The Nature of Core Liquidity Providers: Who Are They and What is Their Feature?

Jan 26, 2024

Any market, representing an integral multifaceted system of interconnected, smoothly working elements, is a place of continuous turnover of funds due to operations on purchasing or selling those or other investment instruments, the liquidity of which plays the most critical role.

In order to maintain a stable, market-compliant level of liquidity, core liquidity providers are used to ensure the continuous, in-volume, sufficient distribution of cash flows between markets and assets to balance the supply and demand necessary for efficient trading.

This article will reveal the concept of core liquidity provider (CLP) and tell you what their features, main functions, and known varieties are, as well as the advantages of working with them.

Key Takeaways

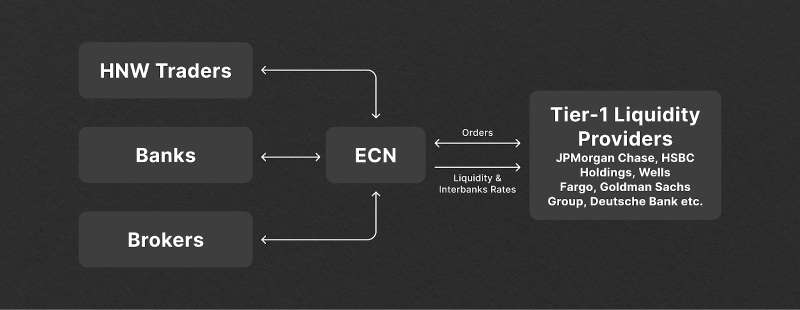

- Core liquidity providers comprise a group of large and well-known financial institutions with a large amount of capital that can be used to supply the exchange markets.

- Among such organizations are mainly large investment banks with large cash reserves. Other organizations include hedge organizations, non-banking firms, and electronic trading platforms.

- Core liquidity providers provide balancing of large orders, reduce the spread ratio, and help combat slippage.

What are Core Liquidity Providers?

When considering the concept of operation and essence of core liquidity providers, it is important to emphasize what the idea of core liquidity is and what it consists of.

In essence, core liquidity is a set of free cash and other financial assets that can be immediately liquidated or sold by a financial institution in order to meet the need to ensure stability and high performance of market operations to buy or sell investment instruments, which in turn provides the right balance between the levels of supply and demand, on which the effectiveness of the trading process as a whole depends.

In turn, core liquidity providers are large, often international, financial institutions whose activities are primarily related to the management of cash flows within the framework of work in a particular area of the financial sector.

In this case, these organizations provide a full range of services related to the provision of liquidity in financial markets, including Forex, crypto market, CFD, etc., among which are frequently highlighted consulting, technical support, risk management, money management, analytics, and statistics. Also, they can play the role of financial managers in individual cases.

Fast Fact

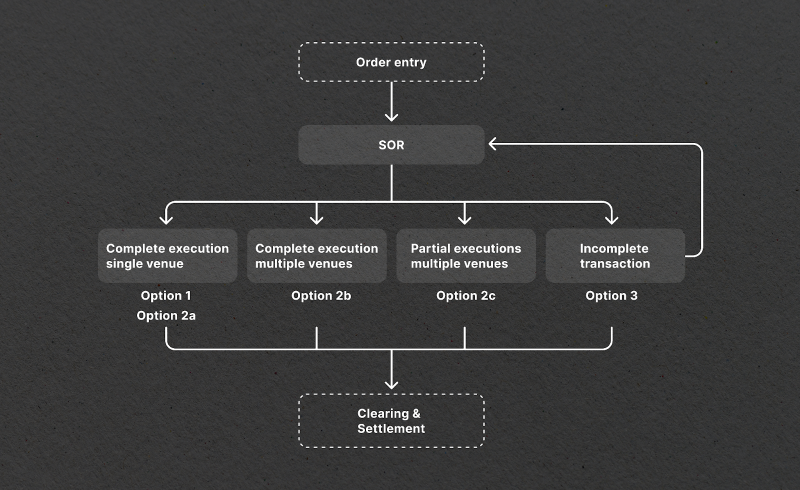

Core liquidity providers can work both on STP and ENC models, depending on the specifics and conditions of trading on a particular market.

Sorts of Core Liquidity Providers

Today, the development of the financial sector is in a dynamic phase characterized by a high concentration of various capital markets, the total money turnover of which is comparable to the budget of a single country. At the same time, there is a high demand for liquidity to meet the needs for efficient trading operations, particularly in the world’s largest trading market — Forex.

