Max Funded IUL Explained: Is It a Legitimate Financial Strategy?

Mar 21, 2025

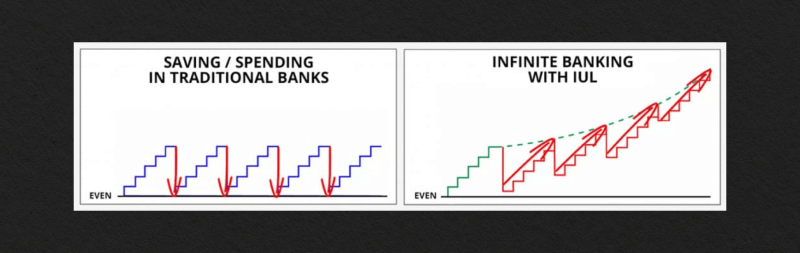

Saving for the future is the best thing you can do with your money right now, especially with the plethora of saving plans that you can use to have a comfortable retirement. Max funded indexed universal life insurance, which many describe as a “hack” to grow wealth, is one way to capitalize on life coverage.

Is a max funded IUL account better than a regular retirement plan? How does it work? Let’s explain this strategy in the following.

Key Takeaways:

- Max Funded IUL is an advanced financial strategy that pays maximum insurance premiums to accumulate tax-free money.

- IUL cash reserve is associated with a selected stock index and increases its value as market prices surge.

- Unlike 401k and other life policies that provide tax-levied income, IUL insurance offers tax-exempt income.

- Policyholders can withdraw and borrow from their IUL account, but excessive unpaid loans can result in policy suspension or lapse.

Understanding Max Funded IUL

The Max Funded IUL is an Indexed Universal Life insurance policy optimized for cash value growth by contributing the maximum allowable premium without causing the policy to become a Modified Endowment Contract (MEC).

This strategy enhances the policy’s cash accumulation potential while preserving its tax-advantaged status. As such, the cash value account grows based on the performance of selected stock market indexes, offering the opportunity for higher returns compared to regular whole-life insurance.

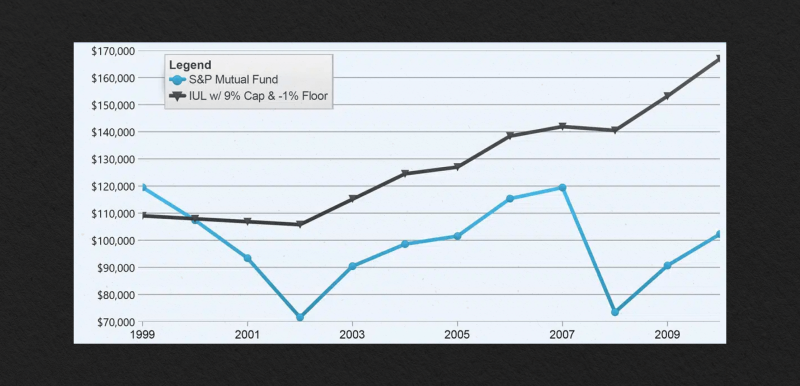

Additionally, these policies typically include a floor earning, ensuring that the cash value does not decrease due to market downturns, thereby providing downside protection.

IUL vs 401(k)

While both IULs and 401k plans serve as vehicles for retirement savings, they differ significantly in structure and benefits.

The 401(k) is a tax-advantaged retirement account that allows pre-tax contributions with potential employer matching, where investments grow free from taxation until withdrawal. Withdrawals are taxed as ordinary income, and required minimum distributions (RMDs) apply starting at age 72.

In contrast, a Max Funded IUL provides death insurance coverage besides cash value accumulation, with the potential for tax-free withdrawals through policy loans.

Unlike the 401(k) plan, there are no RMDs, and the cash value growth is linked to the performance of a certain market instrument, offering growth potential and downside protection.

However, IULs can be complicated and pricier than 401(k) plans.

IUL vs Traditional Life Insurance Policies

Traditional life insurance policies, such as whole life or term life, primarily focus on providing a death benefit to beneficiaries. Whole-life policies offer a guaranteed cash value accumulation with fixed premiums, while term-life policies provide coverage for a specific period without any cash value component.

