How to Choose a Forex Liquidity Provider in 2023?

Nov 16, 2023

The Forex market is experiencing a continuous rise in the number of brokers: over 1,200 Forex brokers are available on MetaTrader alone currently, with the total number of brokerages in the foreign exchange industry exceeding 1,500, according to some estimates. In this fast-paced Forex world, liquidity plays a critical role in ensuring smooth and efficient transactions between participants.

That’s why choosing a reliable liquidity provider today is crucial for consistent, stable operations at your brokerage.

In this article, we will delve into the key aspects of selecting a trustworthy Forex liquidity provider. With our help, you will gain the knowledge and tools necessary to navigate this dynamic industry and make the best choice for your brokerage needs.

Key Takeaways:

- Liquidity is a crucial component of every trading market.

- Liquidity providers are responsible for ensuring smooth trading within brokerage platforms.

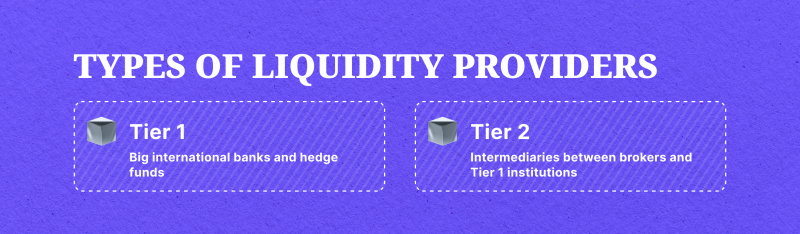

- LPs can be of two types: Tier 1 and Tier 2.

- To choose a liquidity provider, take into account reputation, technology, costs and several other aspects.

Liquidity in Forex

Before delving into the intricacies of selecting a liquidity provider, it is essential to grasp the concept of liquidity in Forex. So, what is it?

In simple terms, liquidity describes how easily a trader can buy or sell a financial instrument with minimal price fluctuations. It represents the depth of the market and the ability to execute trades quickly and at a fair price.

Liquidity is like the pool of cash in your bank account. The more cash you have, the easier it is for you to withdraw and use it when you need it. Similarly, the more liquidity there is in the market, the easier it is for traders to buy or sell financial instruments without significantly affecting the price.

High and Low Forex Liquidity

But how does liquidity affect trading in practice?

High liquidity, characterised by a large number of buyers and sellers in the market, provides traders with abundant opportunities to enter and exit positions swiftly and efficiently. This trading environment allows for tighter bid-ask spreads and reduced slippage, enhancing the overall trading experience.

On the other hand, low liquidity, with limited trading activity, can result in wider spreads and potential challenges when executing trades. Traders must navigate such conditions with caution, considering the impact of liquidity on price movements and order execution.

Fast Fact

The most liquid currency pair on the Forex market is EUR/USD, which makes up a whopping 28% of the total transaction volume. This is due to the fact that both currencies hold significant weight in the global economy and are widely used for trade and investment. Following closely behind is USD/JPY, accounting for 13% of the market share. Rounding out the top three is GBP/USD with 11%, making it another popular choice among traders.

What is a Forex Liquidity Provider?

When brokers enter the market, they require plenty of liquidity to offer their traders in order to ensure smooth and fast transactions on their platform. And to access this liquidity, brokers turn to special firms called “liquidity providers”.

Thus, a Forex liquidity provider (LP) is a financial institution or organisation that facilitates the smooth operation of the market by offering liquidity to brokers and other market participants.

These providers typically have access to large pools of currencies and are responsible for executing trades and orders on behalf of their clients. Liquidity providers act as market makers, offering both buy and sell prices for currency pairs.

Types of Liquidity Providers

Forex liquidity providers can be classified into two main categories: Tier 1 and Tier 2. Let’s take a closer look at each type:

