The Two Worlds of the Liquidity Pool: A Comparison of Forex and DeFi

Aug 4, 2021

The term liquidity pool is sometimes a source of confusion in modern finance. It is used to describe two fundamentally different systems: the aggregated order books of the traditional Forex market and the automated contracts of the DeFi world.

One system is built on decades of institutional relationships, aggregating billions in orders from the world’s largest banks. The other is a permissionless, autonomous market often created for new and experimental digital assets, run entirely by code.

This guide provides a direct breakdown of how each type of liquidity pool works and why they are so foundational to modern trading.

Key Takeaways:

- A liquidity pool in Forex is a collection of orders from big banks. In DeFi, it’s a pot of crypto in a smart contract that anyone can trade against.

- In DeFi, anyone can become a liquidity provider by adding their assets to a pool and earning a share of the trading fees in return.

- The main risk in DeFi pools is impermanent loss, where you can end up with less value than if you had simply held the assets in your wallet.

- For any broker, a deep liquidity pool is essential. It means better prices and more reliable trade execution for their clients.

How Liquidity Works in Traditional Markets

In traditional finance, a liquidity pool is a conceptual term for the combined depth of buy and sell orders that a broker aggregates from major financial institutions to create a stable, liquid market for their own clients.

Aggregating Liquidity from the Top Tier

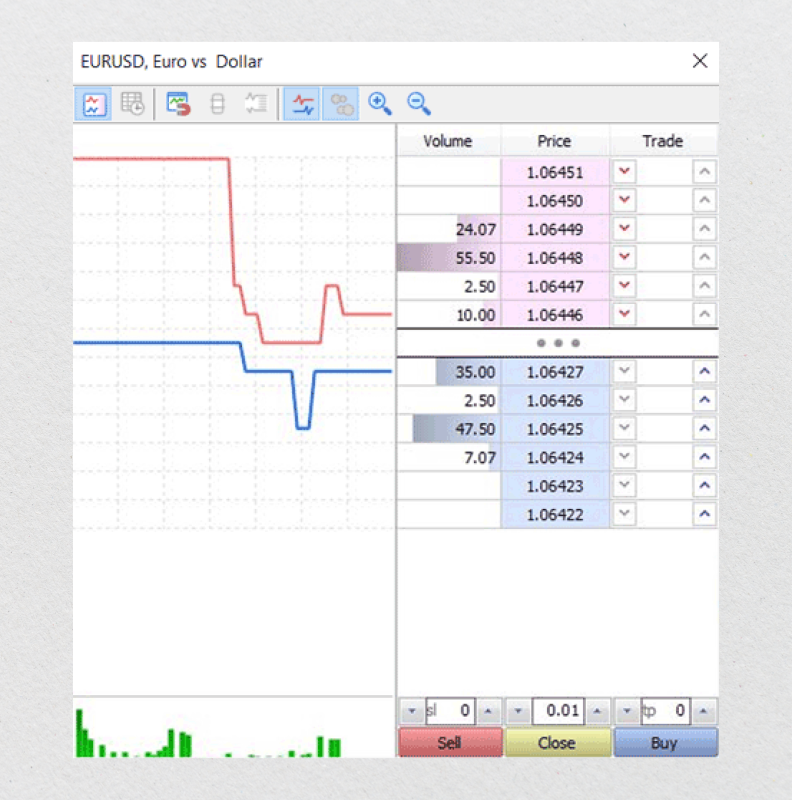

Every traditional market operates on an order book—a live ledger of all bids (buy orders) and asks (sell orders) for a specific asset. A retail brokerage’s own clients, however, rarely generate enough trading volume to create a deep and stable order book on their own.

An order book with only a few participants is “thin.” This results in wide bid-ask spreads and high slippage, where a large order can drastically move the price. This is an unacceptable trading environment for any serious participant.

To solve this, brokers connect to a liquidity provider, or more often, a network of them. These providers are the true market makers: major Tier 1 banks like JPMorgan and Deutsche Bank, hedge funds, and other large financial institutions.

These institutions process trillions of dollars in daily transactions. The sheer scale of their order flow is what creates the deep liquidity seen in markets like Forex, which, according to the Bank for International Settlements, trades over $7.5 trillion per day.

Creating a Deep Forex Liquidity Pool

A broker’s technology aggregates these separate institutional feeds into a single, unified order book. This creates a deep forex liquidity pool for their retail clients, giving them access to the best available bid and ask prices from the entire network.

The direct result for a trader is a highly efficient market. Spreads are kept extremely tight, often to a fraction of a pip, and large orders can be executed instantly with minimal price slippage.

Finding the right liquidity partner is a foundational step for any brokerage. Our comprehensive ranking can help you compare the top providers in the industry.

See the Top Liquidity Providers for 2025

The Decentralized Finance Revolution

The traditional liquidity model is powerful but centralized, built around a small group of major financial institutions. The core promise of Decentralized Finance (DeFi) was to build an alternative—an open, permissionless financial system that did not depend on these intermediaries.

