Crypto Token Supply From A to Z

May 18, 2023

We all agree that cryptocurrency investment is an attractive method to generate profits in the long run. But with so many options, which crypto assets should you choose?

In such cases, we use different metrics and analytic tools to determine which crypto is worth putting money in or not. One such metric is the crypto token supply, as it highly influences the token’s future value. For instance, Bitcoin, the pioneering cryptocurrency, has a limited supply of 21 million tokens, whereas Dogecoin follows an inflationary paradigm with an infinite supply.

Currently, the circulating supply of DOGE exceeds 140 billion DOGE, and many more are being created daily. This fundamental difference in supply structure partially explains why Bitcoin’s value has soared while Dogecoin grapples with appreciating significantly.

Yet, token supplies and their underlying tokenomics extend far beyond these basic examples, so let’s delve into the fundamentals of crypto token supply.

Key Takeaways

- Understanding the differences between maximum, circulating, and total supplies is essential for evaluating a cryptocurrency’s value and growth potential.

- Fixed, dynamic, and hybrid token supplies have unique characteristics that can impact a coin’s price and investment appeal.

- Factors such as inflation rate, coin burning, and forks can influence and affect a token’s total supply and market dynamics.

- Investing in cryptocurrencies with a fixed supply might offer more promising growth opportunities, but demand and supply exhaustion timelines should also be considered.

- Staying informed about token supplies and their effects on cryptocurrency prices can help investors make wiser investment choices and capitalize on market opportunities.

What Is The Crypto Token Supply, And Why Does It Matter?

Crypto token supply refers to the aggregate number of coins that will ever exist. The upper boundary of all the coins is known as the maximum supply, while the circulating supply denotes the tokens currently available for trading. In essence, the total supply is the total amount of coins mined/minted – a sum of the max supply and any additional tokens that have been minted but remain unreleased.

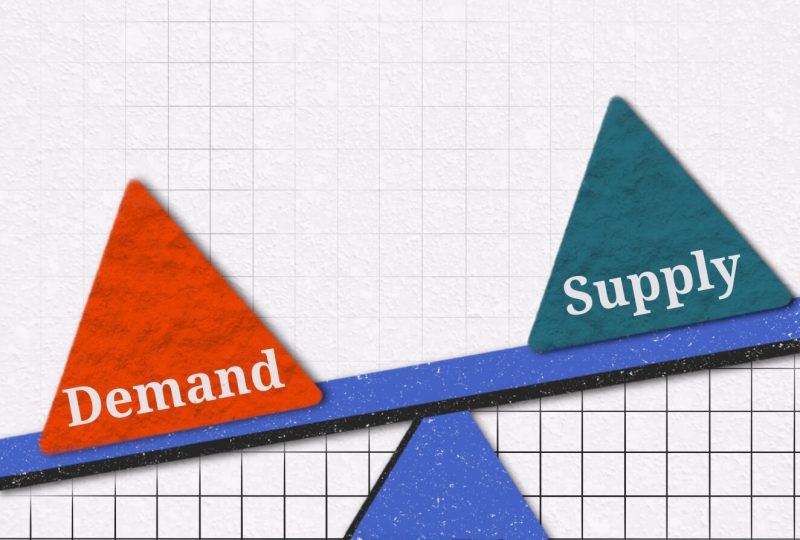

Understanding token supply is crucial because it directly impacts a cryptocurrency’s value, and simple economics explains that well. For instance, if a particular cryptocurrency coin has a limited supply and strong demand, its price will likely rise on the open market.

Conversely, if crypto has an abundant supply and comparatively low demand, its price will witness a more downward pressure. Although the total and circulating supply can also influence a token’s price, the maximum supply is more significant in determining its value. In other words, knowing a token’s supply structure is vital when assessing the potential of cryptocurrency investment.

How Is A Token’s Supply Created?

In contrast to fiat currencies, which central banks may issue to meet demand, cryptocurrencies have a predetermined number of new coins that will never increase. A cryptocurrency’s supply might be distributed instantly or gradually through mining and staking.

Again, Bitcoin has a limited total supply, while Ethereum has a maximum but not a finite supply. That means that the overall supply of Ethereum tokens will ultimately reach a maximum level and stop growing, even if there is no hard cap on the total number of tokens that may be issued.

The production of new coins is subject to the specific rules and regulations of each cryptocurrency coin and blockchain project. Investors may make better judgments and more correctly estimate the future value of a digital asset if they have a thorough understanding of the diverse supply generation processes involved.

Maximum Supply

The maximum supply refers to the highest possible number of tokens that can be created for a particular cryptocurrency. This value is often predetermined and unchangeable. However, some cryptocurrencies, like Ethereum, have a variable max supply, which can increase if changes are made to the protocol.