Tier 1 Liquidity Providers

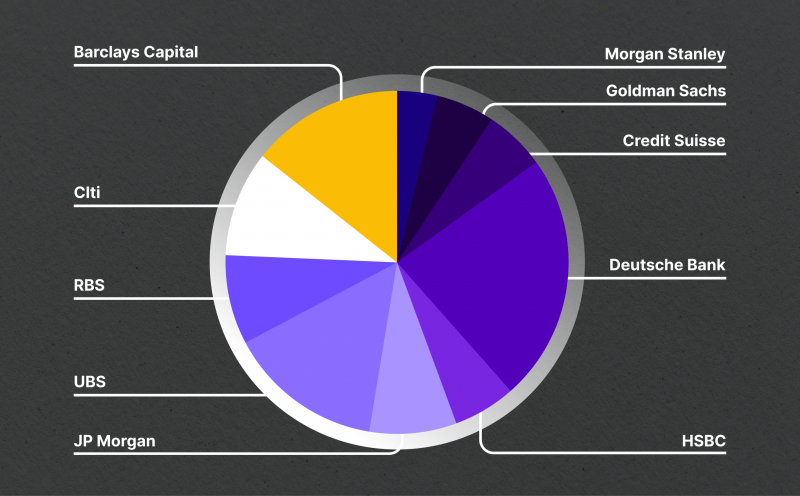

Tier 1 liquidity providers are the major players in the Forex market. They include large hedge funds and international banks such as Morgan Stanley, J.P. Morgan, HSBC, Credit Suisse, and others.

These institutions have substantial trading assets and provide liquidity to the market by offering buy and sell prices for currency pairs. Tier 1 liquidity providers are connected through Electronic Communication Networks (ECNs) and form the interbank markets.

As a result, Forex liquidity providers of the first-tier trade currencies directly with each other. Their actions have significant implications for the whole market.

Tier 1 liquidity providers are only accessible to well-established brokers who have the financial resources and technology infrastructure to access them.

Tier 2 Liquidity Providers

Tier 2 liquidity providers act as bridges between brokers and Tier 1 institutions. They bridge the gap for smaller brokers who do not have direct access to Tier 1 liquidity.

While Tier 2 liquidity providers may not have the same level of resources as Tier 1 providers, they play a crucial role in facilitating liquidity for smaller market participants. Some well-known Tier 2 liquidity providers include B2Broker, FXCM PRO, X Open Hub, Finalto, and Leverate.

Most brokers in Forex are connected to Tier 2 providers, and this option is usually considered the most cost-effective and efficient way to access liquidity. Tier 2 providers also deliver a wide range of services, such as price aggregation, risk management, and reporting.

Fast Fact

The Forex market consistently increased its average daily turnover over the past two decades. In the year 2000, it surpassed the $1 trillion mark, averaging $1,239 billion. In 2023, the average daily turnover of Forex trading amounted to $7,5 billion.

How Liquidity Provision Happens

Let’s explore how the process of liquidity provision from LPs to broker’s clients happens.

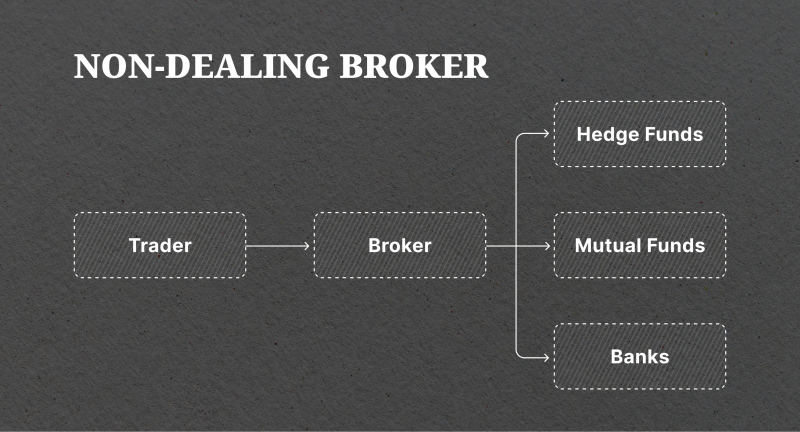

First of all, it is important to understand the distinction between Non-Dealing Desk (NDD) / Direct Market Access brokers and Dealing Desk (DD) brokers.

NDD brokers are those who utilise the services of Tier 2 liquidity providers. They do not take the opposite side of client trades and do not act as market makers. Instead, NDD brokers route their client orders directly to the interbank market, where a liquidity provider executes the trade. On the other hand, DD brokers trade against their own clients using their own capital.

Now, let’s dive into the process of liquidity provision for NDD brokers that are connected to liquidity providers FX:

- Client Order Placement: When a trader places an order with their broker, the broker forwards the order to a liquidity provider. This order includes details such as the desired quantity, price, and other relevant parameters.

