Best Liquidity Providers in 2024 and Beyond

Nov 13, 2024

In the high-stakes world of financial trading, liquidity is the lifeblood that keeps markets dynamic and profitable. In the global Forex market, where over $7 trillion changes hands daily, or the booming $3 trillion cryptocurrency sector, seamless liquidity access means the difference between capitalizing on opportunities or missing them.

With constant volatility, reliable trade execution isn’t just an advantage; it’s essential for survival. Thus, selecting a trustworthy partner to access FX or cryptocurrency liquidity is one of a business’s most strategic decisions.

Leading providers offer broad asset coverage—currencies, metals, commodities, and crypto—paired with ultra-fast execution, tight spreads, and advanced risk management.

In this guide, we highlight the best liquidity providers of 2024—firms known for pushing the boundaries of what’s possible in the trading world.

Key Takeaways

- Leading liquidity providers offer diverse assets, fast execution, and customizable tech for competitive trading.

- Key factors in choosing a provider include asset range, execution speed, pricing transparency, and regulatory compliance.

- White-label and CRM tools help new brokers enter the market efficiently.

Overview of 10 Best Liquidity Providers in 2024

The FX liquidity market is a competitive and technologically advanced space driven by constant innovation and an increasing demand for multi-asset support. Leading liquidity providers offer more than just basic FX services—they also deliver crypto liquidity, CFDs, and other assets with high levels of customization and support.

Each provider profiled below has carved a niche, building a reputation for dependability, competitive pricing, and flexibility. This overview serves as a guide for businesses seeking the right partner to streamline their liquidity needs.

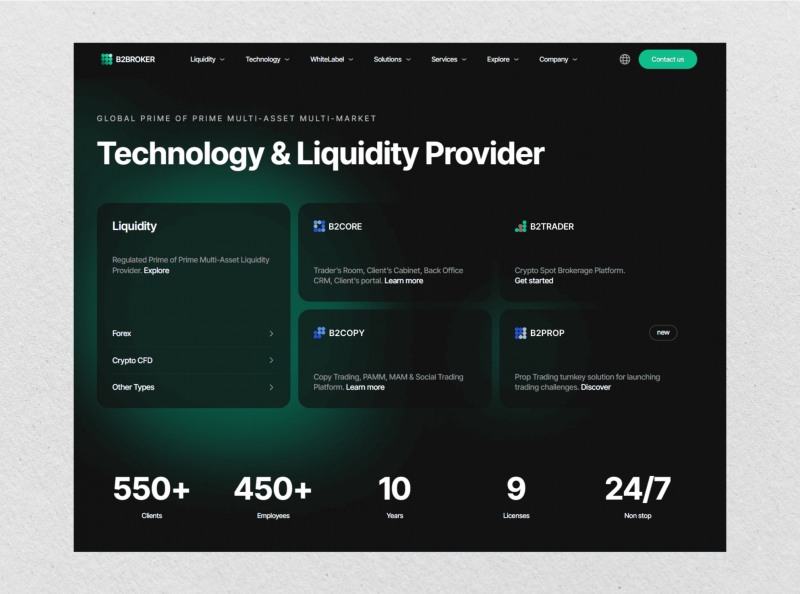

B2BROKER

Since its founding in 2014, B2BROKER has grown into a frontrunner in liquidity provision thanks to its extensive and varied offerings. The company takes a “Prime of Prime” (PoP) approach, leveraging tier-1 liquidity sources from major banks and commercial brokers, which it then redistributes to smaller businesses. This model is ideal for smaller brokers and financial institutions that want access to high-quality liquidity but lack direct access to tier-1 liquidity pools.

B2BROKER offers an impressive range of liquidity options, covering everything from Forex and cryptocurrencies to precious metals and indices. This coverage is supported by robust technical capabilities, such as B2CONNECT, a liquidity hub that enables seamless integration.

Furthermore, B2BROKER’s B2TRADER crypto spot trading platform provides a powerful solution specifically designed for digital asset markets.

By combining liquidity services with proprietary B2CORE CRM and analytics modules, B2BROKER creates a complete package that supports both new and established brokers. Their affiliate model, Introducing Brokers (IB), further allows brokers to increase their client base and revenue. B2BROKER’s commitment to quality and customization has positioned it as a top choice for businesses aiming to offer comprehensive trading experiences.

