Prop Trading: What Is It And How Does It Work?

Mar 1, 2024

In recent years, the number of those wishing to trade on financial markets has increased several times. Some lose their first deposits, and others need more funds to start working effectively.

However, only some people know that trading prop firms are operating on the market, offering everyone who wishes to become a trader and investor without investing personal funds within the framework of so-called prop trading.

This article will guide you to the world of prop trading concept and tell you what it is. You will also find out what advantages it has, the main types of strategies used to work with it and what varieties of companies in the market give access to trading under this concept.

Key Takeaways:

- Proprietary trading refers to a type of employment in certain commercial companies that entails utilising only the company’s funds for trading in the financial markets.

- The concept of prop trading offers advantages such as risk management, educational support, coaching, and automation, among others.

- Among the most popular and effective prop trading strategies are two types of arbitrage — volatility and merger, as well as global macro.

What is Prop Trading and What Does It Stand For?

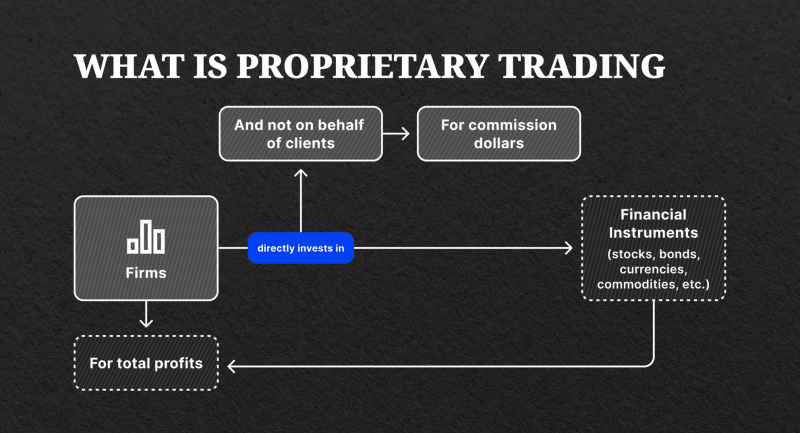

Prop trading is a form of work in some commercial companies’ financial markets, which implies using only one’s own funds in trading. As a rule, such companies work on several available markets and platforms, sending only their capital to the accounts without attracting funds from private or legal entities from outside.

Consequently, the prop trading firm receives only speculative income from the purchase or sale of exchange assets and, possibly, interest income on those instruments that can bring it (dividends on shares, coupons on bonds, etc.).

Proprietary trading firms enhance market liquidity and efficiency within the financial ecosystem. These firms actively trade a diverse range of financial instruments, such as equities, derivatives, and Forex, acting as intermediaries that contribute to stabilising asset prices.

Aspiring traders or those seeking to expand their trading activities often find Forex prop firms appealing due to the benefits of accessing larger capital and advanced trading technologies.

Moreover, these firms offer a supportive environment that includes training, mentorship, and a community of prop traders, providing valuable resources for professional growth and strategic advantages.

Fast Fact:

Unlike hedge funds, which invest in the financial markets using their clients’ money, proprietary traders use their own money to invest in the financial markets using their clients’ money and retain 100% of the returns generated.

Selling Points of Proprietary Trading Concept

As practice shows, prop trading is a unique combination of advantages that benefit both prop trading firms that give access to this type of trading and traders who avoid conflicts of interest in the process of cooperation. Particularly, traders benefit from the following advantages in the framework of advanced proprietary trading:

1. Educational Support

Top prop firms offer a comprehensive range of educational materials designed to cater to the needs of both novice and seasoned traders. These valuable resources cover a broad spectrum of trading knowledge, from fundamental concepts to sophisticated strategies, and are presented in diverse formats.

Engaging in webinars and live sessions, traders can actively participate in interactive learning sessions that enable them to acquire new trading techniques.

Additionally, best prop trading firms provide e-learning modules and self-paced courses that empower traders to enhance their skills at their convenience and assure that traders have access to cutting-edge trading software equipped with educational functionalities, enabling them to stay updated with the latest tools and techniques in the industry.

2. Technological Instruments

Proprietary trading firms have advanced technological systems to provide traders with top-notch trading experiences through various tools. These tools include real-time data feeds, which are essential for making well-informed trading decisions.

