Financial Planning in the Cryptocurrency Era — Master Crypto and Digital Asset Strategies

Jul 23, 2025

Finance has been a centrally banked, paper-money-based, and lethargic system only in recent times. It is now, with the shock from cryptocurrency and virtual assets, being reconstituted on a record global scale in a remarkably short period.

What was previously experimental technology has now become the leading edge of a global revolution, transforming the way we save, earn, and think when investing money.

When crypto is integral to day-to-day life, ranging from purchasing Bitcoins through smart contracts and digital wallets, a new era in planning is being moulded, where people must adjust to working with traditional finance, in addition to the shifting, ever-evolving landscape of blockchain-led creation.

The Basics of Financial Planning in the Age of Cryptocurrency

Over the last couple of years, cryptocurrency has evolved from being an outsider technology to becoming one of the pillars of the world monetary framework.

With cryptocurrencies and digital assets increasing their presence in daily finance, individuals need to cultivate the skills for handling money so they consider conventional finance as much as the growing realm of digital finance.

Whether you’re new to the scene or are an existing participant in crypto asset marketplaces, it’s also critical for you to learn how to organise your finances.

Digital Assets and The Changing Finance World

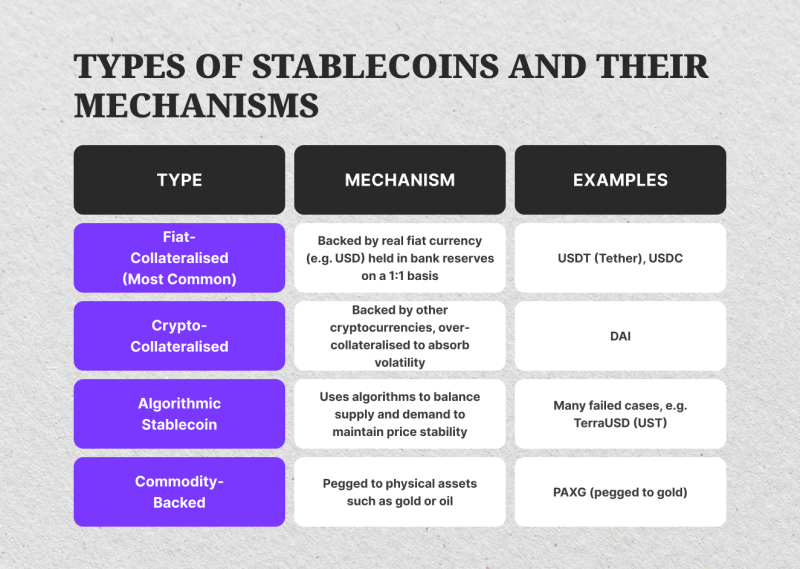

Cryptocurrencies, like Bitcoin and Ethereum, stablecoins, and tokenized securities are an entirely new phenomenon in value storage and value transfer.

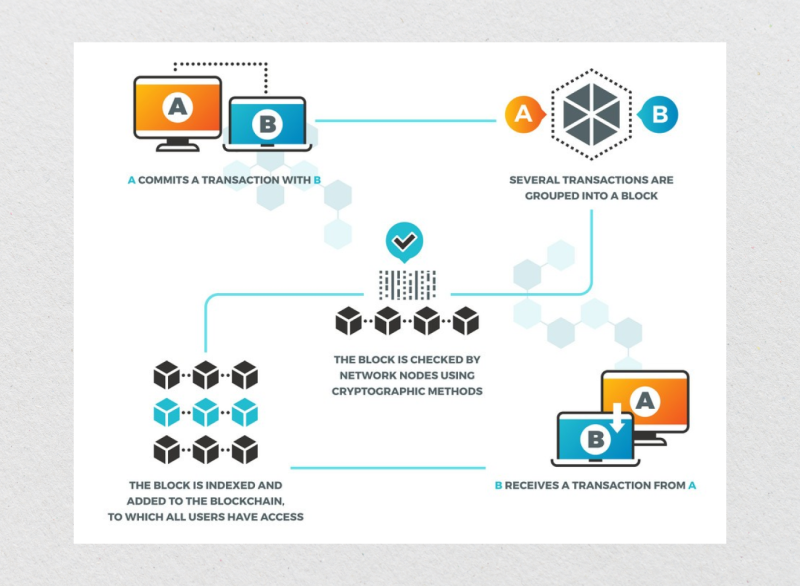

These assets are powered by blockchain technology, which enables them to exist independently of banks and central authorities. Smart contracts, digital wallets, and tokenized ownership are an exciting array of possibilities, but they also bring challenges.

While traditionally bank deposits are held by banks, crypto assets are owned directly by their holders. Individuals own them, but they exclusively possess the private keys, and hence, have total control over their holdings. This is an empowering model, but individuals are also held entirely responsible for the security of, as well as the management of, assets.