Swissquote Bank

Swissquote Bank, a leading Swiss financial institution, offers liquidity services with an emphasis on regulatory compliance and competitive institutional pricing. By aggregating pricing from tier-1 banks and non-bank sources, Swissquote provides a secure environment for FX trading, supported by proprietary technology that integrates seamlessly with industry-standard platforms.

Swissquote’s banking solutions and FIX API access enable clients to engage in a highly regulated trading environment, which is ideal for institutional clients who prioritize security and compliance. With its dedication to transparency, Swissquote is a preferred choice for financial institutions seeking a reliable, regulated liquidity provider.

Learn more about Swissquote Bank.

Leverate

Founded in 2008, Leverate has built a reputation for its comprehensive suite of solutions for brokers and financial institutions. The company’s liquidity service, LXCapital, aggregates liquidity from leading global providers, delivering low latency execution across diverse asset classes, including Forex, stocks, and cryptocurrencies. Leverate’s LXFeed technology ensures that clients have access to accurate, stable prices, eliminating risks associated with spikes and requotes.

Leverate also offers LXRisk, a robust risk management tool that enables brokers to monitor and adjust their exposure instantly, ensuring secure trading environments. Leverate’s white-label solutions allow brokers to operate with their brand, with access to an established technology framework that supports growth and scalability.

Leverate is a strong choice for companies seeking to minimize risk and maximize profit by providing end-to-end solutions that include risk management, price feeds, and liquidity.

FXCM Pro

FXCM Pro, the institutional arm of the FXCM Group, delivers high-quality execution and liquidity solutions for retail brokers, hedge funds, and emerging banks. With over two decades of experience, FXCM Pro has deep insights into the FX market’s needs and trends. The company’s partnership with Jefferies Financial Group adds further depth, granting access to prime brokerage services and enhanced Forex liquidity offerings.

FXCM Pro’s extensive network includes tier-1 banks and leading non-bank liquidity providers, allowing it to source competitive pricing and support complex trade executions. The provider’s advanced liquidity management enables clients to access large orders, sticky intraday pricing on metals, and other customizable features based on trading requirements.

Additionally, FXCM Prime, the company’s clearing and data solution, provides businesses with direct access to various trading venues and customizable data packages that enhance market insight. With a client-centered approach, FXCM Pro suits institutional clients requiring global access, sophisticated data analytics, and robust liquidity options.

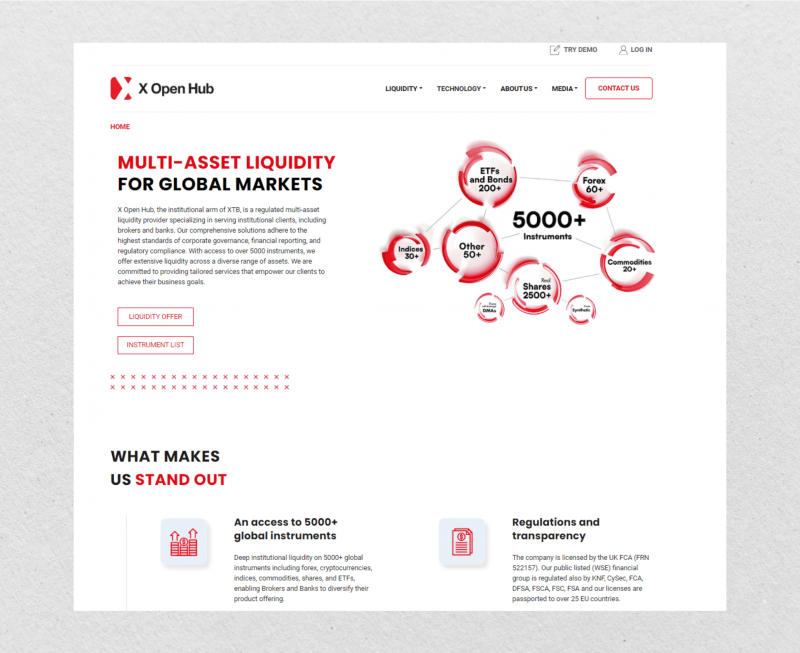

X Open Hub

Based in London and operating with a technology center in Warsaw, X Open Hub offers multi-asset liquidity and a flexible trading platform designed for banks, brokers, and hedge funds. Their liquidity offerings span a broad range of assets, including Forex, indices, and cryptocurrencies, with a focus on execution speed and low latency. This ultra-fast, multi-asset liquidity is made possible by X Open Hub’s direct connections to data sources, ensuring instant orders with zero re-quotes.

