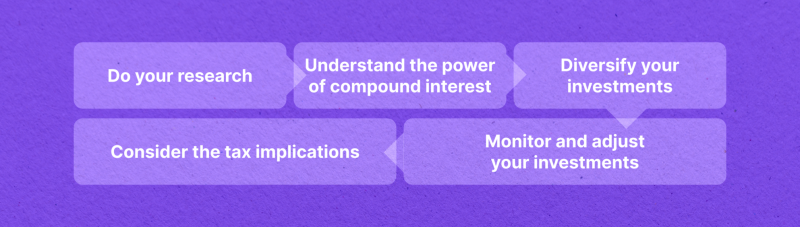

Before we start to investigate opportunities, there are several points to keep in mind:

Research different options

Research is an important part of any investment. Look at various investment options available and assess their risks and potential returns.

Understand the power of compound interest

The key to making big returns is understanding the power of compound interest. This means that not only will you earn interest on your initial investment but also on the accumulated interest over time.

Diversify your investments

As the saying goes, “Don’t put all your eggs in one basket”. It’s important to diversify your investments in order to minimize risk. Instead of putting all $100 into one loan or investment, spread it out among multiple options.

Monitor and adjust your investments

Investing is not a one-time decision – it requires active management. Keep track of your investments and evaluate their performance regularly. If certain investments are not performing well, consider withdrawing or reinvesting in other options.

Consider the tax implications

As with any financial decision, it’s important to consider the tax implications of investing. While some forms of investment may be tax-free, others may require you to pay taxes on your earnings. Be sure to consult a financial advisor or do thorough research before making any investment decisions.

Traditional Strategies

While traditional strategies like bank accounts can help turn your $100 into bigger numbers over time, they are usually not as profitable as more aggressive investment options.

High-yield Savings Accounts

A high-yield savings account is a type of bank account that offers higher interest rates than traditional savings accounts. This means that your money will grow at a faster rate, making it an attractive option for those looking to save and earn more from their funds.

The annual percentage yield (APY) is the metric used to measure the interest rate of a high-yield savings account. It represents the total amount of money you would earn in one year if you didn’t touch your initial deposit or any accumulated interest. A higher APY translates into bigger returns on your investment. The average interest rate for high-yield savings accounts is 5% or more.

It’s important to note that while high-yield savings accounts offer competitive interest rates, these rates are not fixed and can fluctuate over time. This is because they are influenced by the federal funds rate set by the Federal Reserve, which can change based on the current economic climate. However, even with potential fluctuations, high-yield savings accounts still provide significantly higher returns compared to standard savings accounts.

But how does it turn $100 into $1,000? Let’s say you deposit $100 in a high-yield savings account with an APY of 2%. By the end of the year, your initial deposit will have grown to $102 due to the interest earned. If you leave that money alone for another year, it will earn another 2% on top of the original amount ($102), resulting in a total of $104.04. This compounding effect continues over time. If you combine this strategy with others, you’ll have a greater chance of making big profits.

Fund Your Retirement Account

Retirement may seem far away, but it’s never too early to start planning for your golden years. One of the first steps towards a secure retirement is opening a retirement account.

Employer-Sponsored Retirement Plans

Employer-sponsored plans are offered by companies to their employees as a way to save for retirement. These plans often come with benefits such as matching contributions from the employer, tax advantages, and easy contribution options through payroll deductions.

One common type of employer-sponsored plan is a 401(k) plan. With a 401(k), employees can make contributions from their pre-tax income, meaning they won’t pay taxes on that money until it’s withdrawn during retirement. Many employers also offer matching contributions up to a certain percentage of the employee’s salary, providing an even greater opportunity for savings.

Another employer-sponsored option is a pension plan, which provides regular payments to employees during their retirement years based on their final salary and years of service with the company. These plans are becoming less common but still exist in some industries.

Self-Employed Retirement Plans

If you’re self-employed or have your own small business, don’t worry – there are retirement options available for you, too. One popular choice is a Simplified Employee Pension (SEP) IRA. With a SEP IRA, you can contribute up to 25% of your net earnings from self-employment, with a maximum contribution limit of $58,000 for 2021.

