How to Create a Cryptocurrency

Mar 22, 2023

How to Create a Cryptocurrency

As the world grows more digital, the desire for new and innovative technology has increased dramatically. Cryptocurrency is one such technology that has grabbed the globe by storm.

With the popularity of cryptocurrencies such as Bitcoin and Ethereum, many businesses are developing their own coins to adapt to this new technology. Creating crypto may seem like a daunting task, but it can be a rewarding experience with the proper direction and information.

This article will walk you through how to create a cryptocurrency and provide you with essential information.

Key Takeaways

Anyone with programming and advanced technical knowledge can design cryptocurrencies.

There are three primary ways to create crypto: building your own blockchain, modifying existing blockchain platforms, or building on an existing blockchain.

Before launching your crypto project, consider the legality of cryptocurrencies in your jurisdiction, determine the utility of the crypto, and evaluate startup costs.

What is Cryptocurrency?

Cryptocurrency is a digital currency that uses cryptography to safeguard and verify transactions and regulate the issuance of new units. Bitcoin is the most well-known crypto, but there are already thousands of other cryptocurrencies, each with its own characteristics and use cases.

Coin VS Token

There are two primary types of digital assets in cryptocurrencies: coins and tokens. Cryptocurrency coin is designed to operate as a medium of cryptocurrency exchanges, similar to traditional fiat currencies, and are often employed as a payment method or store of value.

On the other hand, tokens are typically constructed atop existing blockchain technology or networks and represent a specific digital asset, or utility, such as access to a specific product or service, voting rights, or ownership in a particular project or firm.

For instance, Binance Coin (BNB) is the native crypto token of the world's largest cryptocurrency exchange, Binance. BNB was initially used to validate cryptocurrency transactions, offer discounts to users, and cover trading fees, and eventually expanded to one of the largest coins on the cryptocurrency market.

Benefits of Launching Cryptocurrencies For Businesses

It is estimated that over 15,000 businesses worldwide currently accept Bitcoin, and many more are utilizing alternative coins or launching their own tokens.

The primary motivation of businesses for adopting cryptocurrencies is to replace traditional payment services with digital currencies, as they offer streamlined transactions, lower fees, access to international markets, and a new customer base. Additionally, they provide a competitive advantage for innovative businesses with no existing blockchain infrastructure or platforms.

But apart from the transactional benefits, cryptocurrencies have also demonstrated the ability to enhance user engagement for brands. Crypto popularity has led to the emergence of decentralized finance (DeFi) projects that have created a governance system that is more user-oriented, resulting in stronger bonds between companies and their customers.

Investors in crypto companies have evolved from mere clients to dedicated members who serve as ambassadors for the brand's long-term growth. Their personal financial goals align with the Web3 company’s objective to expand and create a vibrant community around its projects.

Having discussed the impact of cryptocurrencies on business, let's examine how to create your own crypto coin.

What to Consider Before Launching Your Crypto

There are a few things to remember before developing your own cryptocurrency.

Legitimacy

Cryptocurrencies' legitimacy differs by country. It's essential to check whether or not cryptocurrency use is legal in the area where your business operates. Cameroon has a de facto prohibition on crypto, China has a complete ban, while the United States allows it within limited legal frameworks.

Some recent high-profile crypto failures have ratcheted the pressure on regulators to crack down on the industry. You should, then, go to an attorney and learn the rules that apply to your cryptocurrencies.

Use Case

Among the many factors that potential backers consider is how your cryptocurrency will be put to use. Explain why your crypto exists and how it differs from others like it. Like Bitcoin's whitepaper, this should be laid out clearly.

Depending on the use case, it will either be a permissionless or permissioned blockchain.

Determining your purpose will help you define the goals you want to achieve with your crypto business.

Tokenomics

Tokenomics is the study of the economic principles behind your token. It's crucial to think about the total supply of coins or tokens, how they'll be first distributed, and how many will end up in the hands of cryptocurrency developers and partners.

Tokens' post-launch availability and creation method (mining vs. minting) are also up for debate. Consider the economic rewards or other motivations for network participants to keep the distributed ledger secure and updated. How coins are destroyed and whether or not your cryptocurrency buys back and burns any of its supply are important factors in tokenomics.

Smart Contracts' Integrity

When releasing a new crypto on an existing blockchain, it is necessary to conduct an audit of the smart contracts. An audit of a smart contract is a check of the code for flaws and potential security holes.

Given the potentially disastrous financial and economic ramifications of a smart contract bug, this is especially crucial when establishing a new cryptocurrency on an existing blockchain.

