Top AI Companies to Invest in April 2025

Feb 26, 2025

Artificial Intelligence (AI) has become one of the most transformative industries, revolutionizing technology, healthcare, finance, and cloud computing. With AI stocks consistently outperforming the market, investors are looking for the best AI companies to invest in. As AI adoption accelerates, it is crucial to identify the top AI stocks with strong financial growth, innovation, and long-term potential.

This article is designed to make you understand what the AI sector is today and the key trends. You will also learn what investors should consider when investing in AI stocks and which are the most promising in the short term.

Key Takeaways

- AI stocks are rapidly growing, with NVIDIA, Microsoft, Meta, and Amazon leading in AI innovation, automation, and cloud computing.

- AI is transforming healthcare, finance, cybersecurity, and semiconductor technology, offering multiple investment avenues for long-term gains.

- Investors should track AI regulations, ethical AI practices, and compliance policies, which can affect AI stock volatility and growth potential.

Overview of the AI Industry’s Rapid Growth

The Artificial Intelligence (AI) industry has experienced explosive growth over the past decade, evolving from a niche research field into a multi-billion-dollar global market. AI’s expansion is driven by the convergence of massive computational power, big data, and breakthroughs in machine learning (ML) and deep learning.

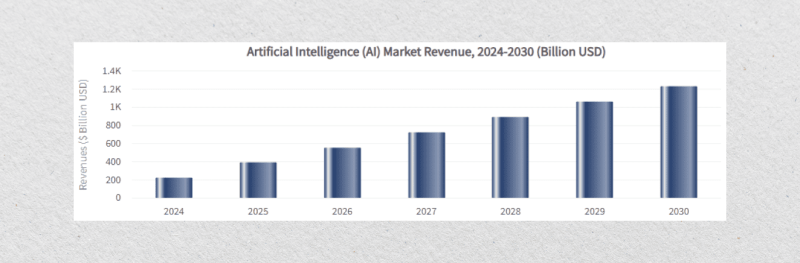

According to market research firms, the AI industry, valued at around $250 billion in 2023, is projected to exceed $1 trillion by 2030, reflecting a compound annual growth rate (CAGR) of over 35%. This acceleration is fuelled by increasing investments from private and public sectors as businesses across industries integrate AI to optimize operations, automate processes, and enhance customer engagement.

As AI adoption reaches new heights, ethical considerations and regulatory frameworks are emerging to ensure responsible AI deployment. Governments worldwide are crafting AI policies to address bias, privacy concerns, and data security, which could shape the industry’s trajectory in the coming years.

Despite challenges, AI’s rapid growth trajectory indicates that it will remain one of the most disruptive and profitable industries in the next decade, offering investors lucrative opportunities in AI-driven innovation.

Fast Fact

By 2030, AI is expected to contribute over $15.7 trillion to the global economy, making it one of the fastest-growing and most influential industries worldwide.

Key Trends Driving AI Stock Performance in 2025

AI stocks have consistently outperformed the market over the past few years, and in 2025, several key trends are fuelling their continued rise. From generative AI advancements to AI-powered automation and semiconductor breakthroughs, these trends shape investor confidence and influence market valuations.

Here are the key trends influencing the performance of AI stocks in 2025:

Generative AI Expansion

The rapid evolution of generative AI continues to be a significant catalyst for AI stock performance in 2025. Models like OpenAI’s GPT-4, Google’s Gemini, and Meta’s LLaMA are reshaping industries, from content creation to software development and personalized marketing.

Companies at the forefront of generative AI, such as OpenAI (backed by Microsoft), Alphabet (Google), Adobe, and NVIDIA, are experiencing strong revenue growth as enterprises integrate AI-powered solutions into their operations. NVIDIA, in particular, benefits from the demand for high-performance GPUs, which are essential for training and deploying these models.

The increasing commercialization of generative AI — through AI-powered assistants, automated coding tools, and creative applications — ensures continued stock market expansion for key players.

AI-Powered Automation and Productivity Gains

AI-driven automation revolutionizes business operations, helping companies reduce costs, optimize workflows, and increase efficiency. AI-powered solutions are now widely used in customer service, supply chain management, cybersecurity, and manufacturing.

