Forex Trading: A Beginner’s Guide

Mar 23, 2023

Forex, an abbreviation of "foreign exchange," is something we encounter frequently. When traveling abroad and exchanging your money for the local currency, you simply make a Forex exchange. Therefore, the term "Forex" refers to the process of exchanging one currency for another, mostly for commercial, trading, or touristic purposes.

The Forex market is the largest on the globe. Any simple currency exchange or transaction has the potential to alter the exchange rate, which in turn affects global prices, trends, and even wages.

Since the Forex market operates around the clock, with each exchange and transaction factored in, the prices show considerable swings. Trading Forex involves monitoring currency pairs for price fluctuations, studying patterns, and profiting from these changes using one's analytical and risk management skills.

This may sound intimidating to those just starting out, so let's walk through the basics of the foreign exchange market, examine how it works, and show you how to start making money quickly and easily by buying and selling currencies you already use in daily life.

Key Takeaways

Forex is the world’s largest market where currencies are exchanged for various reasons, including commerce, trading, and tourism.

Forex trading is the act of buying and selling currency pairs to make a profit, with traders making predictions based on price fluctuations and market trends

Multiple factors, like economic and political events, can impact the Forex market and influence currency prices.

Proper Forex trading strategy, risk management, and technical analysis can help traders maximize their profits and minimize their losses.

Forex Origins and Importance

An average daily trading volume in the Forex industry exceeds $6,6 trillion (double of the New York Stock Exchange), making it the largest market and an attractive trading venue for traders around the globe. But how did we come here?

Forex trading has existed, at least in some form, for centuries. Bartering and currency exchange have been around since the beginning of human commerce. However, the Forex market, or Forex, as it is known today, is a recent development.

Following the breakdown of the Bretton Woods agreement in 1971, more currencies were allowed to float freely against one another. Since then, Forex trading services track the rise and fall of currency values in accordance with supply and demand.

Commercial and investment banks mostly trade in the foreign exchange market on behalf of their clients. Still, there is also room for speculation by professional and individual investors.

There are two ways to earn from Forex trade:

By the difference in interest rates between the two currencies;

By the change of currency exchange rates.

If two currencies have different interest rates, an investor can make money by buying the currency with the higher interest rate and selling the currency with the lower interest rate.

For instance, when we say buying the EUR/USD pair, it translates as one is selling USD to acquire EUR. The holdings will be worth more money if the Euro appreciates against the Dollar, but if the Euro loses ground against the Dollar, your holdings will have less value.

There is no such state as an absolute decline in the Forex because for one currency to rise, others must fall against it. Therefore, every currency can't grow simultaneously, meaning some people will come out on top while others will fall short.

FX traders evaluate the prospects of one currency relative to another and make trades accordingly.

What Drives The Forex Market?

Interestingly, no central physical locations serve as trading venues for the world's Forex market. Rather, it's a web of interconnections established via computers and trading terminals.

In Forex, currencies are traded in over-the-counter (OTC) markets, with no governing authority controlling them. However, obviously, it has its own key players that influence the market: Institutions, commercial banks, individual investors, and several macro forces.

Here are five major factors that drive the foreign exchange markets:

Central Bank Interest Rates

Central banks and their interest-rate decisions are the single most crucial factor affecting the values of exchange rates on a global scale. When a central bank raises interest rates, it indicates economic growth and optimism about the future; when it lowers rates, it indicates economic decline and pessimism about the economy's long-term outlook.

Forex traders will typically start buying a currency well before a central bank decides to raise or lower interest rates.

Central Bank Intervention

There are times when a country's central bank decides to intervene and directly influence the value of its currency to benefit the economy.

Some countries, like Japan, that rely heavily on exports, would suffer if their currency (Japanese YEN) appreciated too much. Central banks can counteract rapid currency appreciation by flooding the market with their currency through the distribution of reserves.

Options

Many companies use FX options to protect themselves from fluctuations in currency values because of their extensive use in international trade. However, an increasing proportion of the volume traded is devoted to speculation.

Double No Touch (DNT) options are the option type that attracts the most attention from FX traders. Such options are frequently sought after by highly liquid investors, who tend to target round numbers in widely traded currency pairs like the Euro to US Dollar or the US Dollar to Japanese Yen.