For newcomers, the process buying Bitcoin can be the gateway into this world. Whether through an official exchange, peer-to-peer, or crypto ATM, buying Bitcoin is the entry point into this revolutionary world of finance—and into the world of owning digital wealth.

Defining Financial Goals in a Tokenized World

With cryptocurrency services and conventional finance services being integrated into the financial realm, setting clear personal goals is more imperative than ever. Are you investing for the long term, day trading, generating earnings, or for inflation cover?

Virtually all financial experts recommend holding crypto assets as part of your overall portfolio, as price volatility is common for virtual asset exchanges. Diversifying exposure between fiat and crypto enables you to ride innovation waves without sacrificing stability.

Budgeting Crypto And Fiat Together

A budget for the era of virtual money is flexible. You can earn or spend government-issued or virtual currencies, depending on your freelancing, staking, or use of decentralized finance applications.

After these revenues and expenditures come programs that can take these types of assets. Whereas the majority of crypto budgeters convert holdings into the native currency values for convenience, as values fluctuate rapidly, programs that interface with virtual wallets can facilitate automation.

Earning and Saving In the Age of Cryptocurrency

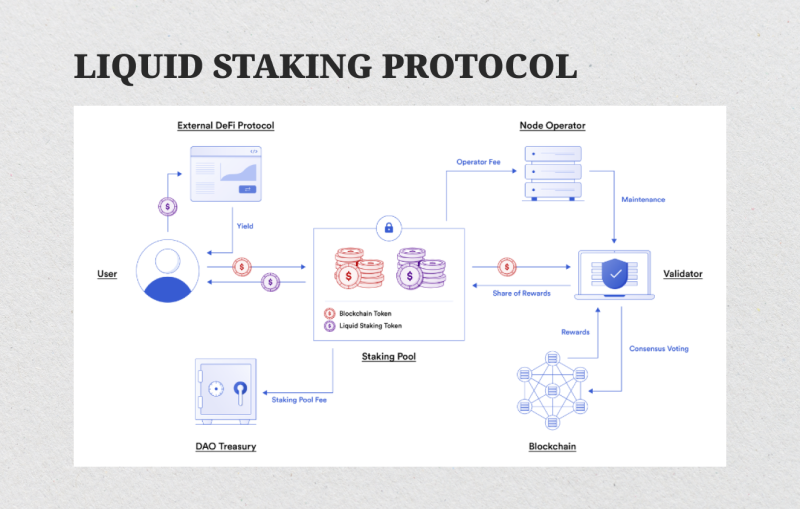

Traditional modes of saving are complemented these days by crypto options. Token staking, participating in liquidity pools, and depositing stablecoins into interest-accruing accounts have become commonplace. These processes are governed by smart contracts and can be availed of through decentralized finance platforms.

Nonetheless, they won’t typically enjoy the same consumer protections as banks. You will need to understand the risks, such as managing private keys and selecting secure sites.

Strategic Investment in Crypto Assets

Crypto investing is also a mental shift. Instead of trying to time the market, investors typically employ strategies such as dollar-cost averaging. This means spreading out purchases and reducing risk because of price fluctuations.

Diversifying your portfolio remains crucial. Mixing reputable coins, stablecoins, and high-quality digital tokens can achieve a more balanced approach. As the cryptocurrency market matures, institutional investor interest is also growing, providing more liquidity and credibility, but also more regulatory oversight.

Staying Secure Within a Decentralized Environment

Crypto security management is different from trusting a bank. In such a setting, ownership is determined by the fact that you possess your own private key. You lose that, and you have absolutely no access to your assets.

Utilize secure digital wallets, activate two-factor authentication, and do not keep large volumes on exchanges. Vulnerabilities are where hackers look, and without custody protections of digital assets markets that exist through traditional finance, the responsibility is yours.

Taxation and Regulation in the United States

In the United States, crypto is treated as property. This means transactions in crypto for buying commodities, switching from one form of cryptocurrency to another, or receiving interest can all trigger taxable events. Regulators, including the Securities and Exchange Commission, are still developing crypto asset treatment regulations.

You can also maintain clean, complaint records with software like CoinTracker or Koinly. As for greater government monitoring, clear regulation can bring crypto services within the law while also enhancing consumer protection.

Preparing for the Future of Money

Its future is a hybrid, where they are going to merge new finance services with what is coming, for instance, central bank digital currencies. As soon as private businesses and governments build better cryptocurrency infrastructure, financial planning itself is going to continue evolving.

If you hold a noteworthy cryptocurrency, consider where it fits in your estates plan and seek advisors with experience dealing with digital assets, just as you would with traditional finance. You may even need to ponder who else would be in a position to access your funds in the event you die or are incapacitated.