Major corporations such as UiPath, IBM (Watson AI), ServiceNow, and Amazon (AWS AI) are leading the development of robotic process automation (RPA) and AI-driven enterprise solutions.

The widespread adoption of AI automation is expected to drive significant earnings growth for companies specializing in AI-powered productivity tools, making them attractive investment opportunities.

Ai-Optimized Cloud Computing and Infrastructure Growth

The demand for AI-powered cloud computing services has surged, leading to significant investments in AI infrastructure. Cloud providers such as Microsoft (Azure AI), Amazon (AWS AI), and Google Cloud AI are expanding their AI and machine learning capabilities, catering to the growing needs of enterprises that rely on AI for data analytics, automation, and cybersecurity. Companies like Snowflake and Databricks are also gaining traction, offering AI-driven big data analytics platforms.

The AI-powered cloud computing industry is poised for double-digit revenue growth, making it one of the most promising sectors for investors looking to capitalize on AI infrastructure expansion.

AI Chipmakers and Semiconductor Boom

AI’s reliance on high-performance computing (HPC) has fueled unprecedented demand for AI-optimized semiconductors. Companies like NVIDIA, AMD, Intel, and TSMC are at the forefront of this trend, producing AI-specific GPUs, TPUs, and accelerators essential for running complex AI models. The exponential growth of AI applications — from generative AI to autonomous systems — has led to record-breaking orders for AI chips.

As enterprises and data centers continue to scale AI workloads, semiconductor companies remain some of the best-performing AI stocks, offering long-term growth potential for investors.

AI in Healthcare and Drug Discovery

AI is driving groundbreaking advancements in healthcare, accelerating drug discovery, improving diagnostics, and enabling personalized medicine.

Companies like Moderna, Exscientia, DeepMind (Google-owned), and Illumina are leveraging AI to revolutionize biotech and genomics. AI-powered drug development has significantly reduced research timelines and costs, making AI-driven healthcare stocks attractive investment opportunities.

The integration of machine learning into healthcare is disrupting traditional biotech models and positioning AI-powered firms as leaders in the future of medicine.

AI Regulation and Ethical AI Investments

With the rise of AI, governments worldwide are increasing regulatory oversight to address data privacy, bias, and ethical concerns. Companies prioritizing compliance and responsible AI development — such as IBM, Microsoft, and Palantir — are gaining investor confidence.

Ethical AI practices are becoming a key differentiator in the industry, as regulatory scrutiny can lead to stock volatility for firms failing to meet evolving AI governance standards.

Investors favor AI companies that align with transparent and ethical AI principles, as they are more likely to sustain long-term growth.

AI Cybersecurity and Threat Detection

As cyber threats become more sophisticated, AI-driven cybersecurity solutions are increasingly in demand. Companies like CrowdStrike, Palo Alto Networks, Darktrace, and SentinelOne leverage machine learning to detect and prevent real-time cyberattacks.

The rise in cybercrime has led to record-high enterprise spending on AI-powered security solutions, making AI cybersecurity firms a top investment sector in 2025. Thus, as businesses and governments prioritize digital security, AI-driven threat detection remains a crucial growth area for the AI industry.

Key Considerations for Investors in AI Stocks

Investing in AI stocks offers significant potential but requires careful analysis of financials, market trends, risks, and regulatory landscapes. As AI reshapes industries, investors must evaluate companies based on their competitive advantage, revenue growth, and long-term sustainability.

Market Position and Competitive Advantage

The AI sector is evolving rapidly, and companies with strong market leadership and a competitive edge are more likely to thrive. Firms like NVIDIA, Microsoft, and Alphabet have positioned themselves as leaders, investing heavily in research and development to stay ahead. A company’s proprietary technology, advanced AI models, and unique algorithms are crucial in maintaining a competitive advantage.

For instance, NVIDIA’s dominance in AI GPUs has solidified its role in high-performance computing, while OpenAI, backed by Microsoft, has led innovations in generative AI with ChatGPT.

Additionally, the size and diversity of a company’s customer base provide insights into its market strength, as businesses that secure enterprise-level AI contracts across multiple industries tend to have higher growth potential and revenue stability.