Another option is a Solo 401(k), also known as an individual 401(k). This type of plan allows self-employed individuals to make contributions both as an employee and employer, meaning they can save even more for retirement. In addition, there are other plans available, such as the Simple IRA and the Keogh Plan, that cater specifically to self-employed individuals.

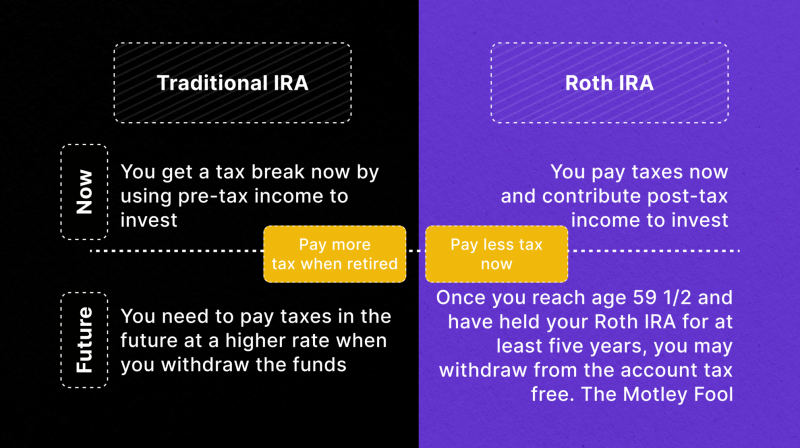

Roth IRA

When it comes to planning for retirement, one thing is certain – the earlier you start saving, the better. While there are various retirement account options available, there’s one type of retirement account that stands out: the Roth IRA account.

A Roth IRA is an individual retirement account that offers tax advantages to grow your savings. Unlike traditional IRAs, where contributions are made with pre-tax dollars and withdrawals are taxed upon retirement, Roth IRAs offer tax-free growth and withdrawals.

One of the main benefits of investing in a Roth IRA is its flexibility. Unlike other accounts that have strict contribution limits and required minimum distributions, Roth IRAs allow you to contribute up to $6,000 a year (or an additional $1,000 if you’re 50 or older), and there are no required withdrawals during your lifetime. This means you can continue growing your savings for as long as you want.

Join a P2P Lending Platform

As a form of investment, peer-to-peer (P2P) lending has gained popularity in recent years due to its attractive returns and low-risk factor. Unlike traditional savings accounts or stocks, P2P lending offers investors the opportunity to directly lend their money to borrowers and earn interest on it.

So, how does peer-to-peer lending work? It’s a simple process where individuals or businesses looking for loans are connected with investors through online platforms. These platforms act as intermediaries, facilitating the entire transaction from start to finish.

As an investor, you can choose to lend your money to a variety of borrowers, such as individuals in need of personal loans, real estate developers, or small businesses seeking capital.

Try a Rolling Membership Transfer Pool

In today’s competitive financial landscape, banks and credit card companies are constantly offering enticing bonuses to attract new customers. These promotions often include cash rewards, free merchandise, or discounted services. However, most individuals can only take advantage of these offers once, leaving potential money on the table.

Using a rolling membership transfer pool, you can reap the benefits of these promotions multiple times by teaming up with friends and family members to maximize your rewards.

So, how does it work? Let’s say you and five other individuals decide to form a rolling membership transfer pool. Each person contributes an equal amount of money, and together, you open six different bank accounts, two at each branch. By strategically timing your account openings and fulfilling the requirements for promotional bonuses, you can potentially earn hundreds or even thousands of dollars in rewards.

This concept may seem too good to be true, but it is completely legal and practiced by many savvy individuals. In fact, this strategy has been around for decades and was commonly used in the 1970s when banks offered free giveaways for opening accounts.

However, before jumping into a rolling membership transfer pool, it’s important to establish clear guidelines and rules with your group. This includes setting a maximum number of accounts per member, keeping track of bonuses earned, and determining how the rewards will be divided among the group. If you plan and coordinate carefully, you could potentially turn an initial investment of $100 into $1000 or more in rewards.

Invest In Real Estate

Investing in real estate can be a great way to create long-term wealth. Real estate investments can provide a steady income stream from rental payments, as well as potential appreciation and tax advantages.

