Chip Stocks Are Getting Pricey. Here Are a Few That Still Look Cheap

Dec 24, 2021

While chip stocks have performed well in the face of worldwide semiconductor shortages, several of the largest brands appear to be pricey.

Nvidia (NVDA), the strongest performer in the PHLX Semiconductor Index, or Sox, year to date, has gained over 130% this year. It is presently trading at 57.9 times projected profits in 2022. That is too pricey, even for bulls in the stock.

Bernstein analyst Stacy Rasgon acknowledged earlier this month that the stock appeared to be expensive on a price-to-earnings ratio. However, he said that he continues to suggest the shares since a high P/E ratio is not always a reason to sell a stock in technology. Rasgon sees significant catalysts and a more compelling story developing for Nvidia as the business continues to monetize and extend its software products while benefiting from rising interest in and investment in the metaverse.

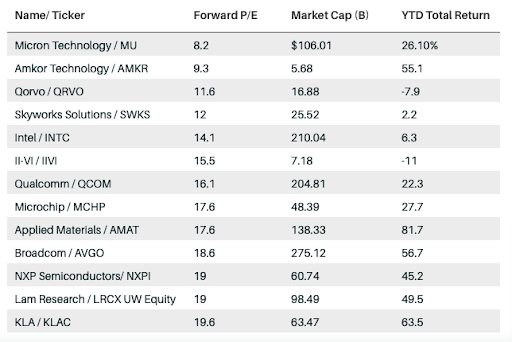

On the other hand, while a low P/E ratio is not a cause to buy a company, it is sometimes a smart location to begin your search. Additionally, the semiconductor sector offers a few deals. That is why Barron's identified the Sox index's 13 cheapest stocks based on their price to expected 2022 profits.

Cheap Chips

These are the cheapest stocks in the PHLX Semiconductor Sector index on a price-to-earnings-per-share basis in 2022.

Micron Technology (MU) is the cheapest memory chip stock in the group, trading at 8.2 times projected profits. Earlier this week, the business posted outstanding earnings and provided a more optimistic outlook for the current fiscal year. This year, the stock has returned 26%.

Amkor Technology (AMKR) is ranked second, trading at 9.3 times 2022 earnings projections. In 2021, the midcap chip stock returned 55%.

Qorvo (QRVO) and Skyworks Solutions, both of which are Apple (AAPL) suppliers, are trading at 11.6 and 12 times projected earnings, respectively. This year, both equities have fallen behind their rivals, falling 7.9 percent and rising 2.2 percent, respectively.

Intel (INTC) is the fifth cheapest company in the group, which Rasgon describes as an excellent example of a cheap but not necessarily appealing stock. Rasgon believes that while CEO Paul Gelsinger is not necessarily doing the wrong thing by investing billions in turnaround attempts, he's bearish on the stock overall.

"He's attempting to atone for ten years of sin," Rasgon explained. "These are not new problems; they have been developing for ten years. And it will take five to ten years to repair. He has shown a willingness to blow up the model to mend it."

Several of Rasgon's other recommendations, including Qualcomm (QCOM) and Broadcom (AVGO), as well as semiconductor manufacturing equipment companies Applied Materials (AMAT) and Lam Research (LRCX), also made the cut for our screen.

Nobody knows for certain when the chip shortage will end, but we know that several inexpensive stocks might gain from a protracted deficit in 2022.