Financial Health and Revenue Growth

AI investments are capital-intensive, so investors must analyze a company’s financial stability and profitability before making a decision. Firms with consistent revenue growth and strong cash flow indicate high AI adoption and sustainable operations.

For example, Microsoft reported a 15% year-over-year increase in revenue in Q4 2024, driven by AI services in its Azure cloud division. Companies with high debt levels, on the other hand, may struggle to fund continued AI research and expansion.

Understanding a company’s R&D spending is another crucial factor, as higher investments in AI research typically indicate a long-term commitment to growth.

Regulatory and Ethical Considerations

As AI becomes more powerful, it is increasingly subject to government regulations addressing concerns like data privacy, algorithmic bias, and ethical AI practices.

Companies that align with AI governance frameworks, such as the EU AI Act or upcoming U.S. AI regulations, are more likely to avoid legal challenges and reputational damage. Tech giants such as IBM and Microsoft have emphasized responsible AI development, ensuring transparency in AI decision-making.

Investors should pay close attention to companies involved in AI-powered surveillance, facial recognition, or deepfake technologies, as these areas may face increased legal scrutiny and potential bans.

Industry Trends and AI Growth Areas

The vast AI sector is a profitable segment, and investors should diversify their portfolios by focusing on high-growth AI applications. AI-powered cloud computing remains another profitable segment, with Amazon (AWS AI), Microsoft Azure, and Google Cloud leading enterprise AI adoption. The demand for AI chips and hardware is also increasing, making NVIDIA, AMD, Intel, and TSMC strong investment options.

Meanwhile, AI-driven healthcare companies like Moderna, Exscientia, and Illumina are pioneering drug discovery and genomics breakthroughs, indicating another lucrative sector. Investors should also watch for AI’s role in autonomous vehicles, cybersecurity, and financial services, where machine learning models are being integrated at scale.

Market Volatility and Risk Management

Given the rapid pace of technological change, market hype, and evolving competition, AI stocks can be highly volatile. The AI industry follows boom-and-bust cycles, similar to past trends in cloud computing and the early days of the internet.

Many AI stocks currently hold high valuations, meaning investors should carefully analyze Price-to-Earnings (P/E) ratios and forward guidance to avoid overpaying. Additionally, new startups may disrupt established players as AI advances, creating uncertainty for long-term dominance.

Different companies have experienced sharp price swings based on AI chip demand and supply chain constraints, highlighting the importance of tracking market dynamics and geopolitical risks.

Mergers, Acquisitions and Strategic Partnerships

The AI industry is evolving through consolidation and strategic alliances as companies acquire startups or form partnerships to strengthen their AI capabilities. Microsoft’s acquisition of Nuance boosted its AI-driven healthcare offerings, while NVIDIA has collaborated with multiple cloud providers to expand its AI chip adoption.

Google, Meta, and Amazon are also heavily investing in AI research labs, ensuring continued advancements in AI technology. In this, investors should track mergers and acquisitions (M&A) activity, as companies that strategically expand their AI portfolios through acquisitions tend to outperform their competitors.

Long-Term AI Demand and Adoption

The long-term adoption of AI is one of the most critical factors in assessing AI stocks. Enterprise AI adoption is growing as businesses leverage AI to reduce costs, enhance automation, and optimize decision-making.

Consumer AI applications, including AI-powered virtual assistants, smart devices, and autonomous vehicles, are expanding rapidly, driving sustained demand.

Besides, governments heavily invest in AI for defense, infrastructure, and national security, with companies like Palantir securing long-term government contracts.

Top AI Companies to Invest in March 2025

As of today, the artificial intelligence sector presents compelling investment opportunities. Building upon our previous discussions, here are additional top AI companies, detailed information, and recent financial data to consider.