A currency pair that has been fluctuating significantly may briefly surge above a key psychological level before retreating below it.

Market Sentiment

Fear can turn a falling instrument into a full-blown panic, and greed can turn a rising market into a reckless buying frenzy.

As widespread anxiety spread about the Eurozone crisis in the 2010s, the Euro was hammered to all-time lows. Not long afterward, however, greed took over, and the currency soared to heights that were bad for the economy as a whole, particularly in terms of employment and inflation.

The European Central Bank was compelled to impose a devaluation through various market mechanisms.

Political Impact

Political elections can significantly affect the value of the local currency. The value of a currency is heavily influenced by monetary and fiscal policy, both of which can transform dramatically with a change in government.

The international political climate is yet another factor to think about. The effects of war are devastating and far-reaching, much like those of a natural disaster. Wars have a catastrophic short-term impact on economies, costing billions of dollars, upsetting currency markets, and displacing millions of people.

What's The Outlook For The Forex Market In 2023?

The post-covid world is still attempting to recover, and the escalating conflict between Russia and Ukraine in the heart of Europe has exacerbated the global economic downturn. The global economy is still showing signs of weakness, which has made the foreign exchange market particularly unstable.

However, the Forex market's volatility can be beneficial for traders. If analyzed carefully, you can expect a price movement of 50-100 pips on one of the major currency pairs almost every day of the week.

Analysis of Forex Markets

As with stock trading, the vast majority of FX trades aren't made to settle an actual transaction but rather to bet on the direction of future currency prices. Forex traders attempt to profit from price fluctuations by buying or selling currencies based on their expectations of future trends.

There are three main venues Forex is traded: The spot market, the forward market, and the futures market, and any of these can bring various outcomes for the traders.

Spot Market

This is the main foreign exchange market where trading occurs and exchange rates are set according to supply and demand.

Forward Market

Instead of executing a trade immediately, Forex traders can enter into a legally binding (private) contract with another trader to lock in an exchange rate for a predetermined amount of currency on a future date.

Futures Market

Similarly, investors may select a standard contract to buy or sell a fixed amount of currency at a predetermined exchange rate on a future date. Unlike the forward market, this takes place on a public exchange.

Forex traders who wish to speculate on or hedge against future price changes in a currency are the primary users of the forward and futures markets. Meanwhile, the spot market is the most active of the foreign exchange markets and the primary factor in determining currency exchange rates.

Role of Currency Pairs in Forex Trading

Currency pairs are quotations of two currencies, with the value of one currency quoted against the other. For every currency pair, the first currency listed is the base currency, and the second is the quote currency.

The exchange rate indicates how many units of the quote currency are required to purchase one unit of the base currency. The quoted currency fluctuates based on the market and the amount needed to purchase 1 unit of the base currency, while the base currency is always expressed as 1 unit.

For instance, the current EUR/USD exchange rate is 1.06, which means that €1 will buy $1.06.

When the exchange rate increases, it indicates that the base currency is more valuable than the quote currency. Following the example, one Euro will buy more than 1.06 US dollars.

The bid (buy) and ask (sell) prices of a currency pair are used to determine the quoted exchange rate (sell). Your Forex broker will buy your base currency at the bid price in exchange for the quote or counter currency.

Currency pairs can be sorted into the "Major," "Minor," and "Exotic" groups.

Major Currency Pairs

"major currency pairs" refers to the group of currencies with the most trade volume against the US dollar. These include:

EUR/USD

USD/JPY

GBP/USD

USD/CHF

AUD/USD

USD/CAD

Minor Currency Pairs

Unlike major currency pairs, minor currency pairs, also called crosses, do not involve the US dollar. Compared to the majors, these pairs have wider spreads and less liquidity but still have a substantial trading volume. These include:

EUR/GBP

EUR/JPY

GBP/JPY

GBP/CAD

CHF/JPY

EUR/AUD

NZD/JPY

Exotic Currency Pairs

Currencies from developing nations are part of the exotic currency pairs. The spreads are much larger, and the liquidity is lower for these pairs. These include:

USD/TRY

EUR/TRY

USD/CZK

USD/ZAR

EUR/MXN

USD/HUF

USD/SEK

EUR/RON

Forex Trading for Beginners: Step-by-Step Guide

When first getting into Forex trading, there are four basic steps that everyone should take:

Find a Reliable Online Forex Broker

Finding a proper Forex broker is the first step on your Forex trading journey, and most of the outcomes depend on your choice, so research wisely and find an authoritative broker to avoid fraud.