To achieve this, DeFi needed to solve the liquidity problem from the ground up, especially for new tokens launching into otherwise illiquid markets. How could a new token create a market for itself without access to the institutional order flow that powers Forex and equity markets?

A New Kind of Market

The DeFi innovation is the liquidity pool crypto model. Instead of matching individual buy and sell orders like on centralized exchanges, this system allows traders to trade directly against a pool of assets locked within a smart contract.

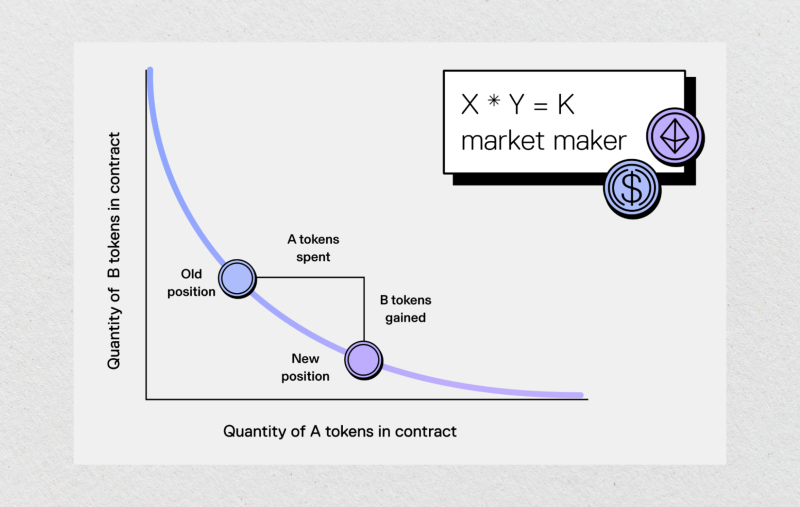

This entire system is powered by an Automated Market Maker (AMM). An AMM is an algorithm that replaces the traditional order book entirely. It automatically determines the asset’s price based on the ratio of the two assets held within the liquidity pool.

The Rise of the AMM

The AMM model was popularized and brought to the mainstream by the decentralized exchange Uniswap. Its success proved that a liquid, efficient market could exist without any traditional market makers or order books, run entirely by code.

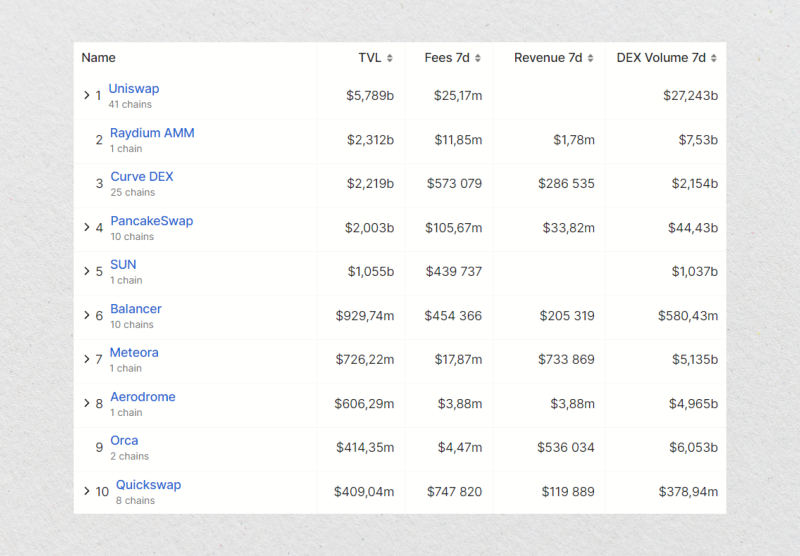

As of mid-2025, the Total Value Locked (TVL) in decentralized exchanges consistently exceeds $20 billion, according to data from analytics platforms like DeFiLlama. This entire multi-billion-dollar market is built on the concept of the AMM liquidity pool.

Fast Fact

DeFi liquidity pools enable a unique financial tool called a “flash loan.” This allows a user to borrow millions of dollars worth of assets with zero collateral, as long as the loan is borrowed and repaid within the same single transaction block (typically 12 seconds on Ethereum).

How Automated Crypto Liquidity Pools Work

An Automated Market Maker liquidity pool operates on a few simple but powerful principles. It combines open participation from liquidity providers with autonomous execution by a smart contract, all governed by a core mathematical formula.

The Role of Liquidity Providers (LPs)

Unlike traditional markets, where market-making is reserved for large institutions, in the DeFi ecosystem, anyone can be a liquidity provider. An LP is simply a user who deposits a pair of assets—for example, an equal value of ETH and a stablecoin like USDC—into a specific pool.

When users provide liquidity, they collectively create the market that other users can trade against.

The Smart Contract and Pricing Formula

All the deposited assets are held in a smart contract. This contract acts as an autonomous vault and a permissionless trading venue. Its rules are transparent and cannot be altered. The credibility of top-tier pools is verified by rigorous security audits from firms like CertiK or Trail of Bits.