Key Features:

- The cap on the number of tokens that can be created

- Can be fixed or variable

- Typically predetermined and unalterable

Circulating Supply

The circulating supply represents the number of tokens currently in existence and available for trading on the open market. This value will always be less than the total supply, but in some cases, it may equal the max supply.

This scenario usually occurs with cryptocurrencies having a finite total supply, such as Bitcoin, where all tokens that will ever exist are already in circulation. Currently, around 19 million Bitcoins are in circulation, less than its maximum supply of 21 million.

Key Features:

- The number of tokens currently in existence and tradable

- Consistently lower than the total supply

- It can sometimes be equal to the maximum supply

Total Supply

The total supply is the sum of the maximum supply and any additional tokens minted but not yet released. This number will always be greater than the circulating supply. For instance, coins that are being held under a lockup or vesting period, which typically follows a private sale or Initial Coin Offering (ICO) event.

If a cryptocurrency has a max supply of 100 million tokens, and an additional 30 million tokens have been minted but remain unreleased, the total supply would be 130 million. An example would be Ripple (XRP), which has a total supply of 100 billion tokens, with around 51 billion currently in circulation and the rest held by the company and its founders.

Key Features

- Equals the maximum supply plus any additional tokens minted but not yet released

- Always greater than the circulating supply

- It can be fixed, dynamic, or hybrid

Which Is The Most Important Metric?

Understanding the supply parameters of a token and how they could affect its price is essential for navigating the murky waters of cryptocurrency investment. Given that total and circulating supplies might shift throughout a project’s lifetime, keeping up with its progress is crucial.

It’s not easy to single out one supply metric—total, circulating, or maximum—as the most important since each has its unique role. However, understanding the distinctions between these metrics can improve your ability to analyze the cryptocurrency market and comprehend how they affect the value of a coin.

One crucial metric is the total market capitalization, or market cap, calculated by multiplying a token’s max supply by its current price. This number includes all vested tokens and provides information about potential market actions. When the currency finally hits the market, early investors and the project team may opt to dump a lot of their tokens.

What Are The Different Types Of Crypto Token Supplies?

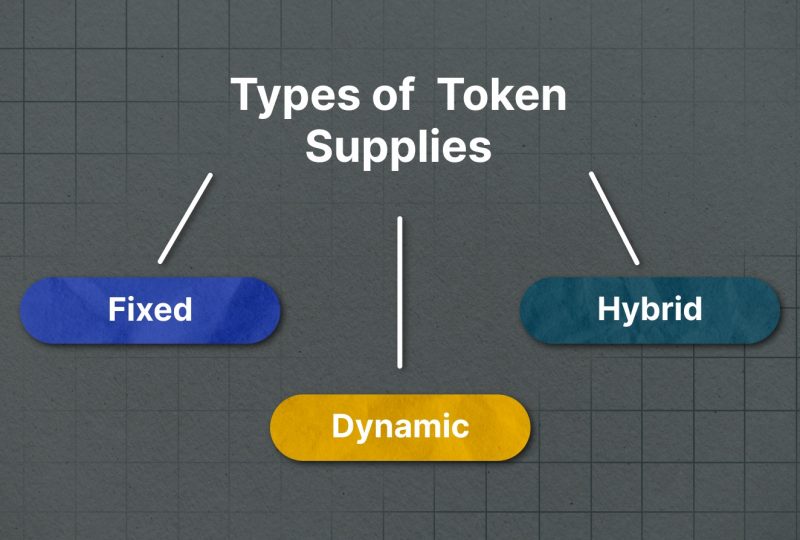

Cryptocurrency token supplies can be categorized into three primary types: fixed, dynamic, and hybrid. Understanding the differences between these types can help investors make informed decisions about their investments.

- Fixed Supply

A fixed supply is a predetermined and unchangeable supply. Cryptocurrencies with a finite total supply often adopt this model, such as Bitcoin. In this case, there will never be more than 21 million Bitcoins.

- Dynamic Supply

A dynamic or variable supply can be adjusted if the cryptocurrency’s protocol permits it. Ethereum is an example of a dynamic supply, where the total supply will eventually be capped at 100 million ETH. However, this number could change if modifications are made to the Ethereum protocol.

- Hybrid Supply

A hybrid supply combines elements of both fixed and dynamic supplies. Augur is an example of a hybrid cryptocurrency with a maximum supply of 11 million REP tokens. It also allows for creating new REP tokens through “repurposing.”

Recognizing the distinctions between fixed, dynamic, and hybrid token supplies can provide valuable insights for investors as they navigate the crypto market.

How Can The Token Supply Be Changed?

A cryptocurrency’s total and circulating supply can significantly impact the coin’s price. For instance, if a coin has a low circulating supply but a high total supply, it implies that limited coins are available for trading. However, there is potential for the price to increase as more new coins are yet to be released.