Startup Costs

Creating a cryptocurrency requires some level of startup costs, such as paying a third party to design, build, and audit your blockchain or gas fees for setting up your cryptocurrency token on an existing blockchain.

For instance, Binance's Smart Chain gas fees can be as low as $2.6. It's essential to factor in these costs in your budget to avoid financial constraints and setbacks during the creation process.

How To Create Your Own Cryptocurrency: Step-By-Step Guide

There are fundamentally three options for making your own new cryptocurrency. Most of them call for technical expertise, so if you're not sure of your own abilities, it's best to employ a professional or look for an agency that can provide a tailored solution to your specifications. Now, let's break down each approach to learn how to create a cryptocurrency.

Building Your Own Blockchain Platform And a Native Currency

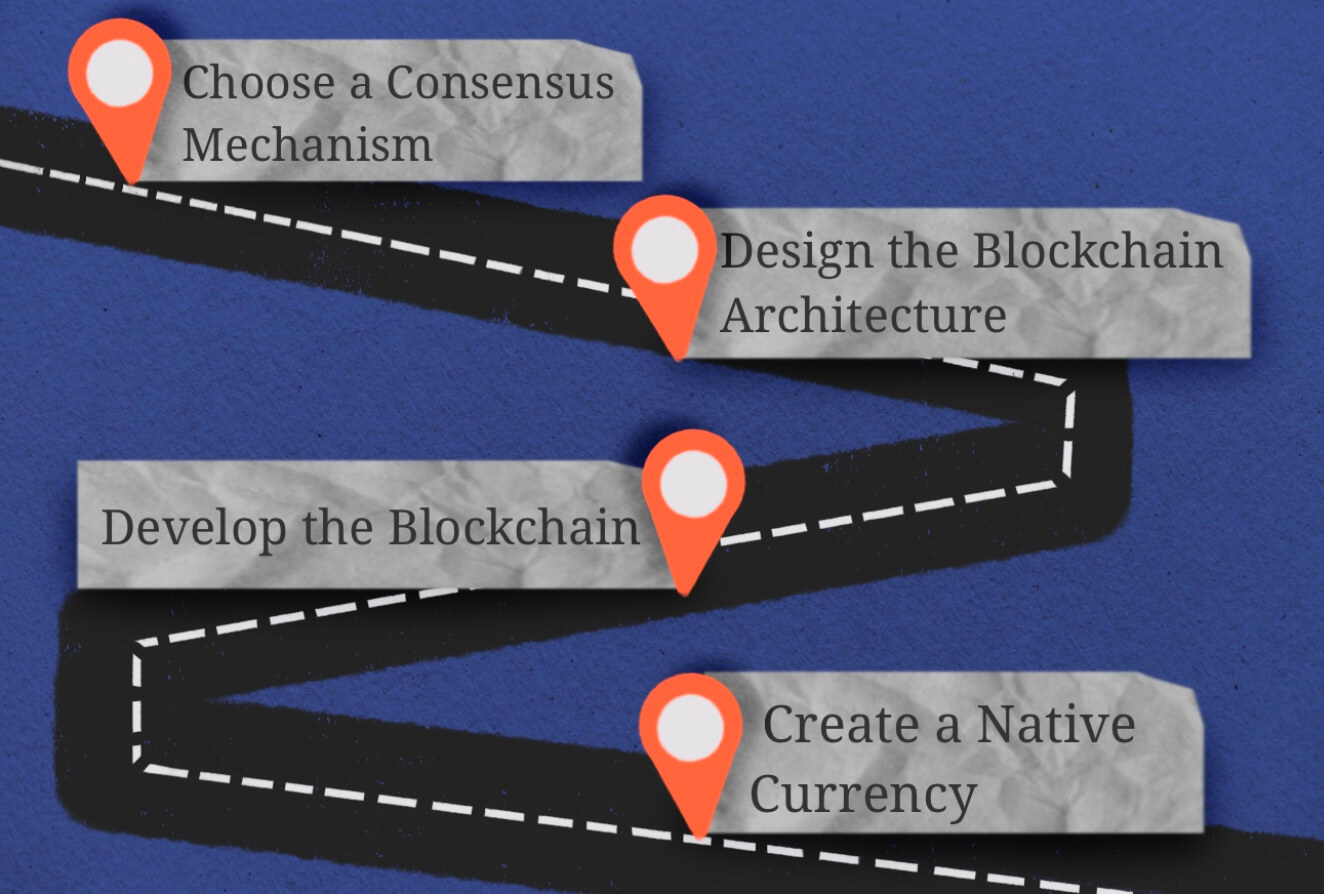

Building your own blockchain and decentralized digital currency, from the ground up is the most complex and time-consuming alternative. But it also gives you the most say in how the new coin looks and works. Here are the steps involved:

1. Choose a Consensus Mechanism

There are numerous consensus procedures in use today, including Proof of Work (PoW), Proof of Stake (PoS), Delegated Proof of Stake (DPoS), and more. Choose a method that best fits the needs of your cryptocurrency, as each has advantages and downsides.