- Liquidity Provider Evaluation: Upon receiving the order, the liquidity provider will then either fill the order or pass it on to another liquidity provider who can fill it. This process continues until the order is eventually filled.

- Order Execution: The liquidity provider provides the required liquidity to facilitate the transaction. This involves matching the client’s order with suitable counterparties in the interbank market. Once the trade is executed, the liquidity provider then charges a small fee or commission for their services.

Liquidity providers continuously update their buy and sell prices based on market conditions and supply and demand dynamics, which helps them to offer stable and reliable feeds. They take into account factors such as current market prices, recent trades, and overall market sentiment. This ensures that their prices remain competitive and reflective of prevailing market conditions.

How to Choose a Forex Liquidity Provider

Selecting the right Forex liquidity provider is a critical decision that can significantly impact the trading experience of your users. Here are some key factors to consider:

1. Technology

A liquidity provider’s technology infrastructure plays a vital role in facilitating smooth trade execution. It is essential to verify that the provider has a robust and dependable system in place, which includes advanced trading platforms and various connectivity options. Look for features like low latency execution, efficient order routing, and reliable data feeds. Additionally, ensure that the provider offers comprehensive technical support to promptly address any issues that may arise.

2. Regulatory Compliance

Ensuring regulatory compliance is paramount when engaging in the trading business. It is crucial to verify that the provider possesses licences and operates under the supervision of reputable authorities. This guarantees their adherence to rigorous guidelines and standards, fostering trust and transparency. If you want to confirm their compliance with regulatory requirements, check for certifications and memberships with industry organisations.

Some examples of well-known regulatory bodies in the trading industry include the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), and Commodity Futures Trading Commission (CFTC). These organisations set rules and regulations to protect investors and maintain fair market practices.

3. Reputation and Track Record

Don’t forget to evaluate the company’s reputation and track record. Take the time to read reviews, testimonials, and ratings from other market participants. A provider with a strong reputation and positive feedback is more likely to offer reliable and high-quality services. Additionally, consider the provider’s experience in the industry and their longevity in the market.

4. Financial Stability

Evaluate a liquidity provider’s ability to handle financial risks. Financial stability ensures that the provider can fulfil its obligations to clients, especially during volatile market conditions. Review their financial statements, credit ratings, and any other relevant financial information. Consider partnering with providers who have established relationships with reputable banks and financial institutions.

5. Pricing and Cost Structure

Finally, compare the pricing and cost structure of different liquidity providers. Look for competitive spreads, low commission rates, and transparent fee structures. Consider the overall cost-to-value ratio, taking into account the quality of services offered. It’s important to strike a balance between cost-effectiveness and the reliability of the liquidity provider.

Reliable Liquidity Providers for Brokers

While there are numerous liquidity providers in the market, we have identified five best liquidity providers for brokers in 2023. These firms have a strong reputation and offer comprehensive solutions for brokers:

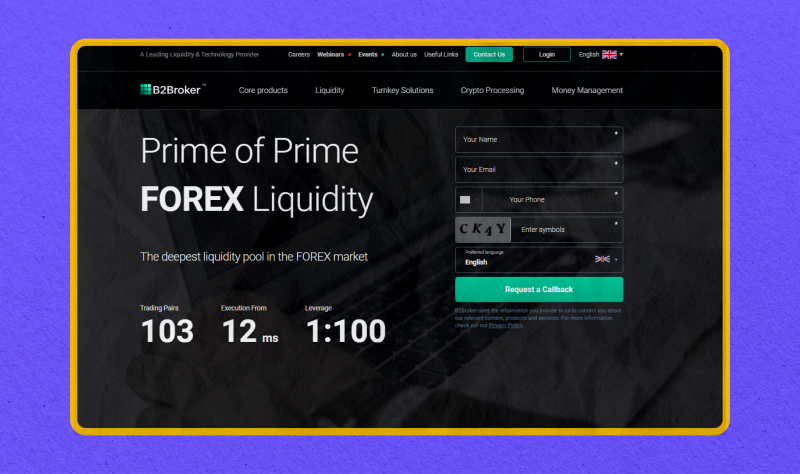

1. B2Broker

B2Broker is a reputable liquidity provider that offers a comprehensive range of services to Forex brokers. They specialise in delivering Prime of Prime multi-asset liquidity solutions through popular platforms such as MT4 and MT5. B2Broker offers its clients highly competitive spreads starting at just 0.1 pips, as well as efficient trade execution. In fact, their order execution speed is taking less than 20ms while also offering a maximum leverage of 1:100. B2Broker provides access to a wide range of trading pairs, currently offering 103 Forex pairs.