X Open Hub’s XOH trading platform offers a customizable trading environment equipped with MAM (Multi-Account Manager) capabilities, enabling clients to design unique offerings. Their white-label technology allows companies to launch their own branded brokerages, supported by the reliability and depth of X Open Hub’s liquidity pools.

Regulated by multiple international bodies, X Open Hub combines regulatory rigor with cutting-edge technology, making it a trusted partner for brokers looking to expand their product range with competitive spreads and high-quality execution.

B2PRIME

B2PRIME specializes in Prime of Prime (PoP) services, catering to institutional clients with customized liquidity solutions for Forex, metals, indices, and crypto. B2PRIME’s technology allows seamless integration with popular trading platforms, including MT4 and MT5, via FIX API connections. Clients benefit from a single-margin account, enabling 24/7 access to multiple asset classes with competitive pricing and fast execution.

With strong regulatory credentials, B2PRIME ensures compliance and transparency, making it a trusted partner for brokers, exchanges, and investment firms. B2PRIME’s commitment to supporting its clients with reliable and flexible trading options has established it as a standout provider in the PoP liquidity space.

Finalto

Finalto, backed by Playtech, is a comprehensive liquidity provider and prime broker with access to over 800 instruments across asset classes, including FX, commodities, and crypto. The company customizes a liquidity pool for each client, creating a tailored solution that aligns with their trading requirements.

Their in-house technology continuously optimizes liquidity flows, providing clients with the best possible pricing through partnerships with both tier-1 banks and non-bank venues.

Finalto’s solutions include ClearVision, a trading system designed for operational efficiency, and Finalto 360, an award-winning CRM platform for client management. Their white-label solutions are highly adaptable, allowing partners to enter the market with minimal technical and financial burden.

For businesses focused on operational efficiency and tailored liquidity, Finalto presents an attractive option with comprehensive support.

Advanced Markets

Advanced Markets has long been known for its transparency and competitive spreads, driven by a commitment to offering direct market access (DMA) to clients. With the recent addition of DMAhub, Advanced Markets enables clients to configure liquidity solutions that match their needs, creating a customized trading environment for Forex, precious metals, and energy markets.

The company’s platforms, Fortex 5 and Fortex 6, offer low-latency connectivity for algorithmic trading, making Advanced Markets ideal for institutional clients focused on high-speed trading and data precision. Advanced Markets’ depth of liquidity and execution reliability is particularly attractive to those seeking direct access to a liquidity pool provider with low-risk, transparent operations.

Learn more about Advanced Markets.

IXO Prime

IXO Prime by INFINOX provides liquidity services to brokers, exchanges, and hedge funds with customized liquidity solutions that cater to specific client needs. Their offerings include access to a deep liquidity pool from tier-1 banks, non-banks, and PoP venues, facilitating tight pricing and efficient trade execution.

IXO Prime’s white-label solution allows clients to leverage its global infrastructure and risk management tools, making it easy for brokers to launch under their branding with minimal setup. With a focus on high-quality execution and comprehensive support, IXO Prime is well-suited to businesses seeking efficient trading infrastructure and competitive pricing.

Match-Prime

Match-Prime offers multi-asset liquidity and flexibility through its proprietary Match-Trader platform. With a range of 1,000+ instruments, including Forex, indices, and commodities, Match-Prime supports diverse trading needs with transparent conditions. Clients can manage their liquidity accounts through Market Depth, daily reports, and an efficient API connection.

Match-Prime’s white-label options allow brokers to utilize the company’s infrastructure with minimal onboarding time, making it an accessible option for brokers looking to establish a presence quickly. The firm’s focus on simplicity and flexibility makes it a popular choice for businesses that value ease of access and low setup costs.

How to Choose Liquidity Provider?