To meet the high demand for consistently high liquidity, specialized managers of large amounts of capital in the form of large international financial organizations and institutions step in, among which are the following:

Investment Banks

Investment banks are a group of large financial and investment institutions whose business scale exceeds the coverage in one country. Often, these are international financial units that have at their disposal large amounts of capital expressed in reserves of cash, precious metals, and other financial instruments that can be used for investment activities, hedging, and also to supply financial markets with the necessary amount of liquidity to maintain stability.

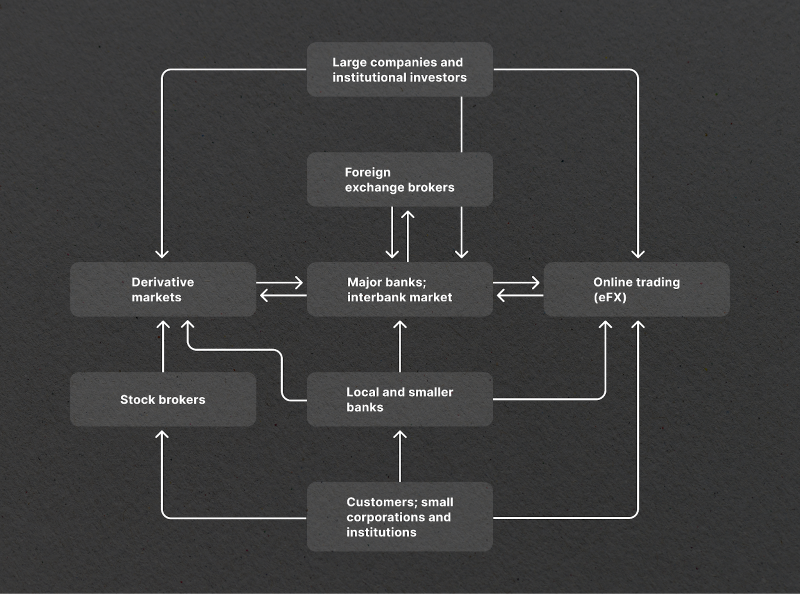

These organizations are among the Tier 1 sources of liquidity for various markets, and in particular for the FX market. And since the latter has the highest daily trading turnover of all, its stable operation is extremely important both to ensure a comfortable trading process and to ensure the stability of other markets, between which there is a certain connection.

Electronic Trading Platforms

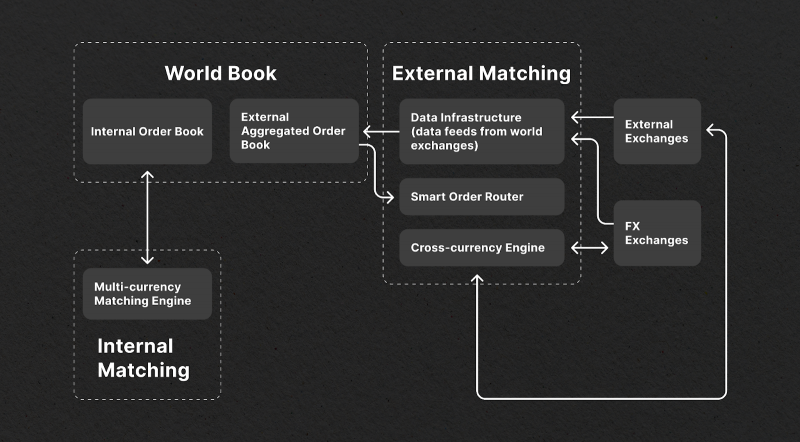

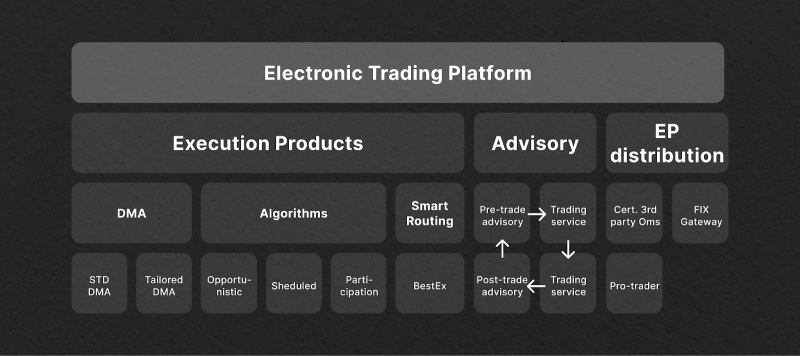

Electronic trading systems (platforms) are highly professional services offering liquidity to supply different types of markets. Today, such platforms operate on a new model for aggregating liquidity and distributing it between markets, called the World Book.

