Crypto Investing vs. Crypto Trading: What’s The Difference?

Apr 27, 2023

You’ve probably heard the captivating stories of ordinary folks who struck digital gold and turned into millionaires overnight. It’s true; the crypto market can be a goldmine for those who know how to play their cards right. But it’s also a rollercoaster ride, with many ups and downs and a fair amount of risk involved.

Now, when it comes to participating in the crypto world, people often consider two main approaches: crypto trading and crypto investing. While many assume these terms are interchangeable, there’s actually a significant difference between the two.

So, let’s break down the differences and determine which one might best fit you.

Key Takeaways

- Trading involves speculating on short-term price movements to generate quick profits, whereas investing focuses on long-term growth potential.

- Investing is a more long-term approach that requires patience and belief in the future appreciation of a cryptocurrency’s value over time.

- The key differences between investing and trading lie in their time frames, risk profiles, analysis methods, and trade frequency.

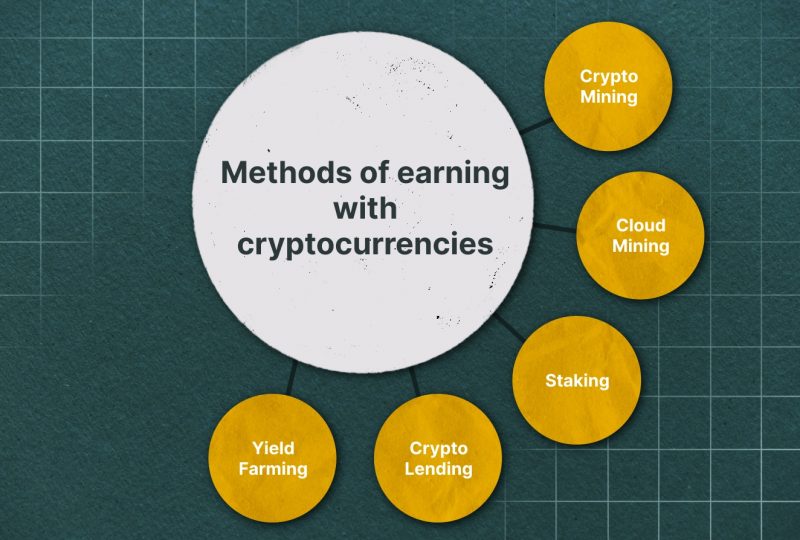

- Less risky alternatives to make money with crypto include mining, cloud mining, staking, and lending on DeFi platforms or P2P lending platforms.

What Is Crypto Investing?

Cryptocurrency investing, sometimes called “HODLing” (a twist on the words “hold” and “hold on for dear life”), is a more long-term approach compared to crypto trading. Instead of focusing on short-term market ups and downs, investors who choose this path pay more attention to the core qualities of the crypto assets they buy.

There are a few popular strategies that crypto investors use to navigate the market. Let’s take a closer look at them.

- Value Investing

Value investors always look for undervalued cryptocurrencies with solid fundamentals and potential. They buy these assets when they’re low-priced, hoping their value will increase.

- Growth Investing

This approach focuses on investing in newer crypto assets that have the potential to grow massively in the future. Growth investors are willing to take on more risk to see big returns on their investments.

- Dollar-Cost Averaging

With this strategy, investors buy small amounts of cryptocurrency at regular intervals, no matter what the market is doing. By spreading out their purchases, they hope to average the prices over time and reduce the impact of market volatility on their overall investment.

- Index Fund Investing

Similar to exchange-traded funds (ETFs) and mutual funds, cryptocurrency index funds allow investors to invest in diverse digital currencies. These funds hold a mix of different assets, which can help spread out risk and provide more stable returns.

- Market Cap – Weighted Portfolio

In this approach, you periodically adjust your portfolio holdings. You sell cryptocurrencies that have increased in value while buying those that have underperformed at lower prices. By implementing this strategy, you can avoid over-concentration in a single digital currency and potentially enhance your portfolio’s growth in the long run.