On the other side, IUL packages combine the death benefit with the potential for money value growth linked to market index performance.

This connection offers the possibility of higher returns compared to the fixed returns of whole-life policies. Additionally, IULs allow policyholders to adjust premium payments within certain limits, whereas traditional policies typically have fixed premium schedules.

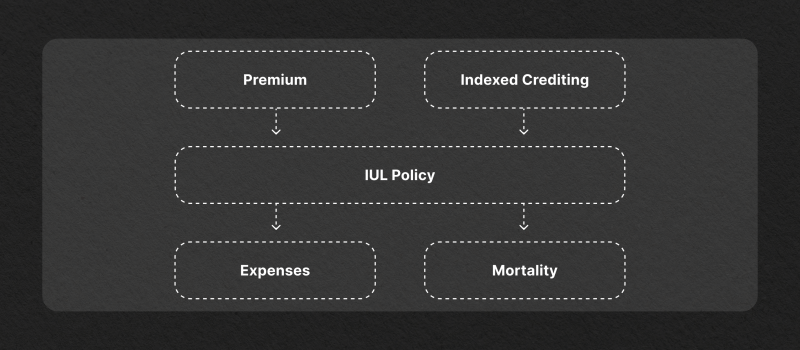

Main Components

Indexed universal life policies can be challenging to understand, especially if you are not a financial expert. Let’s explain its basics.

Death Benefit

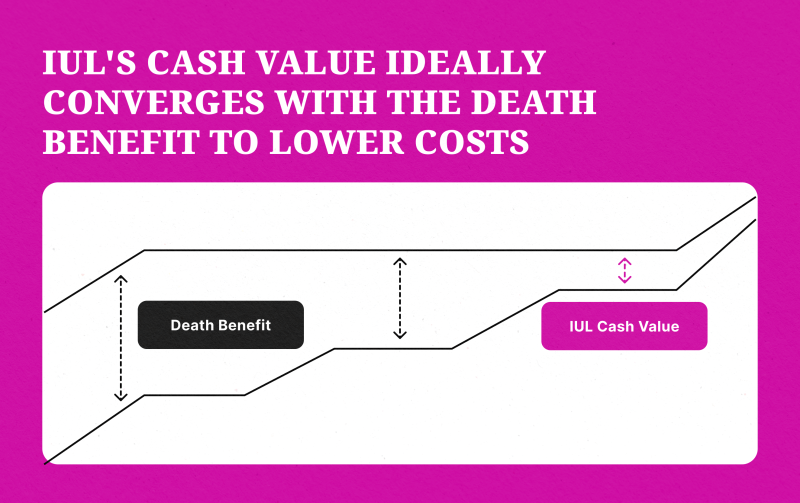

The death benefit is the core component of any life insurance coverage package, providing a lump-sum payment to beneficiaries upon the insured’s passing. In a Max Funded IUL, the death benefit not only offers financial protection to loved ones but also plays a role in determining the cost structure and tax advantages.

Properly structuring the death benefit is crucial to maximize cash value increase while maintaining the policy’s tax-advantaged status.

Cash Value

The cash value in an IUL account accumulates over time as premiums are paid and interest is credited based on the performance of selected market indexes. This cash value can be accessed during the policyholder’s lifetime through loans or withdrawals, providing a source of tax-free income if managed correctly.

However, it is worth noting that excessive cash-out activity can reduce the death benefit and cause the policy to lapse if not properly managed.

Indexed Interest Crediting

Indexed interest crediting ties the insurance cash value growth to the performance of a specific stock market index, such as the S&P 500.

When the index performs well, the associated interest increases to a predetermined cap. If the index performs poorly, the policy’s floor ensures that the cash does not decrease as downside protection.

This mechanism allows policyholders to participate in market gains while mitigating the risk of losses and downside market exposure.

How Do You Benefit From Max Funded IUL Policies?

Maximizing the Funding of an IUL policy offers several potential benefits, including accelerated cash value growth, tax-advantaged income, and flexible access to funds.

By contributing the maximum allowable premiums, you can enhance the policy’s cash accumulation potential, providing a source of funds that can be accessed for various needs, such as financing your retirement income or funding major expenses.