The smart contract uses a simple algorithm called the constant product formula (x * y = k) to price assets. It automatically adjusts the price based on the ratio of the two assets in the pool after each trade, removing the need for a traditional order book.

LP Tokens: Proof of Your Share

When a liquidity provider deposits funds, the smart contract automatically mints and sends them a unique “LP token.” This new token becomes a digital receipt, representing that provider’s proportional share of the entire pool.

To reclaim their underlying assets, plus any trading fees their capital has generated, LPs must “burn” or redeem their LP tokens. The amount of assets they receive back will depend on the current price and ratio within the liquidity pool crypto.

What Is Impermanent Loss?

Providing assets to a decentralized liquidity pool exposes a liquidity provider to a unique and counterintuitive risk known as impermanent loss. This is the single most critical concept to understand before participating in an AMM.

Impermanent loss is not a loss in the traditional sense, where your total capital decreases. It is an opportunity cost. It measures the difference in value between holding your assets in a liquidity pool crypto versus simply holding them in your own wallet.

This loss occurs when the market price of the assets in the pool changes, or diverges, from the price at which you initially deposited them. The greater the price divergence, the larger the impermanent loss.

How It Works

Imagine you deposit 1 ETH and 3,000 USDC into a pool when ETH is priced at $3,000. Your total initial deposit is worth $6,000.

If the price of ETH then doubles to $6,000 on external markets, arbitrage traders will rebalance the pool. Your share of the pool might now be 0.5 ETH and 6,000 USDC. The total value is $9,000.

However, if you had simply held your original 1 ETH and 3,000 USDC, your portfolio would be worth $9,000 (1 ETH at $6,000 + 3,000 USDC). In this specific scenario, the impermanent loss is zero. But if the price of ETH had moved differently, the value of your assets in the pool could be less than if you had just held them. The trading fees you earn are meant to compensate for this risk.

Why Brokers Should Offer Deep Liquidity?

For any trading business, liquidity is the foundational asset upon which the entire operation is built. A broker’s reputation, client retention, and ultimate profitability are all direct consequences of the quality of its liquidity.

- Spreads and Slippage

A trader’s entire experience is defined by their execution quality. A deep liquidity pool, whether from a traditional liquidity provider or a DeFi protocol, results in tight bid-ask spreads. This directly lowers the cost of trading for the end client.

More importantly, deep liquidity absorbs large orders with minimal price impact. This prevents slippage, the costly difference between the expected price of a trade and the price at which it is actually executed.

- Client Trust

Traders are highly sensitive to poor execution quality. A single large trade that experiences significant slippage can erode a client’s trust instantly. In an industry where reputation is paramount, consistent, high-quality execution is a broker’s most powerful marketing tool.

Negative reviews detailing poor fills and wide spreads can permanently damage a brand. Conversely, a reputation for reliable execution is a key driver of client loyalty and organic growth through word-of-mouth referrals.

- Competitive Product Offering

A deep and reliable liquidity pool also determines a broker’s ability to compete on product offerings. A brokerage cannot offer a new trading instrument—whether it’s forex trading pairs, a new stock CFD, or a crypto asset—unless it can source stable, high-quality liquidity for it.

Access to a top-tier forex liquidity pool or a robust liquidity pool crypto allows a broker to confidently expand its range of tradable assets. This is a critical factor in attracting and retaining a diverse client base in the hyper-competitive 2025 market.

Sourcing reliable liquidity across both traditional and digital asset markets is a primary challenge for any modern brokerage. B2BROKER offers a Tier 1 liquidity pool that solves this, providing access to ten asset classes, including crypto, from a single source.

Learn More About B2BROKER’s Multi-Asset Liquidity

Conclusion: Two Models, One Goal

The term liquidity pool now describes two fundamentally different market structures. The traditional model, seen in Forex and equities, involves aggregating deep order books from major financial institutions to provide tight spreads and reliable execution.

The DeFi model, the liquidity pool crypto, replaces this structure entirely. It uses an AMM within a smart contract to create a self-sufficient, permissionless market for any digital asset.

One system relies on aggregating institutional depth; the other on automating a market with pooled assets. For any brokerage or exchange, however, the strategic goal is the same: securing deep, reliable liquidity is a non-negotiable requirement for building a competitive and trusted platform.

FAQ

Can you lose crypto in a liquidity pool?

Yes. The two main risks in a DeFi liquidity pool are impermanent loss (where holding assets is more profitable than pooling them) and smart contract risk (where a bug or hack could lead to a total loss).

What is the main difference between a Forex and a DeFi pool?

A forex liquidity pool is a collection of buy and sell orders from large banks. A liquidity pool crypto is a pot of tokens locked in a smart contract that traders use to swap assets directly.

How do you earn money in a DeFi liquidity pool?

In this process, often called liquidity mining or yield farming, you earn a percentage of the trading fees generated every time a user makes a swap using the assets you deposited into the pool.

What is an AMM?

An AMM is the algorithm that powers a DeFi liquidity pool. It uses a mathematical formula to automatically determine the price of assets, replacing the need for traditional order books.