There are also a variety of ways to invest in real estate, such as purchasing a rental property, developing a property, or investing in a real estate investment trust (REIT). However, if you want to invest only $100 and make $1000 a day, the latter might be the most suitable.

REITs are companies that own and operate income-producing real estate properties. By investing in a REIT, you can own a small portion of large-scale commercial properties such as shopping malls, office buildings, or apartment complexes. This allows for diversification in your portfolio and the potential to earn regular dividends from the rental income. However, REITs are subject to market fluctuations and may not provide the same level of control as other types of real estate investments.

Invest in Financial Markets

Investing in financial markets can be done through stocks, bonds, mutual funds, and ETFs. The rewards of investing in financial markets are much higher than in the previous options. However, this type of investment is also more risky than bank accounts and retirement plans. It requires more research and understanding of the market, and the potential for losses is much higher.

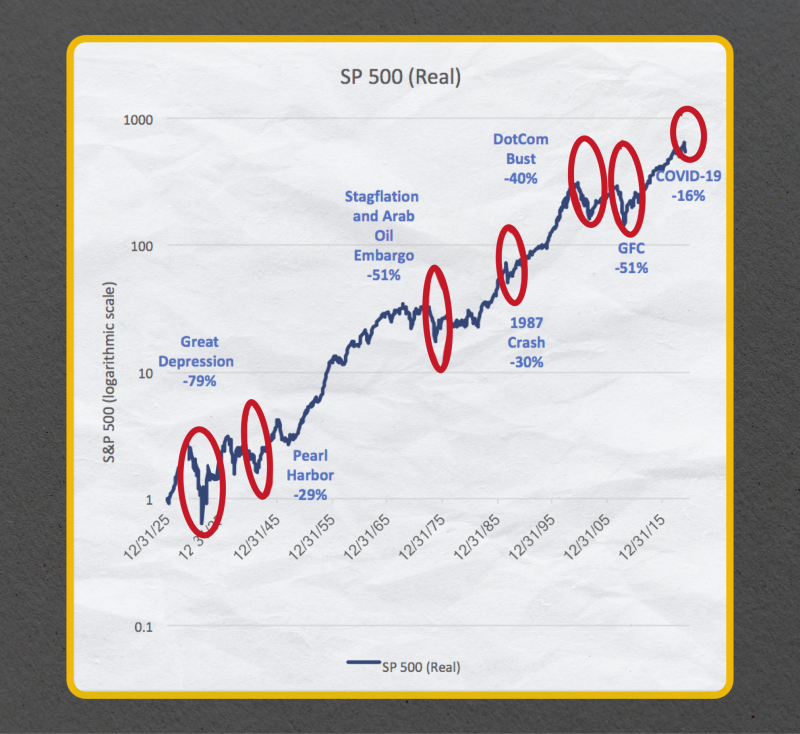

Get a Stake in the Stock Market

When it comes to investing in the stock market, there are various paths that one can take. Some may choose to invest in individual stocks, while others may opt for a more passive approach through ETFs or mutual funds. Additionally, there are those who take on the high-risk world of futures trading.

According to historical data, the average stock market return is about 10% per year, as measured by the S&P 500 index. So, in the long run, you have a chance to make big profits if investing carefully.

But what exactly are these different types of stock market investing, and how do they differ from each other?

- Individual Stocks: This involves buying shares of a particular company’s stock, giving investors ownership of the company and potential for long-term growth.

- ETFs and Mutual Funds: These are a collection of stocks, bonds, or other securities that allow investors to diversify their portfolio without having to directly invest in individual companies. This type of investing is less risky as the overall performance of the fund can be more stable than that of an individual stock.

- Futures Trading: This involves buying contracts that give the investor the right to buy or sell a security at a predetermined price in the future. While this type of investing can potentially bring in high returns, it also carries a significant amount of risk and requires extensive knowledge and experience.

Invest in Index Funds

Investing in index funds is a smart way to diversify your portfolio and potentially increase your returns. These low-cost options passively track an index, making them a great choice for novice investors or those looking to minimize risk.

Buy Dividend Stocks

Dividends are payments made by a company to its shareholders out of its profits or reserves. They can be issued in either cash or stock form and are typically paid quarterly.