Additionally, analytical tools are available for conducting in-depth market analysis to pinpoint potential trading opportunities, and high-speed trading platforms are optimised for speed and dependability, guaranteeing smooth and efficient trade executions.

3. Coaching and Mentoring

Proprietary trading firms prioritising excellence strongly emphasise the importance of mentorship and coaching, particularly for traders just starting out in the industry. These firms offer personalised one-on-one coaching sessions to address specific trading obstacles and objectives that each trader may face.

In addition to individual coaching, high-quality prop firms also provide group coaching programs that create a collaborative learning atmosphere where traders can share their knowledge and experiences.

Furthermore, these firms offer access to trading rooms where traders can observe and participate in real-time trading activities alongside seasoned professionals, gaining valuable insights into various trading strategies and methodologies.

4. Profits Maximisation

The practice of proprietary trading provides the advantage of greater profits compared to earning commissions as a broker. The trading firm retains all the profits generated in this form of trading, leading to a more lucrative outcome.

By engaging in proprietary trading, the bank can fully capitalise on the benefits of the trades. This approach allows the bank to exploit favourable market conditions and utilise its resources to generate profits. As a result, proprietary trading can be a highly profitable strategy for banks and financial institutions.

5. Self-Employment and Autonomy

Proprietary traders benefit from a high level of autonomy, allowing them to navigate the trading landscape on their own terms. Unlike traditional traders, they are not confined by fixed schedules or stringent regulations, enabling them to implement trades based on their unique approaches, analysis, and market perspectives.

This level of freedom makes a career in trading appealing to those who value a flexible work-life balance and independence in their professional pursuits.

6. Learning Curve

The prospect of working alongside proficient traders and seasoned professionals offers traders an exceptional avenue for learning and networking. By joining forces with other talented individuals and industry veterans, traders can tap into a wealth of knowledge and expertise.

This unique opportunity not only allows them to expand their understanding of the market but also enables them to establish meaningful connections that can prove invaluable in their trading journey.

7. Risk Management

Risk management is a crucial aspect of trading that futures proprietary trading firms fully comprehend. These firms offer extensive guidelines and limits for their traders to manage risks effectively. By adhering to these safeguards, traders are able to cultivate discipline and safeguard their capital, thereby ensuring a sustainable trading journey.

8. Performance-Based Compensation

Numerous futures prop trading firms provide compensation structures that are tied to performance. In other words, traders are remunerated based on their trading results, frequently through profit-sharing arrangements. Such a system serves as a motivation for traders to aim for consistent profitability, driving them to perform at their best.

Main Variations of Proprietary Trading Firms on The Market

There is a diverse range of prop trading firms, each distinguished by its individual traits and approaches, as well as its own unique trading style and risk management practices. These firms encompass a variety of forms, each with its own distinct characteristics and strategies. The following are the main ones:

Independent Prop Trading Firms

Independent proprietary trading firms provide traders with greater flexibility in terms of trading strategies, but they also come with higher risks since traders bear full responsibility for any losses incurred. These firms utilise their funds to engage in trading activities across different financial markets, employing diverse proprietary trading techniques.

Proprietary traders working independently usually enjoy the autonomy to select their preferred trading approaches and execute trades swiftly. Nonetheless, they must also navigate the complexities of risk management and capital preservation to sustain their trading operations effectively.