Having at their disposal the necessary technological stack to work with any number of liquidity pools, they create the necessary conditions for a smooth distribution of liquidity between different financial institutions (Forex brokerage houses) and thus maintain a balance between supply and demand, even in critical market situations, while reducing price gaps and delays in order execution.

At the same time, these services are not only focused on providing liquidity to the markets but also include a whole system of various analytical services, consulting, brokerage products, etc., which are related to trading on the capital markets. Therefore, these Forex liquidity providers are multifunctional solutions capable of covering a wide range of needs in the process of investment and trading activities.

Non-Bank Market Makers

Non-bank market makers are another type of CLP that provides liquidity to the market. These firms are not banks; they have large trading operations and can provide liquidity by buying or selling assets at any time.

Non-bank market makers are not subject to the same regulations as banks, but they are still subject to market conditions and can be affected by changes in market conditions. However, non-bank market makers can be more flexible than banks in terms of the assets they trade and the pricing they offer.

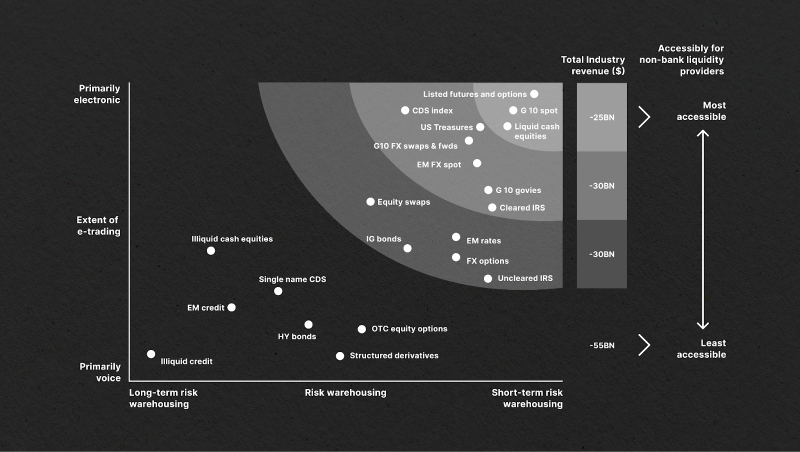

More and more trades are conducted on electronic platforms, which opens up new opportunities for new, tech-savvy players. According to Morgan Stanley and Oliver Wyman, non-bank liquidity providers — the new tech-savvy players — now account for 15 to 35% of volumes in spot FX and developed equity markets.

Central Banks

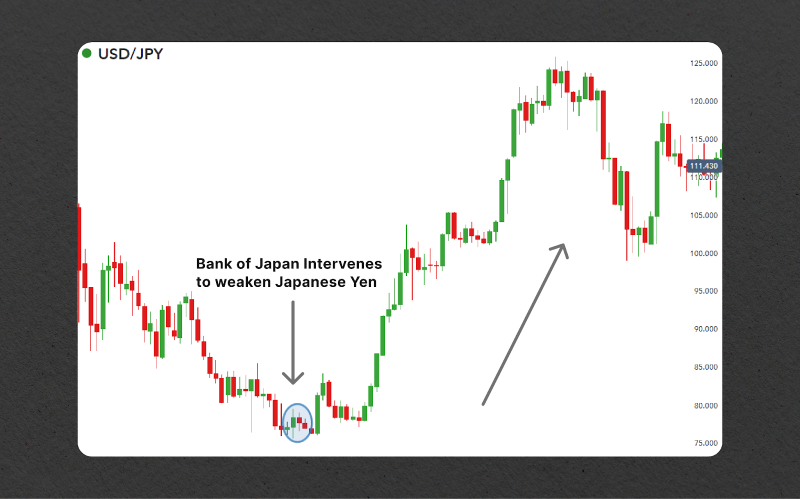

Central banks play an essential role in shaping global currency exchange rates because their policies include interests related to regulating the value of a currency. Thus, monetary policy decisions made by central banks can directly impact the formation of quotations in the trading process.