Investing in dividend stocks can provide investors with two potential streams of income: dividend payments and capital gains. This makes them an attractive option for those looking to dip their toes into the stock market without taking on too much risk. However, before investing in any company’s dividend stocks, there are some key factors to consider:

- Dividend History: Research the company’s track record of paying dividends. This can give you an idea of how reliable their payments are and if they have a history of increasing dividends over time.

- Consistency: Look for companies that consistently pay dividends, even during economic downturns. This shows stability and a commitment to returning profits to shareholders.

- Dividend Yield: This is the percentage of a company’s stock price that is paid out in dividends annually. A higher yield can mean a larger return on your investment, but be cautious of extremely high yields as they may not be sustainable.

- Earnings on Investment: Calculate how much money you can potentially earn on your investment based on the company’s dividend yield and the number of shares you own. This can help determine if the stock is a good fit for your financial goals.

- Payout Ratio: This is the percentage of a company’s earnings that are paid out in dividends. A lower payout ratio indicates that the company has more room to increase dividends in the future.

Invest with Robo-Advisors

Robo-advisors are digital platforms that utilize complex algorithms to provide personalized investment advice based on your financial goals and risk tolerance.

With robo-advisors, you can start investing with lower minimums and potentially see higher returns on your investments. Plus, the automated nature of these platforms allows for a more passive form of investing, making it easier for individuals to grow their money without constantly keeping track of market fluctuations.

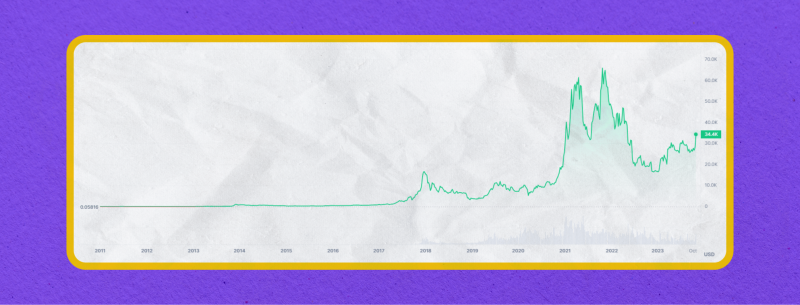

Buy Cryptocurrency

Investing in cryptocurrency can be a tempting opportunity, with the potential for huge returns on even small investments. However, it’s important to approach this market with caution and knowledge, as crypto is probably the riskier market to trade and invest in due to the market’s volatility and unpredictability.

For example, Bitcoin, the most established and well-known cryptocurrency, has experienced extreme price fluctuations, jumping from a low of just several thousand dollars to an all-time high of over $66,000 in November 2021. As of October 2023, bitcoin is trading at between $30,000 and $34,000.

Crypto investment involves a number of factors that should be considered before jumping in:

Research the Coin’s Purpose and Technology

Bitcoin may be the most well-known cryptocurrency, but it’s not the only one with potential. Before investing in any coin, take the time to research its purpose and underlying technology. Understanding how a coin works and what problems it aims to solve can help you make informed investment decisions.

Check the Market Capitalization and Other Metrics

Market capitalization (market cap) is a measure of the value of a cryptocurrency. It is calculated by multiplying the total supply of coins in circulation by the current market price. Market cap is an important indicator for assessing the potential growth and value of a cryptocurrency. It can be used to compare the relative size of different coins and to measure market sentiment. In addition, it can help investors identify coins that have potential for growth and those that may be overvalued.

Consider the Team and Community Behind the Coin

A strong team and community can greatly contribute to a coin’s success. Research the developers, advisors, and supporters behind a coin to get a sense of their experience, expertise, and credibility. A passionate and involved community can also help drive adoption and increase the value of a particular coin.

Evaluate the Market Trends and News

The cryptocurrency market is highly volatile and influenced by a variety of factors, including market trends and news. Keep up with the latest developments in the industry to better understand potential opportunities and risks for your chosen coins.

Some crypto tokens and coins with a good potential to grow right now:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Ripple (XRP)

Besides investing and trading, you can also look into other opportunities such as crypto mining, crypto lending, crypto arbitrage, and crypto staking. By combining all of the strategies and being careful, you can potentially turn your $100 into $1000 a day.