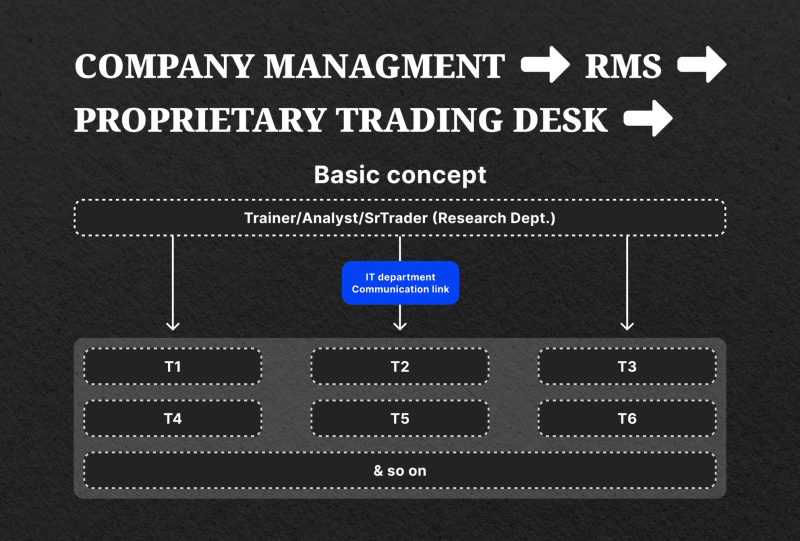

Bank Prop Trading Desks

Proprietary trading desks within banks occupy a distinct role in the financial sector. These units are specifically designed for trading in the financial markets using the bank’s capital rather than on behalf of clients. The primary objective is to secure profits directly for the institution through strategic investments and positions.

The presence of proprietary trading departments in banks typically offers a more secure environment for traders. This sense of security stems from the substantial resources and support major financial organisations provide, ensuring a stable foundation for trading activities.

Broker-Dealer Prop Trading Desks

Apart from bank prop trading desks, broker-dealers also house their own prop trading desks, which are home to four distinct types of trading firms.

Proprietary Trading Firms

Proprietary trading firms, also known as prop shops, are independent entities that engage in trading activities for their benefit. Unlike broker-dealers, which act as intermediaries between buyers and sellers in the financial markets, prop shops trade with their capital.

This means they take on the risk and reward of their trading activities directly. As independent entities, prop shops are not subjected to the exact regulatory requirements as broker-dealers.

Meanwhile, such firms have several subtypes depending on the financial instruments available for trading. Among them are futures prop trading firms that concentrate on providing access to Forex trading instruments, futures prop trading firms offering a wide range of trading tools for trading with leverage, stocks prop trading firms giving access to a wide range of assets traded on the exchange market and options prop trading firms who focus their activities on options trading respectively.

Hedge Funds

Hedge funds are investment vehicles that employ diverse investment strategies to generate returns for their investors. While proprietary trading may be one of the approaches hedge funds use, it is not the sole focus of their investment activities. Hedge funds typically pool capital from various investors and utilise it to invest in a wide range of assets, including stocks, bonds, derivatives, and currencies.

High-Frequency Trading Firms

High-frequency trading (HFT) firms are specialised trading firms that utilise automated trading algorithms to execute trades at extremely high speeds. These firms rely on advanced technology and complex algorithms to analyse market data and execute trades within fractions of a second. By operating at such rapid speeds, HFT firms aim to take advantage of minor price discrepancies in the market and generate profits from short-term trading opportunities.

Direct Market Access (DMA) Prop Firms

By leveraging DMA, traders can bypass intermediaries and gain direct insight into market liquidity and pricing. This direct access enables traders to make informed decisions and capitalise on market opportunities in real time, ultimately giving them a competitive edge in the fast-paced world of trading.

Major Kinds of Prop Trading Strategies

Today, the concept of proprietary trading abounds with an impressive number of trading techniques that can be used to maximise profits in the market under specific conditions and circumstances. Among the most popular strategies are the following:

1. Volatility Arbitrage

In the realm of proprietary trading, traders who engage in volatility arbitrage are not concerned with predicting the exact price of an asset, but rather focus on anticipating the changes in its value. As a result, a discrepancy arises between the option’s estimated price and the asset’s actual market price when these changes occur.

Within proprietary trading, these options form part of a neutral portfolio. Traders who purchase these options are referred to as holding a long-volatility position, while those who sell them are said to hold a short-volatility position.

A long-volatility position is a bet that the asset’s future volatility will surpass the volatility at the time of the trade. Conversely, a short-volatility position is a wager that the future volatility will be lower. It is worth noting that these trades adhere to put-call parity, regardless of whether the traded options are puts or calls.

It is crucial to consider how the asset’s implied volatility will evolve in the future. While there is always the potential for unforeseen events, often referred to as “black swan” events, which can unexpectedly impact the option’s value.

2. Merger Arbitrage

Merger arbitrage is a commonly employed strategy by hedge funds, which entails the simultaneous purchase and sale of stocks from two merging companies to generate “riskless” profits. Due to the inherent uncertainty surrounding the merger’s completion, the target company’s stock price usually trades below the acquisition price.