2. Design the Blockchain Architecture

The blockchain architecture includes the data structure, consensus algorithm and mechanisms, network topology, and protocols that will be used to create the blockchain. You can either design the architecture from scratch or use an open-source framework like Ethereum.

3. Develop the Blockchain

Once you have designed the architecture, you need to develop the blockchain using programming languages such as C++, Python, or Java. The development process includes building several features, such as nodes for the blockchain, a consensus mechanism, and smart contract capabilities.

4. Create a Native Currency

The next step after developing the blockchain is to make a native currency. Depending on the design of your blockchain, the currency could be a token or a coin.

The final step is to set the supply and release the coin to the public by listing it for sale on a cryptocurrency exchange. You may also provide customers with a wallet to store their coins.

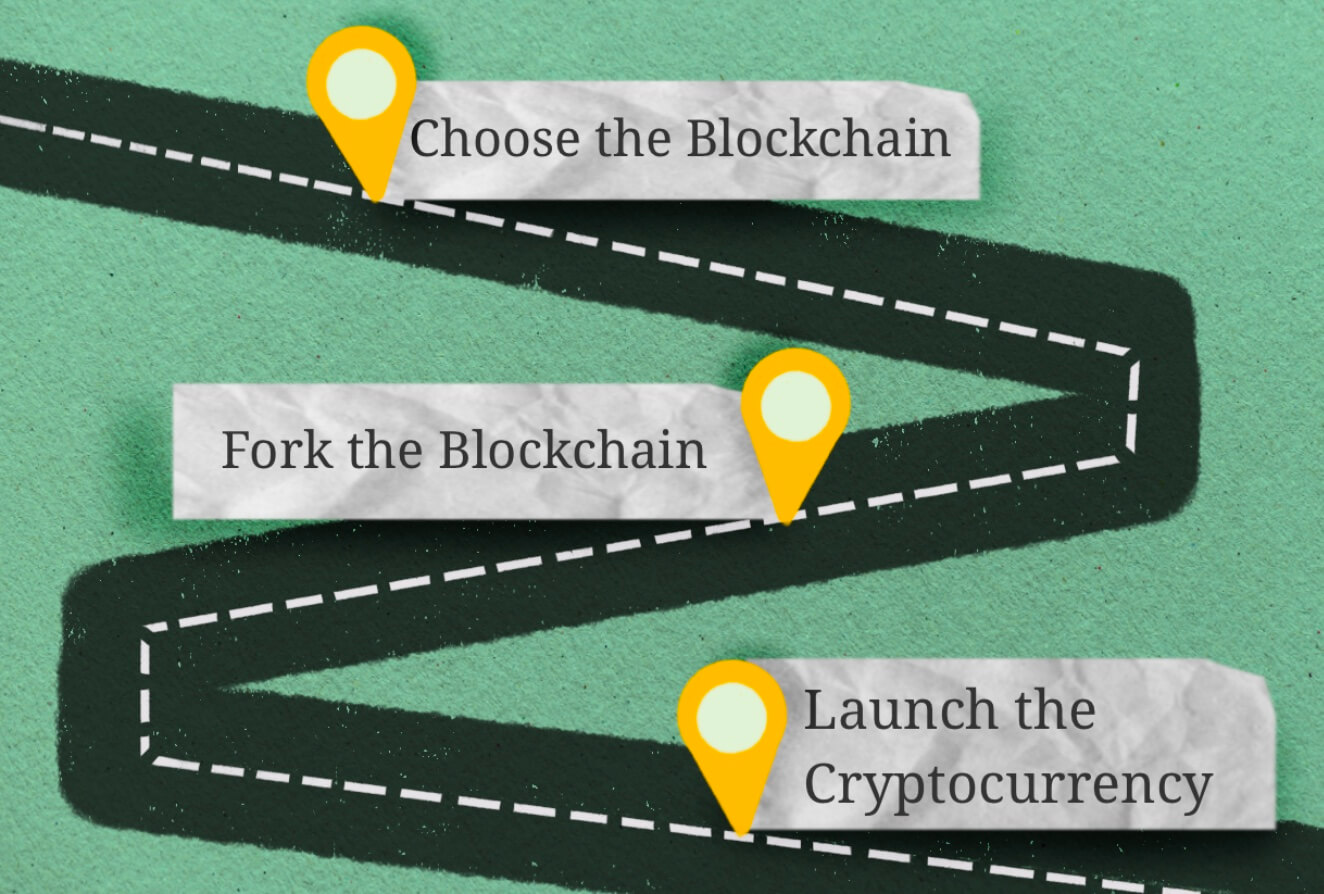

Or Modifying the Code of an Existing Blockchain Infrastructure

Modifying the code of an existing blockchain platform is a less complex and less time-consuming option than creating a blockchain and native currency from scratch. Here are the steps involved:

1. Choose the Blockchain

The first step is to choose the blockchain you want to modify. There are many popular blockchains to choose from, such as Bitcoin, Ethereum, Litecoin, and hundreds more.

2. Fork the Blockchain

Forking a blockchain means copying its code and creating a new blockchain-based on it. Litecoin, for instance, is a fork of the Bitcoin blockchain. There are two types of forks: soft forks and hard forks.

A soft fork is a backward-compatible update, while a hard fork is a non-backward-compatible update. You should choose the type of fork based on your own cryptocurrency development side's goals.

Once you've created a blockchain fork, you can change the blockchain's code to add or remove functionality. C++, Python, or Java proficiency is required.

3. Launch the Cryptocurrency

Finally, you need to launch the cryptocurrency by making it available on a cryptocurrency exchange. You can also create a wallet for your crypto and distribute it to users.