Selecting the right Forex or crypto liquidity provider is a decision that directly affects client satisfaction and business scalability. Here’s what to consider:

Asset Coverage

While Forex remains the foundation for most liquidity providers, the demand for multi-asset coverage is growing. Many providers now offer a range of assets, including cryptocurrencies, precious metals, commodities, indices, and CFDs, catering to the diversification needs of traders.

Recent studies show that nearly half of traders are diversifying into digital assets, so opting for a liquidity provider crypto that supports these asset classes can position you well for future market shifts.

Execution Speed and Low Latency

In high-frequency trading or during volatile market periods, execution speed can make or break profitability. A reliable provider with ultra-low latency and fast execution capabilities can minimize slippage and give traders the confidence to act swiftly.

Providers with advanced infrastructure often have data centers strategically located near trading hubs (such as LD4 in London and NY4 in New York), ensuring quicker execution. Ask providers about their connectivity, data centers, and redundancy measures to ensure you’re choosing a provider that can keep up with demand.

Competitive Pricing and Spreads

The tighter the spread, the lower the cost of each trade—critical for attracting and retaining clients. In highly competitive FX markets, even a fraction of a pip can significantly impact traders’ profit margins, especially for high-frequency and large-volume traders.

Some providers widen spreads during volatile periods or add hidden fees. Look for a provider that maintains transparent pricing and offers stable spreads across various market conditions. Many top-tier providers now use tiered pricing models or volume-based discounts, which can help reduce trading costs as your trading volume increases.

Advanced Technology and Integration

Seamless integration with your platform is essential whether you’re using MT4, MT5, cTrader, or proprietary software. Leading providers often offer FIX API and WebSocket connectivity, allowing for customizable trading environments and real-time data feeds.

Some providers offer tools to adjust liquidity pools and execution settings to match your risk tolerance and business goals. For example, B2Broker’s B2CONNECT hub allows clients to integrate and manage multiple liquidity sources in real time, offering the flexibility to respond quickly to market changes.

Regulatory Compliance and Security

Regulatory oversight provides an additional layer of security, ensuring providers adhere to industry standards and reducing counterparty risk. Look for providers regulated by respected authorities like the FCA, CySEC, or FINMA.

Security is critical in a digital-first trading environment. Choose providers with a strong track record in cybersecurity and data protection to safeguard your clients and business from cyber threats.

Customer Support and Relationship Management

In a market that operates 24/5, having access to responsive support is vital, especially during high-stakes periods. Many top providers offer 24/7 support with dedicated account managers who can offer tailored assistance.

Providers that offer educational resources, market insights, and analytical tools can add substantial value, helping your business and clients stay informed of trends and trading opportunities. Access to regular updates can also help traders optimize their strategies in volatile markets.

Value-Added Services and Turnkey Solutions

If you’re a new brokerage or want to scale quickly, white-label solutions can be a game-changer. Providers like Finalto and X Open Hub offer fully customizable platforms under your brand, reducing your need to invest heavily in infrastructure.

Comprehensive CRM solutions help streamline client interactions, while integrated risk management tools help monitor and control exposure. Leverate, for instance, offers LXRisk, a robust risk management tool that allows brokers to manage their exposure in real-time, which is essential for building client trust and reducing risk.

Final Thoughts

The right liquidity provider is a strategic partner in your business’s growth. By assessing factors like asset coverage, execution quality, technology, compliance, and support, you can find a provider that meets your needs today and is prepared to grow with you tomorrow. Making the right choice in an industry where every millisecond and pip counts can give your business a significant edge in a highly competitive market.

FAQ

What are Tier 1 liquidity providers?

Tier 1 liquidity providers are major financial institutions like JPMorgan and Goldman Sachs, with the highest credit ratings and capital reserves. They offer deep liquidity pools and the tightest spreads, enabling fast and secure trading.

What assets can I access through a liquidity provider?

While Forex is typically a core offering, many providers also offer access to cryptocurrencies, precious metals, indices, commodities, and CFDs, enabling businesses to provide diverse trading options to a broader audience.

What is a Prime of Prime liquidity provider?

A PoP provider aggregates liquidity from Tier 1 sources and distributes it to smaller brokers and institutions, granting them access to institutional-grade liquidity without direct Tier 1 relationships.

What is a white-label solution?

A white-label solution allows brokers to launch their own branded trading platforms using a provider’s infrastructure, enabling quick market entry with minimal technical setup and access to premium technology and liquidity.