How Do You Measure Liquidity in Forex?

Jul 31, 2024

Liquidity is a prevalent qualitative evaluation of market parameters in terms of trading activity in a specialized trading asset. Considering the rapidity with which they can be purchased or sold, liquidity is a metric gauged to establish the survivability of the market, and a number of indicators are used for this purpose.

This article will explain Forex liquidity, why it is essential, and what tools are used to assess it.

Key Takeaways

- Liquidity metrics are a group of analytical and statistical variables calculated on the basis of supply and demand indicators, but taking into account different evaluation criteria.

- Spread level is the most accurate metric for determining the volume of FX liquidity, all other market characteristics being equal.

What is Liquidity in the FX Market?

Liquidity in the FX market revolves around the seamless purchasing and selling of currency pairs without triggering notable shifts in their exchange rates. It reflects the degree of conviviality with which market players can get involved in transactions involving the currency pair so as to avoid engendering substantial harm to its value. When a currency pair exhibits strong liquidity, it points to a robust market with ample buyers and sellers, facilitating efficient trade execution and maintaining stability in the exchange rate.

Examining the liquidity of the FX market is imperative for investors and traders alike. Determining the market’s liquidity rate can help determine the simplicity of purchasing and selling currencies without drastically hampering their prices. Liquidity analysis is also able to yield a glimpse into market depth, volatility, and overall stability, allowing market players to make more precise choices.

Moreover, liquidity measurements are not just for risk management; they are also a tool for profit. By tracking liquidity rates, traders are able to figure out market imbalances and opportunities for profit. This value of liquidity evaluation makes it a valuable tool for both retail traders and large-cap investors in the Forex market, instilling a sense of optimism and motivation.

Fast Fact

The calculation of liquidity levels is part of some trading tactics used to track market cycles and patterns.

Principal Determinants of Liquidity

In the practice of liquidity level estimation, a number of indicators are used, which, due to their informativeness, show the exact and absolute value of liquidity level both on the buying and selling sides. Each of these variables gives a complete picture of the state of market sentiment on any of the existing trading instruments. The main indicators reflecting the level of FX liquidity consist of the following:

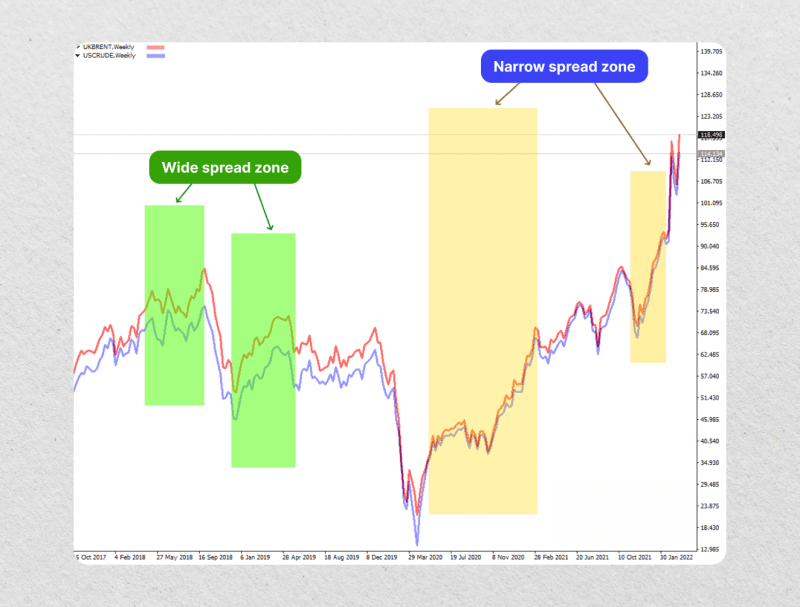

Spread

Spread is a crucial indication of liquidity in capital markets. It works as a fundamental indicator that reflects the discrepancies between the highest price a buyer is keen to receive and the lowest price a seller is eager to accept for a given tool or security. This spread conveys profound information about the swiftness with which an instrument can be bought or sold, indicating the quantity of liquidity in the market.

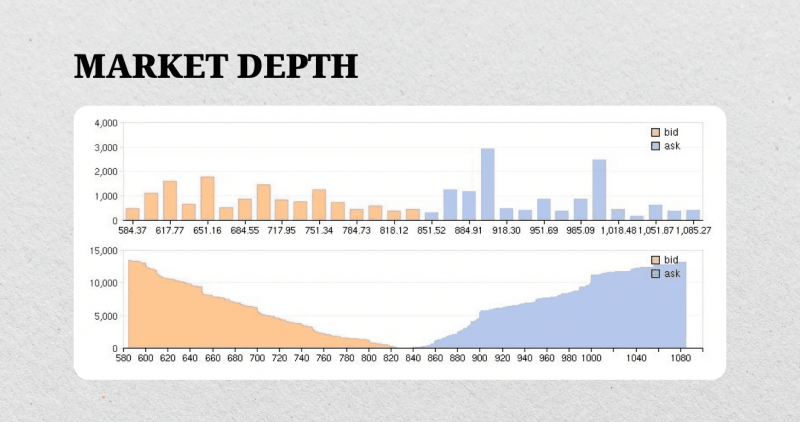

Market Depth

The liquidity in the FX market can be assessed through the market depth indicator. This indicator grants accurate data into the depth of the market, countenancing traders to gauge the availability of buy and sell orders at distinctive price levels.