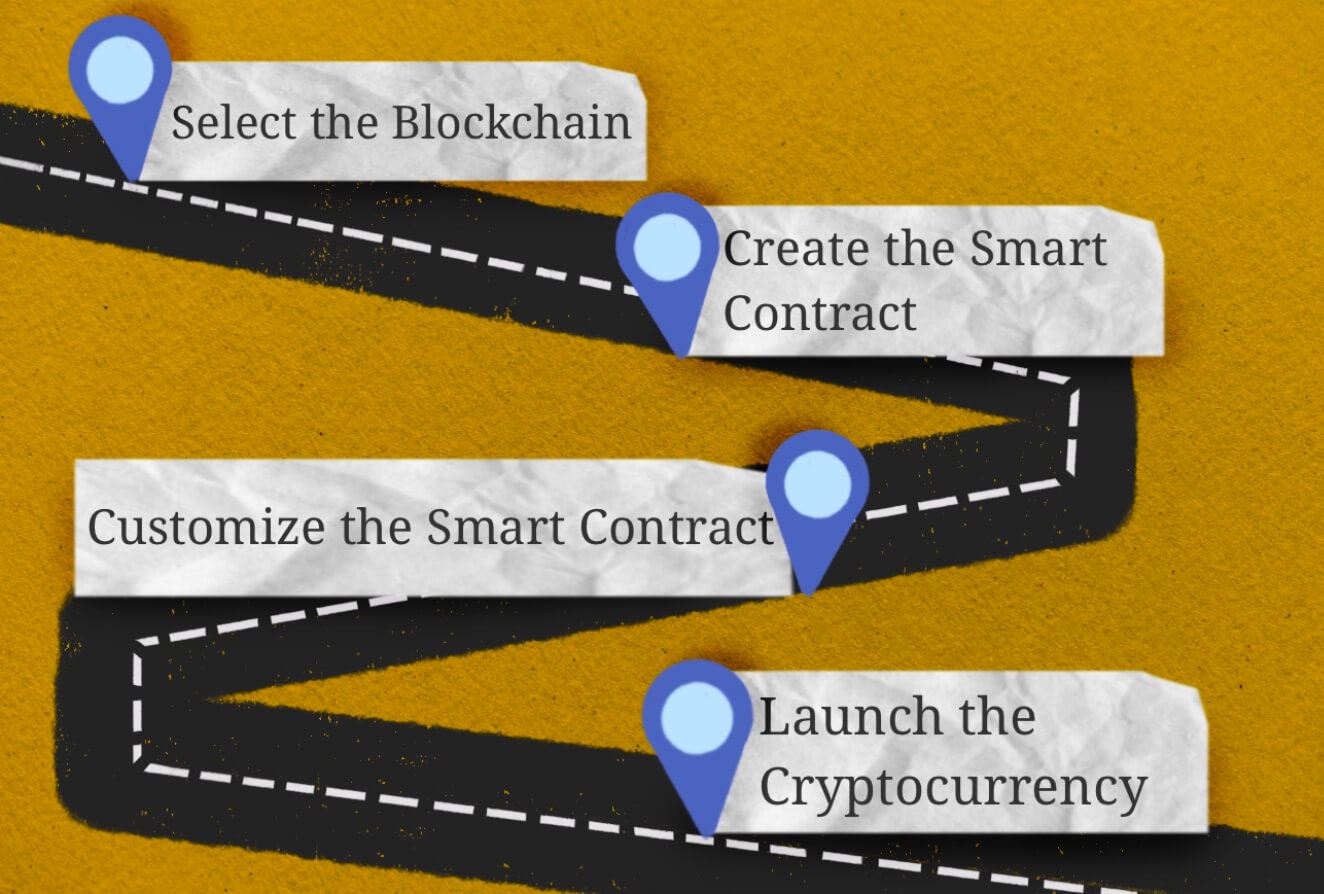

Either Releasing a New Cryptocurrency on an Existing Blockchain

Releasing a new cryptocurrency on an existing blockchain is the least complex and time-consuming option. Here are the steps involved:

1. Select the Blockchain

First, you must decide which blockchain will host your cryptocurrency's initial public offering. Blockchains like Ethereum, Binance Smart Chain, Tron, Polygon, and more are viable options because of their many features for smart contracts.

2. Create the Smart Contract

A smart contract is a self-executing code that automatically executes when certain conditions are met. You need to create a smart contract for your cryptocurrency that includes the rules, parameters, and functionalities.

3. Customize the Smart Contract

Once you have created the smart contract, you can customize it to add or change new features. You can also set the total supply of your cryptocurrency and the distribution mechanism.

4. Launch the Cryptocurrency

After customizing the smart contract, you must deploy it on the chosen blockchain. You can deploy your smart contract using blockchain development tools such as Remix or Truffle. Once the smart contract is deployed, you can launch your cryptocurrency and make it available on a cryptocurrency exchange.

Why Audit Matters?

Regardless of your choice, remember that the crypto industry is still considered risky, with thousands of scam projects appearing on the horizon every day. Therefore, once you build your own crypto project, it's essential to find a professional blockchain auditor and check and verify the code.

Auditing involves a thorough review of the code to identify and fix any vulnerabilities, loopholes, or errors that hackers can exploit or cause the cryptocurrency to malfunction. The audit can be performed by a third-party auditing firm or by using open-source auditing tools.

Obtaining an audit for the new crypto project is a major boost of confidence among the investors, as it guarantees their funds’ safety and the project’s reliability.

FAQs

Can anyone just create a cryptocurrency?