Conversely, if a coin has a high circulating supply but a low total supply, many coins are available for trade, but the price is likely to decrease as more coins enter the market. Therefore, understanding the factors influencing a cryptocurrency’s supply is crucial for evaluating its investment potential. Here are some more examples:

- Several coins minted but not yet released: Consider a cryptocurrency with a max supply of 100 million tokens, of which 30 million have been minted but not yet released. In this case, the total supply would be 130 million. The release of these tokens can impact the price and overall supply dynamics.

- Inflation rate: Some cryptocurrencies have an inflation rate that increases the coin’s total supply over time. For instance, Bitcoin’s inflation rate is currently about four percent, meaning that the total supply of Bitcoin will increase by four percent every year. A higher inflation rate can lead to a decrease in the coin’s value.

- Burning or destroying coins: Certain cryptocurrencies implement “burning” or “destroying” coins. This occurs when the project team sends a specific number of coins to a public address that can never be reassessed, reducing the total supply of the coin. Burning coins can result in increased scarcity and potentially higher value.

- Forks or splits of a coin: A fork or split can transpire when the project team changes the coin’s protocol. This change can create two different versions of the coin, each with its own total supply. Forks can introduce additional coins to the market, altering the supply dynamics and potentially affecting the price.

- Staking and Lock-up Periods: Some cryptocurrencies require users to “stake” or lock up their tokens for a certain period to support network operations, such as validating transactions or earning rewards. This can temporarily decrease the circulating supply and potentially increase the token’s value due to reduced market liquidity.

- Token Buybacks: Occasionally, a project team may decide to buy back tokens from the market and remove them from circulation. This can lead to a reduction in the circulating supply and potentially increase the token’s value.

- Airdrops and Token Distribution Events: Airdrops involve distributing free tokens to existing holders, while token distribution events may reward tokens for participating in specific activities. Both can increase the circulating supply and may impact the token’s price.

- Regulatory Actions: Government regulations can impact the token supply by imposing restrictions on token issuance, trading, or mining. Regulatory actions may force projects to adjust their tokenomics, affecting the total, circulating, or max supply.

- Market Demand: The market’s demand for cryptocurrency can influence its supply dynamics. If demand increases, more tokens may be minted, released, or unlocked to meet the market’s needs, potentially impacting the circulating supply.

- Technological Advancements: Improvements in blockchain technology or changes in a project’s consensus algorithm can affect the token supply. For example, Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS) consensus mechanism with Ethereum 2.0 could influence its supply dynamics.

Best Fixed Supply Cryptocurrencies To Invest In 2023

Investing in cryptocurrencies with a fixed supply offers an appealing strategy for potentially profiting from the future value of these assets. Price growth is often anticipated with a finite supply due to the fundamental principle of high demand and low supply. As investors increasingly put their money into these assets, the overall supply may struggle to keep up with the rising demand, potentially leading to price surges.

While choosing a cryptocurrency with a fixed supply is essential, it doesn’t guarantee profits. Additional factors to consider include the asset’s rising demand and the time it would take for the cryptocurrency to reach its max supply. It’s crucial to invest in a coin with a feasible halving cycle.

Here are some examples of cryptocurrencies with a fixed supply:

- Bitcoin (BTC)

The most popular cryptocurrency globally, Bitcoin has been a go-to option for many investors due to its dramatic increase in demand and value.

- Litecoin (LTC)

Forked from the original Bitcoin project, Litecoin offers better transaction speeds and scalability, with a maximum supply of 84 million (approximately 75% in circulation).

- Cardano (ADA)

This cryptocurrency powers a peer-reviewed app platform and has a maximum supply of 45 billion, one of the highest among fixed-supply cryptocurrencies.

- Stellar (XLM)

Stellar is a cryptocurrency designed for individual and cross-border payment settlements, with a maximum supply of 50 billion.

- Chainlink (LINK)

As an Ethereum-based token, Chainlink has a fixed supply and is used for creating and running smart contracts. Its maximum supply is 1 billion.

- Monero (XMR)

A privacy-focused cryptocurrency with a maximum supply of 18.4 million, Monero offers untraceable transactions and strong security features.

- Zcash (ZEC)

Similar to Monero, Zcash is a privacy-centric cryptocurrency with a maximum supply of 21 million, providing secure and shielded transactions.

- Algorand (ALGO)

Aiming to provide a scalable, secure, and decentralized platform, Algorand has a fixed supply of 10 billion tokens.

- Binance Coin (BNB)

The native token of the Binance exchange, BNB, has a maximum supply of 200 million, with periodic token burns reducing the supply to increase its value.

- 0x (ZRX)

An open protocol for decentralized exchanges on the Ethereum blockchain, 0x has a fixed supply of 1 billion tokens.

Wrapping Up

To sum up, mastering the nuances of token distribution is crucial for making informed investment decisions in the volatile cryptocurrency market. A coin’s maximum, circulating, and total supply dynamics are major factors in its value and development potential. By carefully observing these aspects, you can identify the assets with real opportunities for growth and enrich your financial portfolio.