By examining the order book and calculating its depth, traders can make data-driven choices about the liquidity of a selected currency pair, which can dramatically alter their trading practices. Comprehending the market depth indicator is of paramount importance for FX traders, as it helps them analyze the wide-ranging market landscape and price swings.

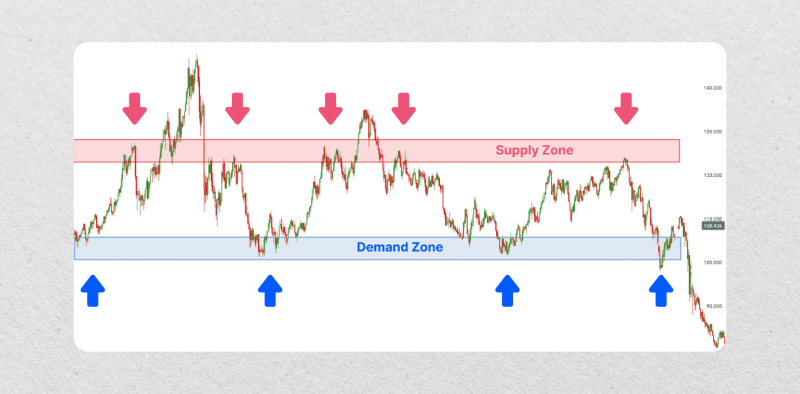

Price Action

Examining historical market tendencies and price oscillations is essential for grasping the FX market liquidity nature and its fluctuation trends. Liquid markets typically exhibit more stable price movements owing to various factors and occurrences.

Conversely, an illiquid market is susceptible to abrupt price spikes and drops in reaction to market shifts. This disparity in price behavior stems from varying levels of supply of the underlying assets.

Volume Analysis

Analyzing trading volume is an essential aspect of quantifying liquidity in the market, as it reveals key trends in market growth and price fluctuating strength. Despite the decentralized nature of the FX market, where there is no central exchange for volume data, traders rely on different techniques and indicators to gauge and interpret volume levels.

Volume analysis fulfills a pivotal role in helping traders make well-informed choices and identify promising trading prospects. By understanding volume oscillations and variations, traders can better appraise market forces and anticipate future price moves. While absolute volume data may not be readily available in the Forex market, various analytical tools and methods allow traders to analyze and interpret volume data effectively for strategic trading purposes.

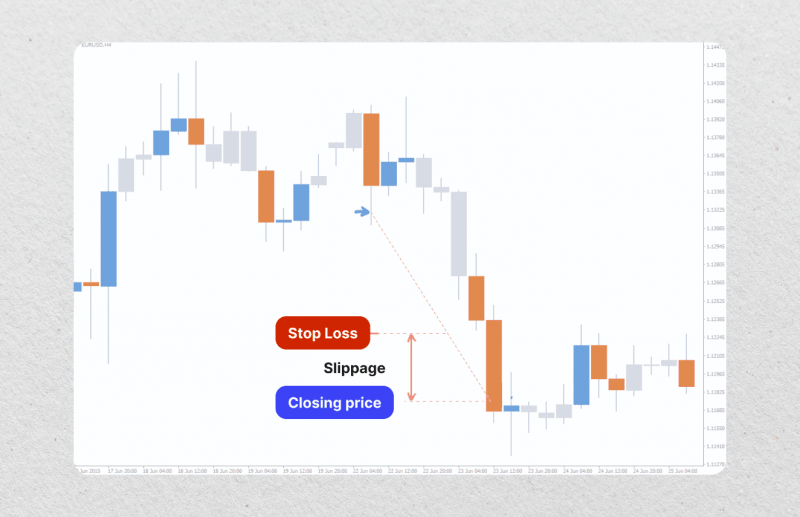

Price Slippage

The price slippage indicator measures the divergence between a trade’s expected or “requested” price and the momentary price at which the trade is executed. This price gap is known as the “slippage” and is an imperative metric for assessing a currency pair’s liquidity.

To analyze the price slippage indicator, traders and analysts typically consider factors such as the size of the trade order, the current market conditions, and the currency pair’s fluctuation in value. By incorporating the price slippage indicator into their full liquidity assessment, FX market players can make more effective trading decisions and optimize their trading approaches for the prevailing market scenarios.

Liquidity Ratios

Ratios related to liquidity in trading offer an effective means of evaluating a business’s liquidity by examining a range of figures and data that convey diverse perspectives on liquidity, profitability, and other matters. Liquidity is often assessed using turnover ratios, such as current, quick, and cash ratios, which are widely recognized and utilized in this context.

Final Thoughts

Forex traders can use several vital methods and metrics to evaluate and estimate liquidity in the FX market. By applying and exploiting these tools, traders can acquire invaluable glimpses into the market’s ability to absorb buy and sell positions efficiently.By utilizing these various measures and techniques, forex traders can develop a fundamental recognition of the market’s actual liquidity state. This knowledge can then be leveraged to make deliberate trading actions, manage liquidity-related risks, and optimize trading practices for the current market “climate.”

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.