What Are The Benefits Of Crypto Investing?

One of the most significant benefits of cryptocurrency investing is the potential for your investment to grow over time. While prices and market sentiment may fluctuate, historical data shows that the crypto market has experienced rapid expansion in the past decade. As a result, long-term investors can profit from this growth.

Another advantage of investing in cryptocurrencies is that they can hedge against inflation. Unlike fiat currencies, which can be affected by changes in market sentiment, cryptocurrency prices tend to be more resistant to such fluctuations. This makes them an attractive option for diversifying their investment portfolio and protecting their assets from inflation.

Moreover, cryptocurrency investing typically involves lower risks than trading, as it focuses on a longer-term commitment to the market. By taking a more patient and strategic approach, investors can reduce their exposure to the short-term volatility that traders often face.

What Is Crypto Trading?

Like other financial assets, cryptocurrency trading revolves around anticipating future price appreciation and making predictions of digital currencies.

The key to trading crypto is “timing the market,” which means buying and selling assets based on educated guesses about the best entry and exit points. Traders closely monitor market news and technical analysis indicators to guide their decision-making. Here are some popular strategies when trading crypto.

- Arbitrage

This strategy capitalizes on price differences across various exchanges for the same asset. Traders quickly buy and sell assets between exchanges, exploiting minor price discrepancies to make fast profits.

- Day Trading

Day traders always look for intraday price changes to make daily profits. They close their trades before the end of the day, with each trade lasting anywhere from a few minutes to several hours.

- Swing Trading

Swing traders take advantage of the rapid price swings of cryptocurrencies. Trades typically last between one day and a couple of weeks. These swing traders rely on technical analysis to identify significant directional movements in cryptocurrency prices within this short time frame.

- Momentum Trading

Momentum traders make decisions driven by the power of recent price movements. They capitalize on price trends, aiming to “surf the wave” by purchasing at a low point during an upward trend and selling when the price loses momentum (and the opposite for downtrends). They aim to benefit from sustained asset price swings, anticipating the trend to continue.

- Position Trading

This form of trading leans more towards investment and shares similarities with swing trading. Position traders study long-term trends and patterns, with trades usually lasting several months to a couple of years.

- Scalping

Scalping is all about making multiple trades within a short period to capture small price movements. As the most active participants in the market, scalpers make quick trades with brief holding times — sometimes lasting just minutes or seconds — to “skim” a profit without taking on too much risk.

What Are The Benefits of Crypto Trading?

One of the primary advantages of cryptocurrency trading is the opportunity to make fast profits by capitalizing on short-term price movements and market trends. Many traders see assets like Bitcoin (BTC) as a secure store of value since cryptocurrencies were designed to function independently of centralized institutions.

Another benefit of trading crypto is the ability to conduct peer-to-peer transactions, often with much lower fees than those involving banks and other financial institutions. This decentralized nature of cryptocurrencies eliminates the need for intermediaries, reducing traders’ costs.

Moreover, cryptocurrencies are generally accessible to anyone worldwide, as long as they have an internet connection and a mobile device or computer. This universal access means that anyone can create a cryptocurrency wallet and start trading, opening the market to a diverse range of participants.

Differences Between Cryptocurrency Investing And Trading

Understanding the differences between cryptocurrency investing and trading is crucial when deciding which strategy best suits your preferences and objectives. Here, we’ll outline the distinctions between these approaches to help you find the suitable option.

- Profit Potential

Investors mainly profit from price increases, with gains calculated as the difference between the selling and buying prices minus the cost of investment (e.g., trading fees). Additionally, they can benefit from airdrops, staking, and yield farming, typically unavailable to traders due to their short holding periods.

Meanwhile, when trading crypto, you profit from market fluctuations and leverage their trades to amplify profits with minimal initial capital. However, leverage also increases risk. Traders can profit in a bull or bear market, while investors may have to wait out the bear market.

