Apple Stock Has Had A Tough Year. That Could Soon Change

Mar 06, 2022

Apple stock, along with the rest of big tech, has had a rough year so far. That may soon change.

On Wednesday, Citi raised US equities and the global IT sector to Overweight from Neutral. It reflects the investment bank's return to bullishness on the S&P 500 index and several favored technology firms such as Apple, Microsoft, and Nvidia, which have had a rough start to 2022.

The S&P 500 has dropped 8.5% since January's start, while the Nasdaq Composite, a proxy for publicly traded technology companies in the United States, has plummeted 13%, solidly in the correction zone.

It's a significant correction for technology stocks—one that may suddenly be worth purchasing.

Both US equities and global technology companies are "growth plays that should profit, at the very least in relative terms," according to a team of Citi analysts headed by Robert Buckland.

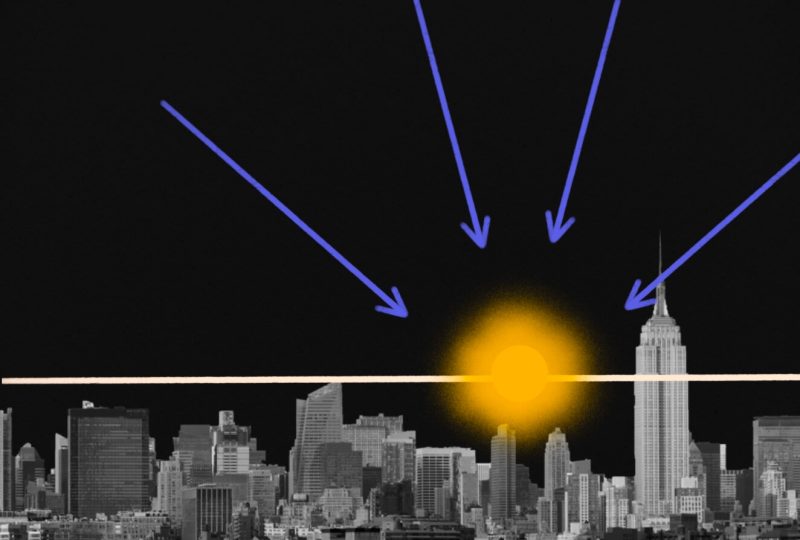

Real rates are the yields on bonds — such as the benchmark 10-year US Treasury note — that have been discounted for the effect of inflation. And they have been declining, as have unadjusted bond rates.

The 10-year note started in 2022 with a yield of only 1.51% and surged beyond 2% in early February. Because higher bond rates discount the present value of future cash flows, and many technology equities are valued based on future earnings, increased yields have been terrible news for tech investors.

This year's increase in yields occurred in response to market signals that the Federal Reserve would soon begin dramatically raising interest rates and tightening monetary policy. However, bond rates have declined lately as a result of the Russian invasion of Ukraine.

The 10-year note ended below 1.73% on Monday, returning to levels reached at the start of the year, before the S&P 500 started its decline or the tech sector began its selloff in earnest. In light of the economic uncertainties created by the Eastern European crisis, traders increasingly expect the Fed will be less aggressive than previously believed.

The mechanism behind the decline in real yields is that inflation expectations are rising—as a result of the war, which has roiled commodities markets—while rate expectations are falling in lockstep with bond rates.

On Wednesday, 10-year real yields were -0.97%. This took them below the level seen in early January, when Federal Reserve meeting minutes indicated that the central bank was adopting a considerably more hawkish stance than anticipated, causing markets to tremble, according to Deutsche Bank analyst Jim Reid.

"The collapse in real rates has undoubtedly aided in cushioning the blow to risk assets from recent really unfavorable events," Reid added.

Citi's investment team agrees and regards this as a purchasing opportunity.

"Growth equities have been harmed by increasing real rates but should profit if they reverse," Buckland's analysts said. "As a result, we re-rate two classic growth bets (US stocks and the information technology sector) to Overweight."

Apart from the change in real rates, Citi remains optimistic about the stock market's ability to withstand the present storm.

"Despite the unpleasant situation in Ukraine, global equities have been rather stable," Citi analysts said, adding that losses have been concentrated in financials and firms with direct exposure to Russia. "We continue to purchase dips and point out that global markets have finished 10% to 20% higher after past geopolitical crises."

Similarly, Quant Insight says in a Thursday note that for "investors willing to take a risk in volatile markets, US technology equities seem to be an effective defensive option."

Perhaps the technological chaos is indeed nearing its conclusion.