Other Ways of Making Money

Ways to make good profits are not limited to just investing assets.

Open an E-commerce Business

In today’s digital age, having a strong online presence is crucial for any business. One way to start an E-commerce business with limited funds is by utilizing existing platforms such as Instagram or Etsy. These platforms have a large user base and can help you reach a wider audience without having to invest in building your own website.

Start a Dropshipping Business

Dropshipping is a business model where a retailer does not keep any inventory of goods. Instead, the retailer takes orders from customers and passes the orders on to a supplier. The supplier then ships the product directly to the customer. Dropshipping businesses require minimal capital to start and can be more profitable than traditional retail models, as they do not have to invest in inventory or in managing a physical store.

Here are some reasons why it could be a great investment opportunity for you:

- Low Overhead: Dropshipping eliminates the need for a physical storefront, inventory storage, or shipping and handling costs. This means you can start your business with just $100 and focus on growing your online presence.

- No Inventory Management: With dropshipping, you don’t have to worry about managing inventory or shipping products yourself. This saves you time and allows you to focus on other aspects of your business.

- Low Risk: Since you only purchase the product once a customer has placed an order, there is minimal risk involved in dropshipping. This makes it a great investment opportunity for those with limited funds or who are new to entrepreneurship.

- Potential for High Profits: With low overhead and the ability to sell a wide range of products, dropshipping has the potential for high profits. Many successful dropshippers have been able to make $1,000 or more in a single day.

Start a Blog or a YouTube Account

Starting a blog or YouTube account allows you to turn your passion for content consumption into something more. It gives you the platform to express your thoughts and opinions on various topics while potentially reaching a large audience.

Starting a blog is relatively easy and requires little to no investment. You can begin by choosing a topic or niche that you’re passionate about and creating your own website using platforms like WordPress, Blogger, or Wix.

Once your blog is set up, you can start writing content and sharing it with others through social media platforms. As you gain a following, you can monetize your blog through advertisements, sponsored content, and affiliate marketing. This allows you to make money while doing something that you love.

Develop an Affiliate Marketing Strategy

Affiliate marketing is a type of performance-based marketing in which a business rewards one or more affiliates for each customer or visitor brought about by the affiliate’s marketing efforts. It is a lucrative opportunity for content creators to earn passive income and maximize profits.

Affiliates generate traffic and leads for the business by promoting products or services through their own marketing efforts, such as website content, social media, or email campaigns. In return, the affiliates are rewarded with a commission for each successful sale or lead.

Grow Personally by Investing in Yourself

According to many experts, focusing on the utility of your money is key. In other words, rather than looking for a nine-bagger investment, invest in activities or knowledge that will bring lasting benefits. For example, investing in books on personal finance and authors such as Ramit Sethi and Tim Ferriss will pay off in the long run.

In today’s competitive job market, having valuable skills and expertise can greatly increase your potential for earning more money. By expanding your knowledge and skill set, you can turn a small amount of cash into a force multiplier that can give you a competitive advantage.

FAQs

How long does it usually take to see a return on my investment using these strategies?

The amount of time it takes to see a return on investment using these strategies will vary depending on several factors, such as the type of investment, the market conditions, and your risk tolerance. In some cases, you may see a return in a matter of weeks or months, while in other cases, it could take years. Some investments may even lose value, so it’s important to carefully research and consider your options before making any investment decisions.

However, there are some general guidelines that can help give you an idea of when you might see a return on your investment. For example, for stocks or mutual funds, experts suggest holding onto them for at least five years to potentially see a significant return. This is because the stock market can be volatile in the short term but tends to trend upwards over longer periods of time. Real estate investments, on the other hand, may take longer to see a return, with experts recommending holding onto them for at least 10 years.

What is the minimum amount of money I need to invest in making a profit?

It depends on your individual situation and the strategies you use. Generally speaking, most investments take time to realize a return. However, longer-term investments such as stocks or real estate can generate returns quickly if markets are favorable. Additionally, some investments, such as mutual funds, may provide a return within a few years.

How can I determine which stocks or assets to invest in?

One common method is to conduct thorough research on the company or asset, looking at its financial history, industry trends, and future growth potential. You can also consult with a financial advisor who can provide personalized recommendations based on your goals and risk tolerance.