One of the key instruments at the disposal of central banks is interest rates. By adjusting interest rates, central banks can influence the cost of borrowing for individuals, businesses, and governments. When a central bank raises interest rates, it attracts foreign investors seeking higher investment returns.

This increased demand for a particular currency can lead to an undervaluation of other currencies in the market. On the other hand, when a central bank lowers interest rates, it can discourage foreign investors from purchasing activity, potentially leading to currency depreciation.

Central banks also influence currency exchange rates by intervening in the foreign exchange market. When a central bank believes its currency is overvalued or undervalued, it can intervene by buying or selling its own currency. In this way, the central bank can directly influence a currency’s supply and demand dynamics, which can affect its exchange rate.

Hedge Funds

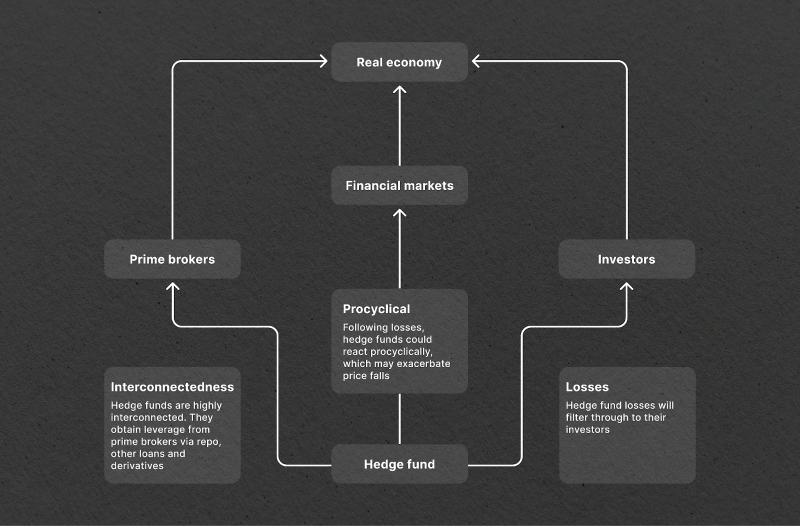

Hedge funds with a large amount of free capital monitor and maintain liquidity in the foreign exchange market, if necessary, helping the market itself and considering how much this contributes to their investment returns on the other side.

Hedge funds that invest globally and operate in the foreign exchange market monitor liquidity levels based on individualized investment styles and the type of assets they manage, where a stronger ability to monitor liquidity may be required by systematic futures hedge funds to protect against the risk underlying foreign assets.

High-Net-Worth Individuals

High-net-worth individuals (HNWIs) can also act as liquidity providers and provide markets with the necessary cash to stabilize trading conditions.

With substantial capital at their disposal, they can act as major players in the financial market without pursuing their own investment interests. At the same time, their participation in the formation of market liquidity is very limited since, as a rule, large exchanges and platforms receive liquidity from banking structures.

Core Liquidity Providers’ Principal Functions

Core liquidity providers are essential for creating the necessary conditions for a smooth trading process across all types of assets. They efficiently distribute cash flows between different markets while providing several distinctive strengths, as described below:

1. Balancing Large Orders

In market realities, one can often observe situations in which there is a liquidity grab phenomenon, which is characterized by a strong and sudden movement of the currency market caused by a surge of trading activity, which, as a rule, is accompanied by significant fluctuations in the prices of certain assets. Such surges occur as a result of an influx of buy or sell orders, which affects individual transactions and the stability of the financial market.

In this case, liquidity providers assist in providing conditions necessary for balancing supply and demand levels in order to prevent the emergence of critical situations caused by sharp price spikes of certain assets, which, as a rule, have dire consequences for some traders and positive ones for others.