How to Add Cryptocurrency to Your Portfolio of Investments

Cryptocurrency is no longer a buzzword among day traders or tech buffs. It is becoming an asset class, akin to stocks, bonds, and real estate, that needs to be part of a well-diversified portfolio. As the world enters the digital transformation phase, cryptocurrencies and digital assets are transforming the way wealth, risk, and opportunity are perceived.

How do you truly put cryptocurrency in your investment plan without losing your hard-earned money in speculation? It has nothing to do with being on trend; everything has to do with making sound, informed decisions based on your long-term objectives.

Understand What You’re Dealing With

Before entering the business world, it is worth knowing what cryptocurrency is. It is cryptocurrencies like Bitcoin and Ethereum, among others, that are decentralised, primarily because they are not based in banks or governmental institutions. It is blockchain technology, an open-source electronic ledger, that immutably and securely stores transactions, propelling them.

Start with a Definite Purpose

It is easy to get swept up in the frenzy—the 10x return articles can do that to you—but if you’re thinking of crypto as part of your future, ask yourself why.

Are you looking for long-term appreciation? Insurance against inflation? A way to diversify your exposure away from the stock market?

Your investment rationale for crypto should guide what you invest in and the types of assets you buy. For most, that means starting out as a fractional part of your portfolio—generally between 1% and 10%, depending upon your tolerance and investment objectives.

Choose Your Assets Wisely

There are thousands of tokens and coins, but they’re far from being equal. Bitcoin and Ethereum are the most reputable, as they have widespread market acceptance and a robust infrastructure. There is an ideal starting point for any newcomer.

From there, you can explore digital tokens that power DeFi platforms or even stablecoins tied to the US dollar, which offer a more stable store of value. Keep in mind, however, that the further into altcoins you go, the more research and risk management you’re going to need.

Select Safe Platforms and Store Securely

When you choose assets, you will then want a way to purchase and hold them. Big exchanges, such as Coinbase, Kraken, or Binance, are user-friendly and regulated. Holding your crypto in the long term, though, on an exchange is not the best.

As an additional protection, transfer your assets into a digital wallet—a physical device where your cryptocurrency is stored in a secure environment. Hardware wallets, where your private keys never go online, are the least vulnerable, especially for long-term storage.

Think About Diversification

Just as it is true for classic investments, having all your eggs in one basket is a bad idea. You don’t require an entire dozen of various tokens, but spreading your crypto asset across multiple decent projects can provide cushioning when market conditions become bumpy.

For instance, you can have mostly holdings in Bitcoin and Ethereum, but invest a few percent in DeFi projects or other emerging technologies. Having some assets of stablecoins can also provide you with liquidity and flexibility, particularly if you’re exploring other cryptocurrency services such as lending or farming yields.

Familiarize yourself with the Tax Aspect

That is where the problems arise. In the United States, the IRS is treating cryptocurrencies as property, not as a form of money. As such, each time you sell, trade, or use a cryptocurrency to acquire an asset, there is the potential for a taxable event.

Records must also be kept accurately. You can use software like Koinly or CoinTracker, which can sync your wallets for you and generate reports. However, if you are still unsure, consult a tax professional who is experienced in working with digital assets and the latest IRS guidance.

Crypto is not a set-it-and-forget-it investment. Prices can fluctuate dramatically even over a short period, so the worth of your crypto assets could shift significantly from your overall portfolio balance.

Set a time—you may opt for monthly, quarterly, or yearly—to review your crypto exposure. If it has grown considerably, consider rebalancing by selling part of your crypto and moving to more stable assets. If you are underperforming, ask yourself if it still aligns with your overall strategy.

Stay Ahead of the Curve

The Crypto space keeps expanding exponentially. New projects continue to emerge, with ongoing discussions between governments regarding a central bank cryptocurrency, and banks are already deploying cryptocurrency services for their clients. As the boundaries between crypto and traditional finance continue to blur, one must keep pace.

Subscribe to good newsletters, pay close attention to well-known analysts, and take notice of regulatory news, especially that issued by the Securities and Exchange Commission and other foreign regulatory authorities. Information in this case is your most highly valued asset.

Practical Crypto Finance Management Tips

Cryptocurrency has introduced yet another sense of freedom and flexibility into personal finance, but it also comes with its own set of complications.

Whether you’re investing in Bitcoin for the long term, profiting from staking, or spending cryptocurrency on daily transactions, managing your crypto finances is slightly different from traditional money management.

The following are some actionable, ground-level recommendations for staying organized, secure, and fiscally responsible as you venture into the world of digital assets.

Treat Crypto Like Real Money — Because It Is

It is simple, yet far too many still treat cryptocurrency as play money. You have invested in your own cryptocurrency, which is part of your overall financial plan, alongside assets such as money, stocks, or real estate.

