Mexican Peso Stablecoin to Be Launched on Bitso Exchange

Mar 31, 2025

Cryptocurrencies have come a long way from being a virtual means of payment to legitimate trading and storage assets based on official national currencies. The widespread adoption of crypto assets motivated the creation of stablecoins that facilitate investing in less-risky blockchain currencies and attract traditional investors.

The Mexican peso stablecoin is the latest attempt by Bitso exchange to spur crypto adoption in Latin America. Let’s dive deeper into this news.

Mexican Peso Stablecoin Coming Soon

On March 26, Bitso, a leading crypto exchange platform in Latin America, announced its plan to introduce a new stablecoin based on the Mexican peso. This launch intends to promote blockchain-based financial transactions in Latin America (LATAM) and attract global investors in the Web 3.0 space.

The Mexican stablecoin, MXNB, will be one-to-one pegged to the Mexican peso, meaning that for every MXNB issued, an equivalent MXN will be stored. This pegging mechanism ensures price consistency and minimizes market risks.

The MXNB token will be minted on the layer-2 ETH network, Arbitrum, a popular, high-performance scaling solution that incurs low fees and manages high volumes.

Additionally, Bitso created Juno, a subsidiary that will manage the token supply and operational responsibilities, including holding reserves and performing regular audits. The firm will ensure transparency through periodic verifications of the stablecoin’s backings and periodic reports.

While the exchange has not announced a fixed date, MXNB is expected to be released in the coming months, with users soon able to access it through Bitso’s exchange platform and other participating partners.

Key Uses

Mexico is renowned for its remittances, where nationals residing abroad send funds to support their families in their homeland. However, Bitso wants to solve some issues pertaining to high transfer costs, slow settlements, and conversion rate volatility.

The Mexican stablecoin will be used to send funds cross-border quickly and safely, involving fewer intermediaries and third-party risks.

Local businesses and individuals can also use MXNB to hedge against volatile cryptocurrencies, fostering a swift transition between the local currency and digital assets in blockchain.

Inviting Blockchain Investments in Mexico

Bitso also aims to boost the LATAM adoption of crypto and attract more businesses in the crypto space. The stablecoin’s ability to support decentralization will offer a more seamless way for inbound investors, trading platforms, other exchanges, and DeFi projects to be launched from Mexico.

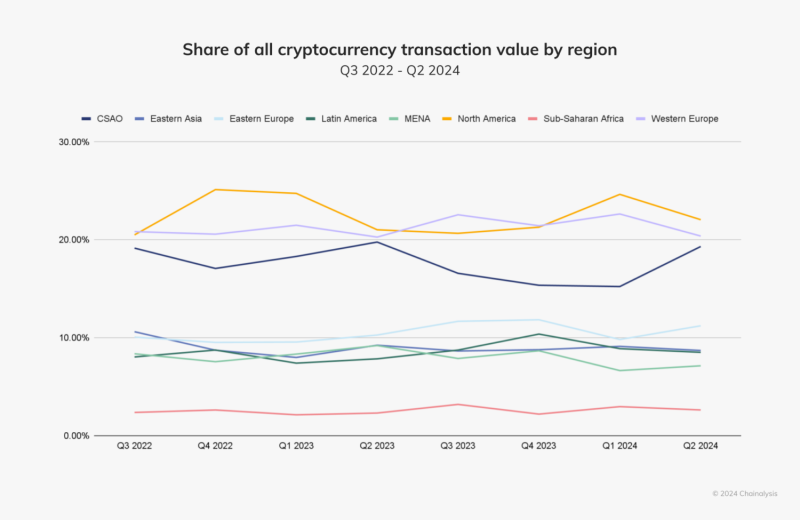

Additionally, this release will solidify the continent’s blockchain development as the third largest region in crypto transactions, following North America and Western Europe.

Conclusion

Launching the Mexican peso stablecoin by the exchange leader in LATAM, Bitso, is set to boost the regional crypto landscape. It aims to tackle crucial challenges involving remittances, offering a faster, safer, and more cost-effective way than traditional money transfers.

This release also plans to boost regional blockchain developments and enhance the financial infrastructure to invite more crypto-savvy investors to Latin America.