Additionally, the tax-free nature of policy loans and withdrawals can offer significant tax advantages if managed well compared to other investment vehicles.

However, it’s essential to consider the associated costs and complexities of this strategy, as it is less popular and accessible to average users.

Regulatory Considerations

Max Funded IUL policies must be carefully structured to comply with Internal Revenue Service (IRS) guidelines to keep their tax-free status.

As such, overfunding a policy beyond certain limits can cause it to be classified as a Modified Endowment Contract (MEC), which alters the tax treatment, making loans and withdrawals subject to taxation and potential penalties.

Therefore, it’s crucial to consult knowledgeable professionals to ensure premium contributions and policy structures adhere to regulatory limits.

How Maximizing Premiums Affect Growth?

Maximizing premium payments in an IUL package accelerates cash value growth by increasing the funds allocated to the indexed accounts. This boosted cash pool can result in higher interest credits, especially during periods of favorable market performance.

However, contributing the maximum allowable premium requires careful planning to avoid exceeding IRS limits that could trigger a tax obligation. Therefore, maximizing payments should be done strategically to balance growth potential with tax efficiency.

Who Should Consider a Max Funded IUL Account?

A Max Funded IUL can be an effective financial tool if properly planned and executed. It might be inaccessible to inexperienced individuals or those lacking IRS framework knowledge.

For example, they are not ideal for those who need short-term liquidity, prefer low-fee investment options, or are uncomfortable with the complicated concept of life insurance-based investment strategies.

As such, this strategy is best suited for the following:

- High-income earners: Those who have maxed out contributions to traditional retirement plans like a 401(k) or IRA may find IULs attractive due to their tax-free growth and flexible access to funds.

- Tax-free retirement income: Since policy loans from an IUL can be structured to be tax-advantageous, this option may appeal to individuals seeking additional tax-efficient income streams.

- Market participation with downside protection: Unlike direct stock market investments, IULs provide interest earnings based on index performance while ensuring protection against market dips.

- Long-term wealth accumulators: IULs work best when managed consistently over many years, making them ideal for those with a patient, disciplined approach to wealth accumulation.

- Sustainable planning solutions: With proper structuring, a Max Funded IUL can facilitate tax-free wealth transfer to beneficiaries, ensuring financial security for future generations.

Key Benefits of Max Funded IUL

Getting a Max Funded IUL policy comes with several financial advantages, making it a compelling option for wealth accumulation, retirement planning, and legacy preservation.

Tax-Free Growth and Withdrawals

One of the biggest advantages of a Max Funded IUL is its tax treatment. The cash value within the policy grows without being taxed, meaning you will not owe national revenue agencies on gains as long as they remain within the policy.

Furthermore, policy loans taken against the cash value are not considered taxable income, allowing for tax-free withdrawals as long as the premiums do not exceed the limit.

This feature makes indexed universal life insurance an attractive alternative to taxable investment accounts or traditional retirement accounts.

Market Participation with Downside Protection

Unlike direct stock investments, which put your money at market fluctuation risks, an IUL policy yields interest based on the performance of a stock index without directly investing in the market.

Most policies include a floor (typically 0% or 1%), meaning the holder will not lose money due to market downturns. However, there is usually a cap (often between 8-12%) on the maximum interest realized, which limits the upside potential.

This trade-off ensures that policyholders benefit from market growth while protecting against losses during downturns.

Retirement Planning and Income Streams

A funded IUL can serve as a powerful supplemental retirement income source, financing households and individuals when they exit the job market.

Policy loans can be taken tax-free, providing a way to access funds in retirement without a financial levy. This strategy can be particularly beneficial for high-net-worth individuals looking to minimize taxes in retirement.

Unlike 401(k) plans or IRAs, IULs do not require minimum distributions, giving policyholders more control over their retirement withdrawals.

Estate Planning and Wealth Transfer

Maximum Funded IUL packages offer an efficient way to transfer wealth to heirs. The death benefit is generally passed on to beneficiaries tax-free, ensuring that loved ones receive the full intended amount.