Fund Your Account

Once you've selected a broker, you can open a Forex trading account, fund it, and begin trading. Bank wire transfers, debit card payments, and electronic payment providers like Skrill and PayPal are some deposit methods accepted by most online Forex brokers.

Download a Forex Trading Platform

To trade Forex, you'll need to use a platform that is either downloadable or accessible online and is supported by your broker. Most FX brokers support either their in-house trading platform or a widely used third-party platform, such as MetaTrader 4 and 5, cTrader, etc.

Research and Find a Suitable Trading Pair

After completing the preceding steps, your Forex account is funded and ready to trade. Now, it's time to locate a favorable currency pair, develop a Forex trading strategy, and enter a Forex trade with clearly defined entry and exit points. Also, consider implementing a stop-loss or take-profit order to mitigate your losses.

Forex Trading Strategies

Although the steps outlined above will help you start, generating profits without a proper trading strategy is incredibly difficult.

The two most fundamental types of Forex trades are the long and short trade. In a long trade, the trader bets that the currency's value will rise, allowing them to profit. A short trade is betting that the currency pair's price will decline in the future.

Forex trading strategies can be divided into four categories based on the duration and number of trades.

Scalp Trade

Scalp trading consists of positions held for seconds or minutes at most, with profits limited by the number of pip movements. These trades are intended to be cumulative, meaning that small gains from each trade add up to a substantial sum at the end of the day or period.

Day Trade

Day Trades are short-term transactions where positions are held and liquidated on the same trading day. The duration of a day trade can vary between minutes and hours.

Swing Trade

The position may be held in a swing trade for days or weeks. Swing trading can be advantageous during major government announcements or periods of economic turmoil.

Position trade

In a position trade, the trader holds the currency for an extended period, which can last for months or even years. Because it provides a rationale for the trade, this type of trade necessitates greater fundamental analysis skills.

Charts in Forex Trading

In Forex trading, you will encounter a variety of charts and visual graphics. Let's break each down to understand the patterns of the market correctly.