Yes, anyone with some technical programming knowledge can create a cryptocurrency.

How long does it take to create a cryptocurrency?

The time required to create a native cryptocurrency depends on the method you choose. Building a new blockchain and native currency can take months to years while modifying the existing blockchain or releasing a new native coin or cryptocurrency on an existing blockchain can be done in weeks.

Is creating a cryptocurrency legal?

Cryptocurrency regulations vary from country to country, so it's important to research the legal status of cryptocurrencies in your jurisdiction before creating one. Some countries have banned or restricted cryptocurrencies, while others have regulatory frameworks in place.

What is the easiest way to make cryptocurrency?

The easiest way to create your own token for a cryptocurrency is to release a new token on an existing blockchain. This method requires less technical knowledge and can be done relatively quickly.

What is the best-used blockchain technology to create your own cryptocurrency?

The best blockchain to create a token depends on the project's specific use case and requirements. Ethereum blockchain is a popular choice due to its smart contract capabilities.

How much does it cost to create a cryptocurrency?

If you need to hire a blockchain developer, crypto experts, designers, and legal advisors, expect the price to range between $10,000 and $30,000 to create a new crypto coin.

The Bottom Line

Creating cryptocurrency for your business is a great way to add a new element to your already established company. It requires careful research into the field, a fundamental understanding of cryptocurrency code, and the ability to design your own blockchain environment.

Working with an experienced blockchain developer and consulting financial advisors should help business owners gain the confidence and knowledge to implement their own cryptocurrency successfully.

Ultimately, cryptocurrency creation for your business can help you achieve your goals and create an entirely new market for yourself.