Explore more on B2Broker’s official website.

3. FXCM PRO

FXCM PRO is a Tier 2 liquidity provider catering to small-medium sized businesses and High-Frequency Trading Firms (HFTs). With spreads starting at 0.1 pips, FXCM PRO offers competitive pricing in the Forex market. They provide access to popular trading platforms such as MT4, Trading Station, and TradingView. FXCM PRO requires a minimum balance of $250,000 and is known for its advanced technology infrastructure.

Explore more on FXCM PRO’s official website.

3. X Open Hub

X Open Hub is a liquidity-providing service owned by XTB, a reputable Forex broker. They offer liquidity on over 3000 financial instruments, including Forex. X Open Hub provides integration with popular platforms like MT4, and they can be connected through FIX API, PrimeXM, and oneZero. With spreads starting as low as 0.14 pips on Forex, X Open Hub offers competitive pricing and reliable trade execution.

Explore more on X Open Hub’s official website.

4. Finalto

Finalto, formerly known as Markets.com, is a well-regarded liquidity provider with a strong track record. They have won numerous awards for their services, including recognition as the best liquidity provider. Finalto offers access to liquidity on more than 800 financial instruments, with a liquidity pool comprising Tier-1 banks and non-bank venues. They provide APIs for seamless integration and offer competitive pricing and reliable trade execution.

Explore more on Finalto’s official website.

5. Leverate

Leverate is a reputable liquidity provider known for its comprehensive solutions for Forex brokers. They offer a range of services, including liquidity aggregation, risk management tools, and trading platforms. Leverate provides access to a broad liquidity pool and offers competitive spreads and efficient trade execution. They have a strong reputation in the industry and are trusted by brokers worldwide.

Explore more on Leverate’s official website.

Also, in case you’re looking for more LP options, you can check out our list of the best Forex liquidity providers on the market.

Conclusion

Liquidity plays a critical role in Forex trading, and LPs are the entities ensuring its constant flow. Understanding their function, types and how to choose a reliable one is paramount for any Forex broker. In 2023-2024, as the Forex market continues to evolve and grow, the role of liquidity providers is even more significant than ever. Make an informed choice based on your requirements and preferences and sail smoothly in the volatile sea of Forex markets.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

How do Forex LPs earn money?

One of the primary ways in which liquidity providers earn money is through spreads. A spread is the gap between the bid and ask price of a currency pair. Some liquidity providers may also charge a commission for their services. This can be a fixed fee or a percentage of the trade’s value.

How do you check liquidity in Forex?

To check liquidity in Forex, you can look at the bid and ask prices of a currency pair. Generally, the wider the spread between these two prices, the less liquid the market is. Additionally, you can also look at trading volume and volatility to get an idea of market liquidity. Keep in mind that liquidity can vary depending on the time of day and economic events happening around the world.

What is the daily volume of liquidity in the Forex market?

Forex is the biggest and most liquid financial market globally, with daily turnovers of about $7.5 trillion as of April 2022. This means that on any given day, there is a massive amount of liquidity available for traders to buy and sell currencies.

What types of liquidity are there?

There are two types of liquidity: market liquidity and funding liquidity.

Market liquidity refers to the ability of an asset to be quickly bought or sold in the market without significantly affecting its price. This type of liquidity is important for investors who want to enter or exit a position in an asset easily.

Funding liquidity, on the other hand, refers to the availability of credit and financing for individuals and businesses. This type of liquidity is crucial for maintaining the functioning of financial markets and ensuring economic stability.

What is the difference between market liquidity and market depth?

Market liquidity and market depth are two terms that are often used interchangeably, but they actually refer to different aspects of a market. In simple terms, market liquidity measures the ability to trade an asset quickly, while market depth indicates the supply and demand for that asset at different price points.

How to open your own brokerage?

Opening your own brokerage involves doing the necessary research to determine which type of brokerage licence you need, registering your business, and obtaining the relevant licences and permits. You will also need to establish a business plan, secure funding, and set up your trading platform and infrastructure.More information can be found here.