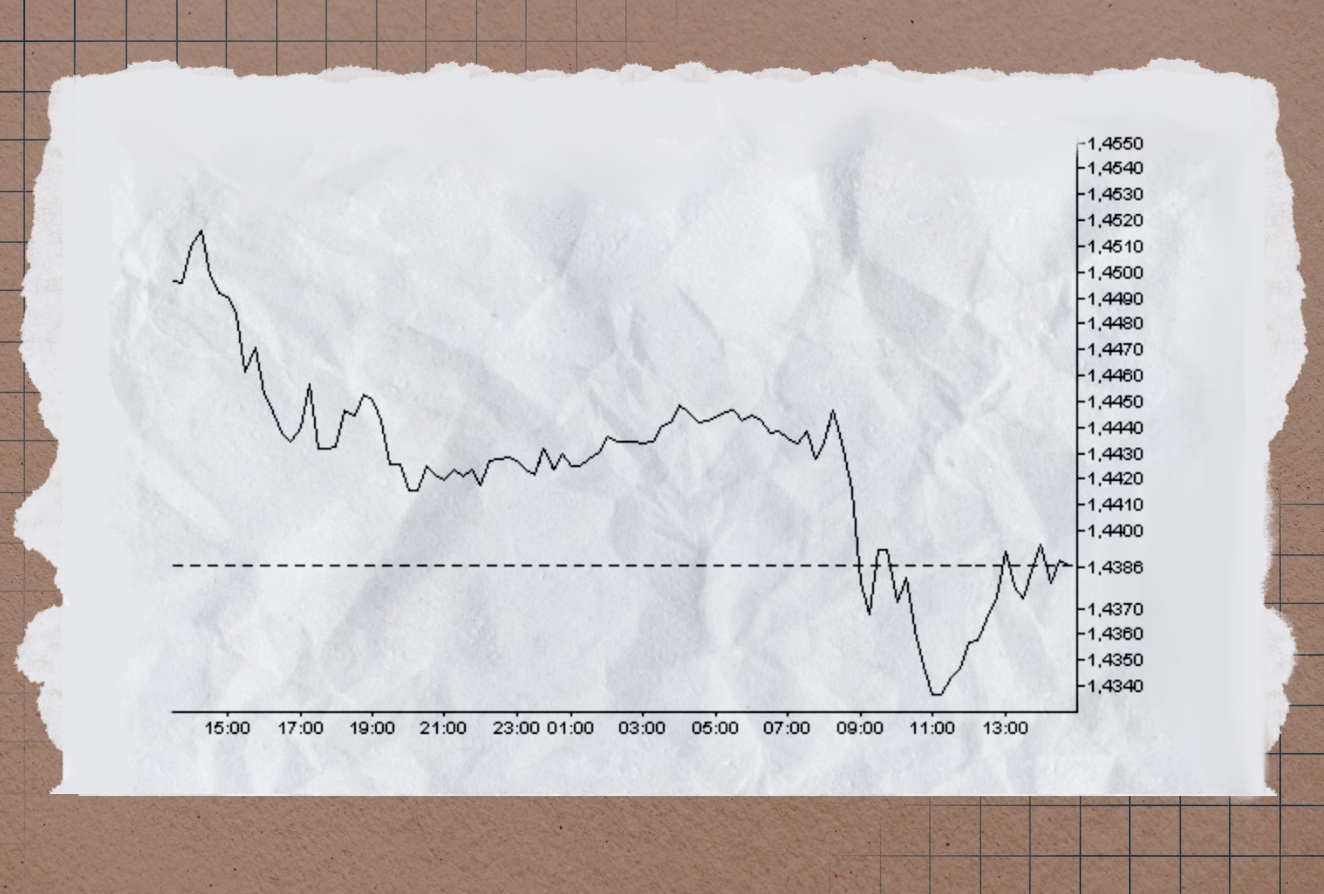

Line Charts

Using line charts, one can determine the overall currency trends. They are the most fundamental and prevalent chart types utilized by Forex traders. They display the currency's closing price for the time intervals specified by the user. Line charts help identify trends, which can then be used to inform trading decisions.