Additionally, it can be used to fund trusts, provide business succession planning, or create charitable legacy programs. Unlike traditional investment accounts, which may be subject to estate taxes and probate, IULs offer a smoother wealth transfer.

Risks and Limitations

As advantageous as IUL insurance programs are, there are some challenges that you must consider. Let’s review these shortcomings.

High Costs

IUL policies tend to have higher fees than other financial products. These charges include administrative fees, mortality charges, and premium payments, which can offset the overall returns.

These expenses make it crucial to analyze and use an IUL calculator before getting such an insurance package to ensure it aligns with your long-term financial goals.

Loan Risks

Although policy loans allow tax-free access to cash value, they come with risks. If not appropriately planned, excessive cash out can reduce the stored reserve and the death benefit.

Eventually, unpaid loans accumulate interest, which can lead to policy suspension if cash value is depleted.

Market Cap and Participation Limits

While protective gain floors apply to prevent market downturns, IULs impose caps and participation rates that limit returns. For example, if an index gains 15% in a year and the policy has a 10% cap, you will only receive 10% interest.

Additionally, high participation rates, which can be as high as 80%, may further limit credited returns, meaning only a portion of index gains are applied to the policy. These restrictions can reduce growth potential compared to direct market investments.

Concept Complexity

Max Funded Indexed Universal Life policies are complex financial instruments requiring careful planning and management. Understanding how premium payments, loan structures, index crediting, and policy costs interact with each other is essential to maximizing benefits.

Without proper knowledge or guidance, policyholders may struggle to optimize their IUL strategy or even lose their investments.

Getting a Max Funded Insurance Policy: Step-by-step

While the concept can be complicated, it is possible with the help of financial advisors and professionals. If you are considering getting a Max Funded IUL, here’s how to start.

- Assess Financial Goals: Determine whether an IUL aligns with your long-term financial objectives, such as retirement income, wealth accumulation, or estate planning.

- Find a Reliable Advisor: Choose a reputable insurance company that understands IULs and can help structure the policy correctly. Beware of scams and agencies without a track record.

- Compare Insurance Providers: Different insurers offer varying fee structures, limits, and participation rates. Compare policies to find the best fit for your budget and financial goals.

- Determine Funding Strategy: Decide how much you can contribute annually while staying within IRS limits to avoid tax-bearing classification.

- Customize Policy Features: Consider options like death benefit type (level or increasing), riders (long-term care or chronic illness benefits), and loan provisions.

- Monitor Policy Performance: Regularly review your policy to ensure it meets expectations and that you have sufficient cash value. Adjust strategies if needed to maintain the tax-free status.

- Utilize Loans and Withdrawals Wisely: Take loans strategically to maintain tax advantages and prevent policy lapse due to excessive borrowing.

Conclusion

A Max Funded IUL is a powerful financial strategy that offers tax-free growth, retirement income, and estate planning benefits. However, it must be planned carefully.

Maximum indexed universal life insurance provides policyholders with downside protection, making it an attractive alternative to traditional investment vehicles. However, its complexity, costs, and potential limitations can make it challenging for newcomers and financially unskilled individuals.

Therefore, you must work with a knowledgeable financial advisor to ensure the policy is structured correctly and aligns with your goals.

FAQs

What are maximum funded indexed universal life policies?

A maximum funded IUL is a life insurance protection designed to accumulate cash value quickly. It offers tax-free growth based on stock market index performance, besides a death benefit and downside protection against market losses.

What is the risk of IUL?

Cap rates (limits on earnings), policy fees, and potential underperformance are a few possible shortcomings. If not properly funded, the policy may lapse, requiring additional premiums or reducing overall value.

Can you withdraw money from an IUL account?

Yes. You can withdraw funds or take loans from an IUL’s cash value. However, withdrawals may reduce the death benefit, while policy loans can grow tax-free if properly structured. However, unpaid loans accrue interest and can cause the policy to lapse if cash value depletes.

How much does IUL insurance cost?

The cost of an IUL policy varies based on age, health, premium structure, and coverage amount. Administrative fees, insurance costs, and riders also impact pricing. For example, A healthy 30-year-old can fund for $200–$500/month, while a healthy 50-year-old may need $500–$1,500/month for similar benefits.