A New CZ Binance Lawsuit: This One is More Industry-Crucial, and Here’s Why

Aug 21, 2024

No rest days for Binance, the largest crypto exchange platform, which got hit by a new class action lawsuit by three crypto investors.

This time, Binance got sued for non-combating money laundering, and the plaintiffs claim that thieves used the platform to launder their stolen crypto assets. If proven correct, this would go against the RICO Act (Racketeer Influenced and Corrupt Organisations) and jeopardise the whole industry. So, why is the CZ Binance lawsuit more sensitive this time? Here’s why.

CZ Binance Lawsuit on Money Laundering

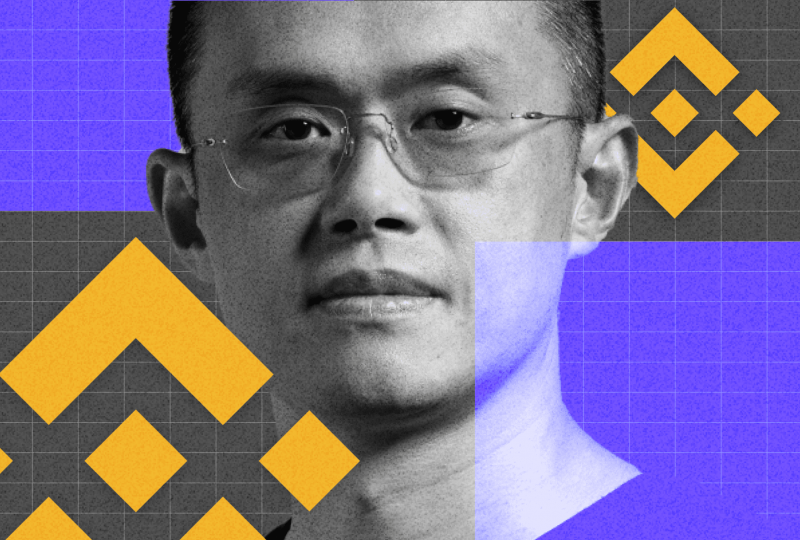

On August 16th, the accusers filed a legal motion against Binance and its ex-CEO, Changpeng Zhao, at a District Court for the Western District of Washington, Seattle. The news was spread on August 20th, driving massive attention from the industry, as the renowned crypto exchange is expected to have robust AML practice in place.

In the claim, three crypto investors, Philip Martin, T.F. Tang, and Yatin Khanna, argue that their cryptocurrencies were stolen by blockchain hackers, who used Binance to exchange their stolen cryptos for clean assets.

This is a typical practice by thieves to get rid of the traceability of cryptocurrencies as the blockchain registers all decentralised transactions accurately and transparently.

The CZ lawsuit comes less than a month before the expected release date of the ex-Binance CEO, who stepped down in a settlement after Binance was penalised by SEC, resulting in a $4 billion penalty and 4-month imprisonment of Changpeng Zhao.

Why is it Important?

This CZ-Binance lawsuit is industry-wide important, and top crypto figures, such as Consensys’s director of global regulatory matters, commented and speculated on court motions and outcomes.

Since the blockchain tracks all transactions timely and Binance failed to raise the anomaly of the embezzled transfer, the integrity of on-chain operation and analytics will be questioned if the motion moves forward.

However, others argue that it is extremely difficult to prove the accusers’ claim, and the plaintiffs might be taking advantage of the increasing crypto theft recovery programs and state prosecution compensations.

Binance Ups and Downs

The Binance news today is a mixture of good and evil, as the court application came a few days away from Binance announcing its return to the Indian market.

Earlier this year, the crypto exchange was fined by the Financial Intelligence Unit in India for failing to comply with regulations and registration requirements, leading to ceasing operations in local markets.

The Binance ban in India lasted for seven months, as the company announced on August 15th that it had complied with the FIU laws to become a regulated crypto exchange in India.

This was good news for the company, marking its 19th regulatory milestone in one of the largest crypto markets in the world. However, will the lawsuit cut the celebrations short?

Conclusion

A new CZ Binance lawsuit is turning heads and speculations on the fate of the crypto exchange giant and, possibly, the whole DeFi industry.

The accusers claim that Binance was part of a money laundering scheme, allowing thieves to wash their money clean, which is against global financial regulations in combating illegal transactions and financing terrorism.

If the motion moves to trial, the blockchain analytics and integrity will be under the radar as to why the transaction was not spotted by blockchain and Binance’s AML practices.