A merger arbitrageur carefully assesses the likelihood of the merger failing to close within the expected timeframe or not materialising at all. Based on this evaluation, they strategically acquire the stock before the acquisition, anticipating reaping profits once the merger or acquisition is successfully concluded.

3. Global Macro

A global macro strategy is a trading and investment approach that interprets significant national, regional, and global macroeconomic events. Fund managers carefully analyse a range of macroeconomic and geopolitical factors to execute a global macro strategy. These factors encompass interest rates, currency exchange rates, levels of international trade, political events, and international relations.

Global macro funds commonly employ trading strategies based on currencies, interest rates, and stock indices. In the realm of currency strategies, these funds typically identify opportunities by assessing the relative strength of one currency against another.

By closely monitoring and projecting economic and monetary policies worldwide, these funds engage in highly leveraged currency trades using futures, forwards, options, and spot transactions.

4. News Trading

Engaging in news trading entails analysing significant events to guide trading choices. Practitioners of this approach closely monitor financial news, earnings announcements, shifts in monetary policies, and macroeconomic indicators. They aim to identify events expected to influence the market and adjust their positions accordingly strongly.

One of the key benefits of news trading is its potential for high profitability. Nonetheless, it is crucial to recognise that this strategy carries a high level of risk. News events can be volatile and unexpected, requiring traders to utilise this method to be agile in responding to market fluctuations.

5. Trend Trading

Trend following is regarded as one of the most intuitive prop trading strategies. It entails analysing the past performance of a specific stock, industry, or even an entire index and then leveraging established trends to inform trading decisions in the current market conditions. By identifying patterns and trends, traders can effectively determine when to buy or sell assets.

Implementing trend following as a strategy involves establishing specific benchmarks for entry and exit points in a stock trade. These benchmarks are typically determined by a percentage increase or decrease in the stock price, historically indicating whether the stock will experience a rise or fall in the upcoming trading sessions.

When employing trend following, traders look for significant changes that serve as a signal to buy, and they also set predetermined thresholds for selling based on the observed trends.

6. Statistical Modelling and Quantitative Strategies

Proprietary trading desks frequently utilise quantitative models and algorithms to detect trading opportunities. These strategies rely on historical data, mathematical models, and statistical analysis to generate trading signals. Quantitative strategies can vary from basic statistical models to intricate machine learning algorithms.

Conclusion

Like all financial activities, proprietary trading presents a unique combination of benefits and obstacles. While the possibility of substantial gains is enticing, it is crucial to recognise the risks involved and the regulatory framework that governs such trading practices. A thorough understanding of these factors is essential for a well-rounded perspective on prop trading.

This insight is not limited to individuals in the finance industry; it is also relevant for anyone curious about how prop trading impacts the overall market. By grasping the intricacies of this practice, one can gain a deeper knowledge of the dynamics at play in the financial world and the implications of prop trading on market stability and efficiency.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

What is a proprietary trading firm?

Proprietary trading firms are specialised financial entities that aim to discover promising traders and equip them with the necessary resources, knowledge, and atmosphere to explore and enhance their trading skills.

What is a prop desk?

A proprietary trading desk, often referred to as a prop desk, consists of traders who conduct proprietary trading activities by utilising the firm’s capital to execute trades in financial markets to generate profits for the organisation. They are generally found within investment banks, hedge funds, and other financial institutions.

How do proprietary trading firms typically structure their compensation?

Proprietary trading firms typically offer compensation structures that include a base salary, performance-based bonuses, and a profit-sharing arrangement. These firms may also provide additional incentives, such as signing bonuses or profit splits based on individual or team performance.

What are the differences between high-frequency trading (HFT) firms and other firms engaged in prop trading?

High-frequency trading (HFT) firms are known for using complex algorithms and technology to execute many trades at high speeds. In contrast, other prop trading firms may focus on a broader range of trading strategies and rely less on high-frequency trading techniques.

What is the difference between a proprietary trading firm and a traditional broker/hedge fund?

Proprietary trading firms operate differently from traditional brokerage firms and hedge funds in that they use their capital to trade in the financial markets rather than executing trades on behalf of clients. Additionally, proprietary trading firms tend to have a more focused and specialised approach to trading. At the same time, hedge funds may employ a broader range of investment strategies, while traditional brokerage firms primarily act as intermediaries for buying and selling securities.