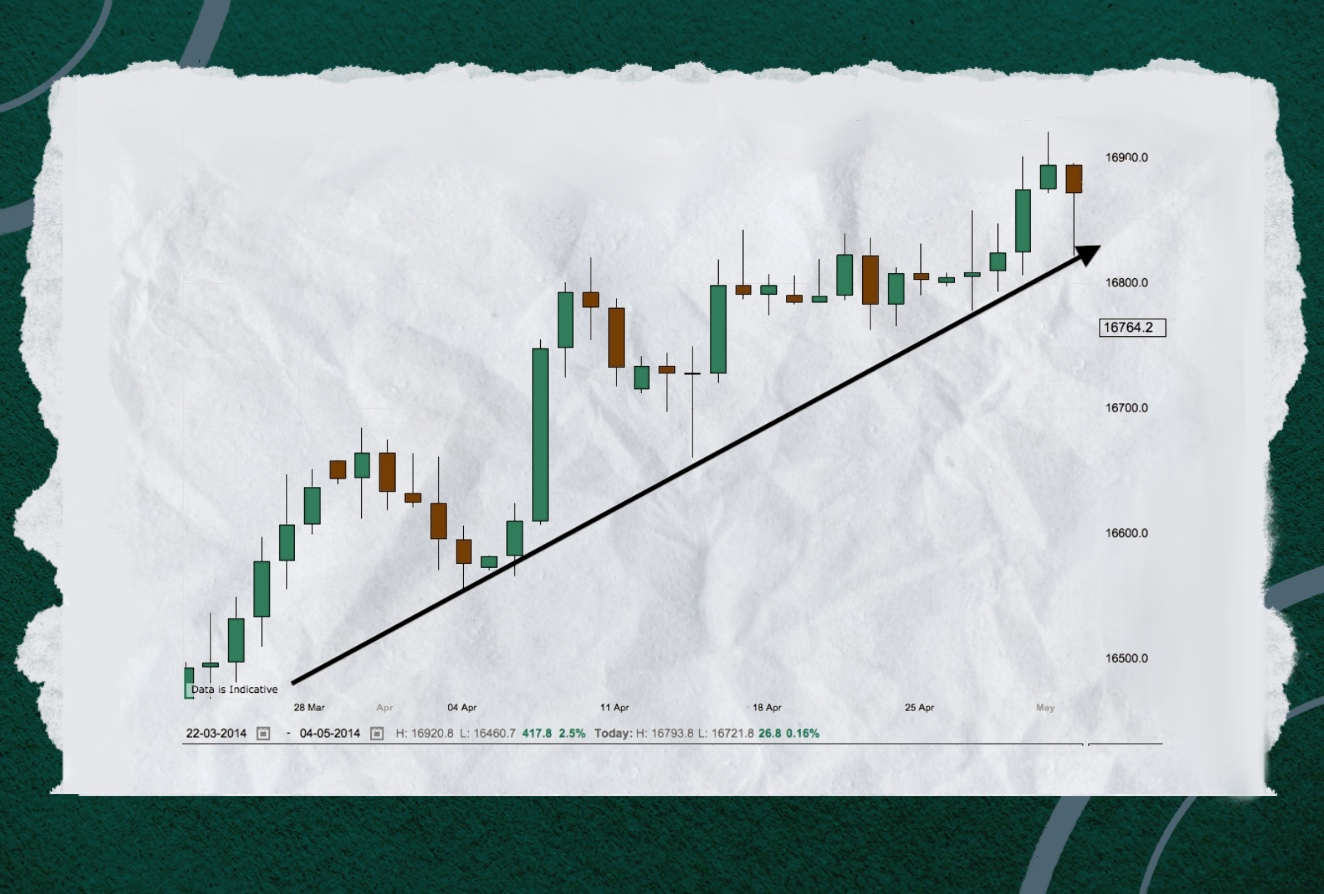

Bar Charts

Bar charts are commonly used in Forex trading to represent specific time intervals. They offer more price data than line charts. Each bar chart depicts one trading day and includes the opening, highest, lowest, and closing price (OHLC) for a trade.

Candlestick Charts

Candlestick charts are more aesthetically pleasing and simpler to read than the preceding charts. The top of the candle represents the opening price and highest price point for a currency, and the bottom represents the closing price and lowest price point. Candles with red or black shading indicate a period of falling prices, while those with green or white shading indicate rising prices.

The hanging man and shooting star are two of the most common candlestick chart formations.

Forex Glossary

Each market has its vocabulary. Below are key terms widely used in the Forex market to help you get started.

Currency pair: Every Forex transaction involves a currency pair. An example of a currency pair is EUR/USD.

Pip - Abbreviation for percentage in points, a pip denotes the tiniest possible price change within a currency pair. A pip equals 0.0001, as currency exchange rates are quoted to four decimal places.

Lot - A lot is the standard unit of currency exchanged in the Forex market. Lot sizes range from 1,000 to 10,000 units of currency, with the standard lot size being 100,000.

Leverage: Some traders may be unwilling to put up so much capital to execute a trade because of the large lot sizes. Leverage, another term for borrowing money, enables traders to participate in the foreign exchange market without the requisite capital.

Margin: Leveraged trading does not come without a cost. Margin is the term used to describe the initial down payment made by a trader.

Bid-ask spread: The exchange rate for a currency is determined by the highest price buyers are willing to pay and the lowest price sellers are willing to accept. The spread between the ask price and the bid price is known as the bid-ask spread.

Sniping and hunting - To "snipe" and "hunt" means to buy and sell currencies close to predetermined points to maximize profits. Brokers often engage in this behavior, and the only way to identify them is through observing price patterns with forces combined with other traders.

The Bottom Line

Forex is integral to our daily lives, so why not learn more about it? With all the essentials covered in the article, you can feel confident to start exploring the market and making your first successful trade.