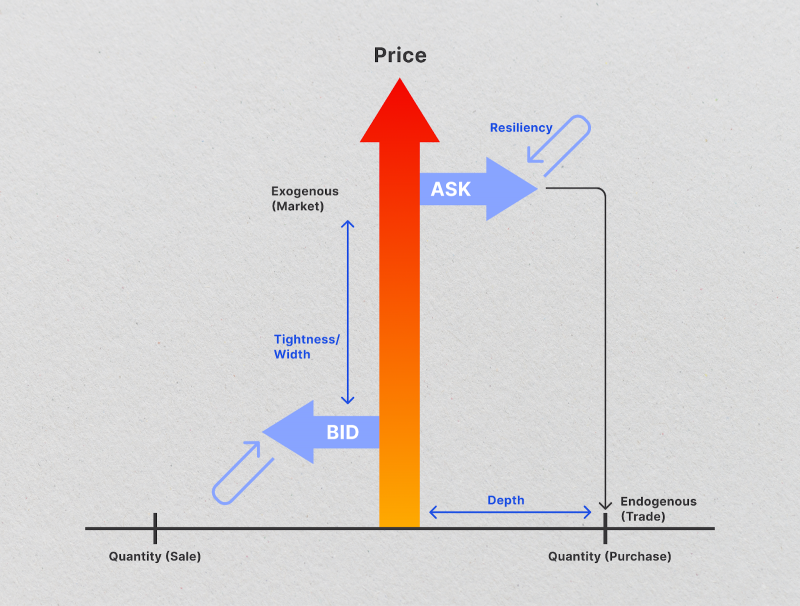

2. Diminishing Spreads

Spread is a very common problem that can be encountered when trading on financial markets. This phenomenon is characterized by the so-called price gap formed as a result of the low liquidity of a financial instrument. It becomes an obstacle in the attempt to trade effectively, reducing the probability of buying/selling assets at the desired price.

Liquidity providers solve this problem because the amount of money they supply is sufficient to meet the needs of any market and any financial asset. At the same time, they supply liquidity on an ongoing basis, not only when the market is in short supply, thus eliminating the possibility of a shortage of liquidity for trading a particular instrument.

3. Underwriting Initial Public Offerings

When a company decides to go public and list its shares on a stock exchange, it must go through an initial public offering (IPO) process. This involves selecting an underwriter, usually a large investment bank, to manage the entire process.

The underwriter plays a crucial role in the IPO process by purchasing the company’s stock directly from them and then reselling it in large batches to large financial institutions. These institutions, known as core liquidity providers, make the shares directly available to their clients.

Core liquidity providers are vital to the IPO process, as they ensure enough demand for the company’s shares. This helps to establish a market price for the shares and makes them more attractive to investors. In addition, core liquidity providers provide liquidity to the market, which helps to ensure that there are always buyers and sellers for the shares.

The Selling Points of Working With Core Liquidity Providers

Liquidity providers Forex are indispensable assistants in matters concerning the supply of vital liquidity in order to maintain a balance between the flows of demand from buyers and supply from sellers. Due to their numerous positive qualities, they are very popular not only among Forex brokers but also among other financial institutions from other spheres. Let’s have a closer look at these advantages below:

Deep Liquidity

Deep liquidity is a phenomenon characterized by high trading volumes within the framework of investment activity in a particular market, such as Forex. When the market is liquid enough, the trading process is characterized by fast execution of orders with minimal delays at a certain point in time.

In this case, liquidity is evenly distributed between assets, excluding the possibility of imbalance, when an asset instrument has liquidity in excess and another has a strong deficit.

Liquidity providers have all the necessary infrastructure to be able to support Forex, or any other market, with money flows sufficient to cover all needs regardless of the volume of transactions, thus providing a guarantee of stability and proper functioning of the trading process.

Competitive Spreads

Core liquidity providers are able to offer competitive spread sizes that arise during trading. This is achieved through efficient redistribution of liquidity between the necessary trading instruments, achieving a balance of supply and demand. At the same time, the spread does not depend on trading volumes and can remain at the same level all the time, without causing delays in placing orders on the market and their execution.