- Risk

Investors tend to have a lower risk tolerance, focusing on long-term price growth and being less concerned with daily price fluctuations. In contrast, traders are risk-takers with a good understanding of market volatility. They study indicators and signals to make trades that capitalize on short-term price swings. Traders can also engage in margin trading, which involves borrowing funds to trade, increasing both potential profits and risks.

- Investment Time Frame and Period

Cryptocurrency investing typically involves a long-term outlook, with investors focusing on their chosen cryptocurrencies’ future potential and price appreciation. They ignore short-term price fluctuations and hold their assets for extended periods, sometimes years.

On the other hand, cryptocurrency trading is a short-term strategy that capitalizes on the extreme volatility of digital currencies. Traders speculate on price movements within various time frames, from seconds to weeks, and can make significant profits due to the high volatility of cryptocurrencies.

- Type of Analysis

Cryptocurrency investors generally perform fundamental analysis, assessing the long-term value of a digital currency based on its underlying technology, adoption rate, and potential use cases. This is different from traditional stock analysis, as no financial statements are available.

Traders, however, rely heavily on technical analysis to predict future price trends and market positioning. They use historical data, technical indicators, and charting tools to make informed decisions and profit from price volatility.

- Trade Frequency

Investors typically have a low trading frequency, holding their assets for extended periods without selling. They are less affected by short-term market volatility and aim to accumulate wealth over time.

Traders, conversely, execute trades more frequently to take advantage of market movements and potentially make substantial gains. This approach is riskier and requires continuous market monitoring and incurring higher costs due to the number and frequency of trades.

Other Ways To Earn With Crypto

Earning from cryptocurrencies goes beyond just investing and trading, and these alternatives are usually less risky as you do not need to purchase or sell these digital assets actively.

- Crypto Mining

Mining is a process that secures blockchains using a proof of work (PoW) mechanism. Miners solve intricate mathematical problems to validate transactions for inclusion in the blockchain’s public ledger. Although mining demands expertise and substantial investments in specialized equipment, miners are compensated with newly minted coins.

- Cloud Mining

This approach utilizes cloud computing power to mine cryptocurrencies, eliminating the need for personal hardware and software installation. Companies providing cloud mining services enable you to create an account and mine remotely for a fee. By purchasing a specific amount of hash power and participating in a mining pool, you can earn a share of the profits proportional to the hash power you’ve acquired.

- Staking

Generating income through staking involves using digital assets to support the security of a cryptocurrency network. This method requires holding cryptocurrency in a wallet for proof of stake (PoS) networks and receiving rewards as an active node within the network (in return for using their coins).

- Crypto Lending

Investors can earn interest by lending their cryptocurrencies to other users via lending platforms. Cryptocurrency lending is facilitated through decentralized finance (DeFi) applications, peer-to-peer (P2P) lending platforms, and crypto exchanges. These loans are typically overcollateralized, which enhances the security of investors’ assets.

- Yield Farming

During yield farming, investors provide liquidity to DeFi platforms and receive rewards through tokens or fees. This strategy allows investors to generate passive income by capitalizing on their crypto holdings.

Some investors often participate in airdrops, where projects distribute free tokens to holders of a specific cryptocurrency. Airdrops can be a lucrative way to accumulate more tokens and potentially profit from their future growth.

As the crypto ecosystem expands, more opportunities for individuals to profit from digital assets innovatively will emerge.

Wrapping Up

A significant number of traders and investors, potentially around 95%, lose money in cryptocurrency and traditional stock or forex markets. However, a select few manage to achieve success and generate substantial profits.

What makes investing and trading so challenging? For one, it’s a highly competitive landscape filled with experienced participants waiting for others to misstep, allowing them to seize profits. Additionally, these markets’ inherent volatility and unpredictability add to the difficulty in consistently making gains.

Nevertheless, it’s crucial to remember that many more individuals experience losses, and one mistake can erase the profits accumulated from months of successful trades or investments. Therefore, proceed cautiously, educate yourself, and have a well-thought-out strategy to maximize your chances of success in trading and investing.