Pay attention to its worth. Budget for it. And don’t forget to include it when your overall wealth is being looked at.

Even as the market is dynamic, never allow volatility to distract your focus away from treating your crypto just like other conventional investment holdings.

Keep Different Purposes Separate Using Separate Wallets

Think of your cryptocurrency as physical cash. You would never keep all of your savings in your wallet, and neither should you have that in cyberspace.

- Maintain different digital wallets for different purposes:

- A hot wallet (online) for occasional, day-to-day spending money or for trading

- A cold wallet (offline hardware storage) for long-term holdings

Splitting your funds is equally about staying organized as it is about reducing the risk of losing all your money due to hacking or device failure.

Document Every Transaction (Yes, Every One)

It is crucial to have a clean history of all cryptocurrency transactions that you have ever done. These include purchases, sales, trades from one coin to another, staking or DeFi rewards, and even receipt of crypto as payment.

Why? Because each of those has tax implications for the US. Crypto is treated as property by the IRS, and you’re held responsible for reporting capital gains, losses, and income. Having crypto tax software like Koinly or CoinTracker handy can save you a gigantic headache come tax season.

Attain a Realistic Distribution Within Your Portfolio

Crypto is fun, but never let excitement cloud your investment judgment. One of the most sensible things you can do is allocate a designated space for your crypto assets within your entire investment portfolio. For example, you can opt to have crypto as 5-10% of your total investment.

That protects your wealth as a whole from the wild price swings characteristic of crypto marketplaces. And if your crypto is yielding you too great a percentage, you can rebalance your portfolio as necessary.

Do Not Depend on Memory — Utilize Tools

Between exchanges, wallets, and other tokens, you can easily become confused regarding your crypto activity, especially if you’re purchasing and selling on multiple blockchains or switching tokens as you would between a WBTC to FTM exchange.

This is where a portfolio tracker is beneficial, as Delta, CoinStats, or Blockfolio can save you time and distress. These programs consolidate all your holdings under one roof and provide you with performance insights in real-time.

Secure your recovery phrases and keys

Private keys are the keepers of your crypto. If you lose them, your holdings can never recover—you can’t change your password and can’t contact customer service.

Keep them in multiple secure locations. Print your recovery phrase (usually a 12- or 24-word seed) on paper and store it in a secure location, such as a vault. Do not use electronic copies, as they can get compromised. Do not hand your phrase or your keys to anyone.

Emerging Trends and the Future of Financing through Cryptocurrency

Cryptocurrency is revolutionizing the world’s monetary system. What began as Bitcoin has evolved into an entire blockchain, decentralized finance, and digital asset ecosystem. As cryptocurrency is increasingly becoming mainstream, the world of finance is shifting rapidly and irreversibly.

Digital Assets and Tokenization

From Bitcoin and Ethereum to stablecoins and tokenized securities, digital assets are enabling faster, more streamlined transfers of value. Tokenization is enabling fractional ownership of assets like stocks and property, pushing traditional finance toward more liquid and democratized models.

Decentralized Finance (DeFi)

DeFi platforms enable people to lend, borrow, and earn interest without banks, leveraging smart contracts. These tools provide borderless access to finance, just what is needed where traditional banking infrastructure is lacking. DeFi is still young, but it is already an enormous step toward open, programmable finance.

Central Bank Digital Currencies (CBDCs)

Central banks are developing central bank digital currencies to update their fiat arrangements. As decentralized crypto does not have state-authorized efficiency and power, CBDCs integrate traditional finance services and blockchain-based infrastructure.

Institutional Adoption and Regulation

Major financial institutions are incorporating crypto assets into their service offerings, enabling expanded infrastructure and credibility. Regulators, including the Securities and Exchange Commission, on the other hand, are shaping the legal environment to facilitate both consumer protection and sustained market stability.

Integral Incorporation and Inclusion

Crypto is becoming an intrinsic part of day-to-day life, from wallet payments to crypto credit/debit cards. For unbanked individuals, cryptocurrencies offer the opportunity to access the financial system with just a phone. Education is, however, core. To manage private keys effectively, avoid common pitfalls, and understand market dynamics, secure inclusion is necessary.

Conclusion

To manage your finances effectively in the era of cryptocurrencies, you require a smart combination of traditional finance sense and modern online strategies. By developing an integrated financial plan that wisely incorporates crypto assets, utilizing secure exchanges, and staying up-to-date with the constantly evolving laws, you can unlock the potential of this virtual revolution.

Start with basic steps, such as properly acquiring Bitcoin, and expand to intelligent diversification strategies and hands-on asset management, including secure exchanges between WBTC and FTM.

As blockchain technology revolutionizes the world economy, those who start first and lay out a good plan of action will have the greatest chance of succeeding in an increasingly digitized monetary world.