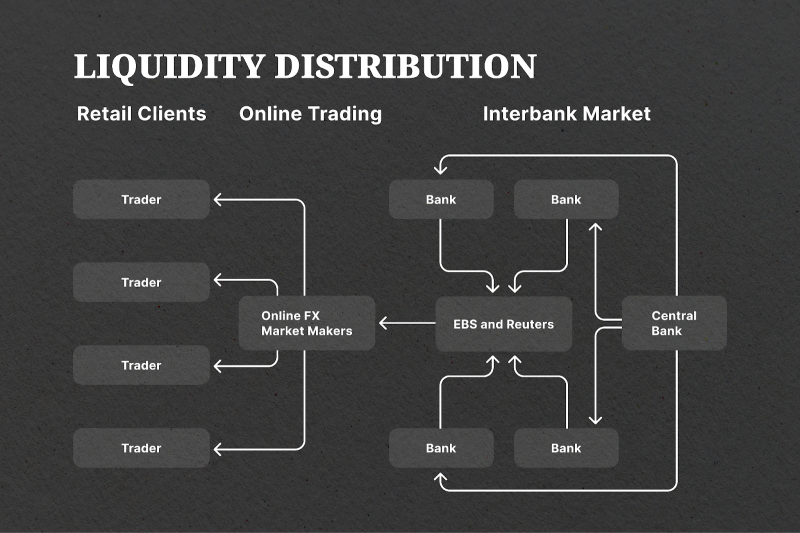

Interbank Market Access

Core liquidity providers possess access to the interbank market, which permits them to present more tightly-knit spreads than other market participants. The interbank market is a platform where banks and other financial institutions trade currencies. By accessing this market, core liquidity providers can access the best possible price for their clients.

This gives them a competitive advantage over other market participants who do not have access to the interbank market and must rely on other sources for their liquidity. Consequently, core liquidity providers can offer more favourable trading conditions for their clients, including tighter spreads and faster execution times.

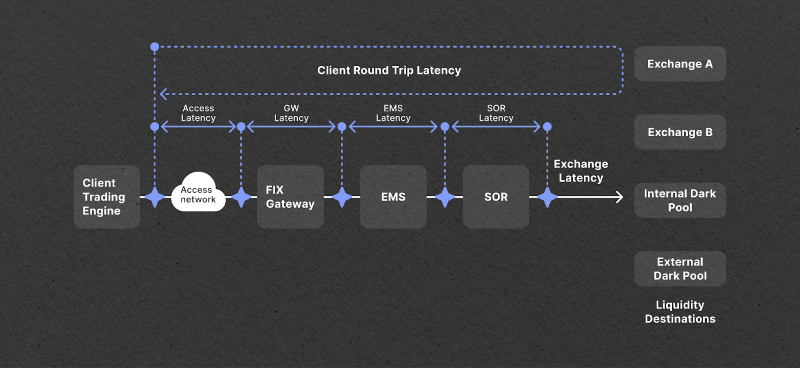

High-Speed Execution

Core liquidity providers FX offer traders faster execution times by utilizing advanced technology that provides a seamless trading experience with low latency and rapid order execution times. This feature is crucial in fast-moving markets, allowing traders to enter or exit the market quickly. In addition, faster execution times reduce the risk of slippage, which can occur when there is a delay in order execution.

By reducing the risk of slippage, traders can increase the likelihood of obtaining a favorable market price, thereby enhancing their overall trading performance. Core liquidity providers are valuable for traders seeking to optimize their trading activities and achieve better outcomes.

Managing Risk

When it comes to trading, managing risk is of utmost importance. That’s where core Forex liquidity providers come in — they offer a range of risk management tools to help traders mitigate their exposure to market volatility and currency risk. One such tool is the stop-loss order, which limits traders’ losses if the market moves against their position.

In addition, core liquidity providers also offer hedging tools, which can help traders manage their exposure to currency risk by offsetting potential losses with gains in other currency pairs. These risk management tools are crucial for traders looking to navigate the market confidently and minimize potential losses.

Conclusion

Core liquidity providers continue to fulfill an important mission on the exchange markets, providing all necessary conditions for trading financial instruments quickly, efficiently, and safely, excluding the possibility of negative market phenomena, among which high spread and slippage are the main problems, the solution to which is provided by their smooth operation.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQ

Who are core liquidity providers?

This is the name of large financial and investment institutions that have a large amount of money at their disposal, part of which is used to meet the market’s needs for a stable and uninterrupted trading process.

Why cooperate with core liquidity providers?

The use of core liquidity providers provides a guarantee of stability of supply and demand levels while ensuring the preservation of trade volumes on the part of both buyers and sellers.

How do core liquidity providers ensure high liquidity?

With a large capital base, these organizations are able to efficiently deliver, manage, and distribute cash flows between liquidity pools and, with high accuracy, identify assets where liquidity is impaired or deficient.

What functions do core liquidity providers perform?

First of all, core liquidity providers stabilize the market trading process by eliminating wide spreads and slippages, as well as the possibility of such phenomena as liquidity grab.

How do core liquidity providers differ from other types of providers?

The main distinguishing feature of core liquidity providers is the availability of large reserves of free cash used for distribution as a source of liquidity for different financial sector entities in order to meet their needs.