Here are the top 5 companies working with distinct AI technologies that are to be considered for investment as of March 2025:

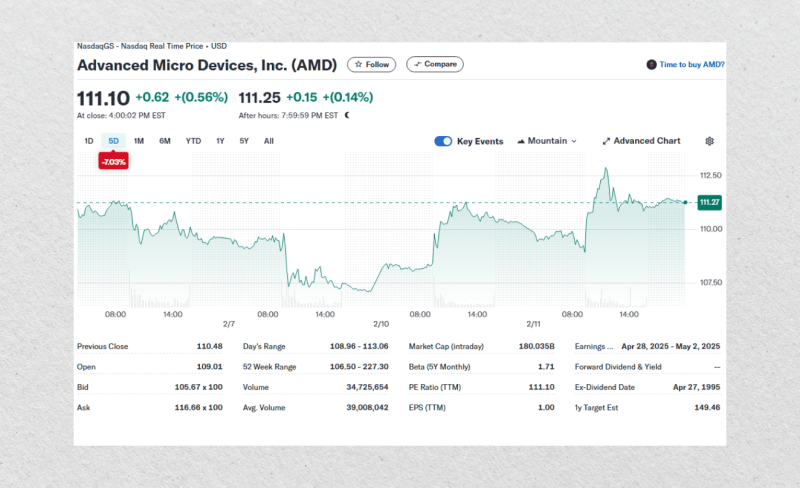

Advanced Micro Devices, Inc. (AMD)

AMD has established itself as a dominant force in AI hardware, producing high-performance GPUs and processors essential for AI model training and cloud computing. With the increasing demand for AI acceleration in data centers, AMD continues to expand its market presence. The company’s latest MI300X AI chip is expected to challenge NVIDIA’s dominance in the AI hardware space.

In the fiscal year 2024, AMD reported strong revenue growth driven by AI-driven computing needs, although its stock recently experienced a 0.56% decline, trading at $132.80. Despite the dip, the company’s AI-focused product line positions it as a long-term growth stock.

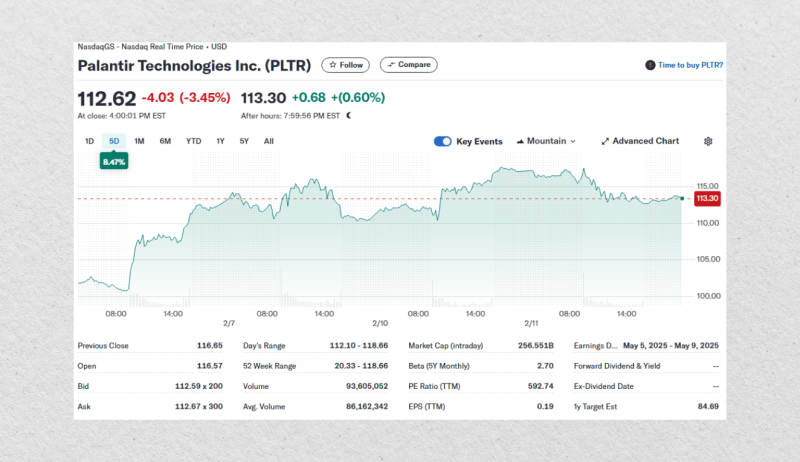

Palantir Technologies Inc. (PLTR)

A leader in AI-driven big data analytics, Palantir has cemented its position as a crucial player in government and commercial intelligence solutions. The company’s AI-powered Gotham and Foundry platforms help businesses and agencies leverage machine learning for data-driven decision-making.

Palantir’s revenue for Q4 2024 reached $1.5 billion, marking a 25% year-over-year increase, indicating continued enterprise adoption of its AI analytics capabilities.

Currently, the stock is trading at $411.44, with a minor 0.18% decline. The company’s strong government contracts and expanding AI capabilities suggest long-term stability and growth potential.

Taiwan Semiconductor Manufacturing Company (TSM)

As the world’s largest contract chipmaker, TSM remains a pivotal player in chip manufacturing. The company produces advanced 5nm and 3nm AI chips for tech giants like Apple, NVIDIA, and AMD, fuelling the exponential growth of AI applications.

AI chip production has significantly contributed to TSM’s 20% revenue growth in 2024, driven by increasing demand for AI-optimised processors. Despite a 0.59% decline in stock price, currently at $185.32, TSM remains a solid investment, given its indispensable role in global semiconductor production and AI hardware development.

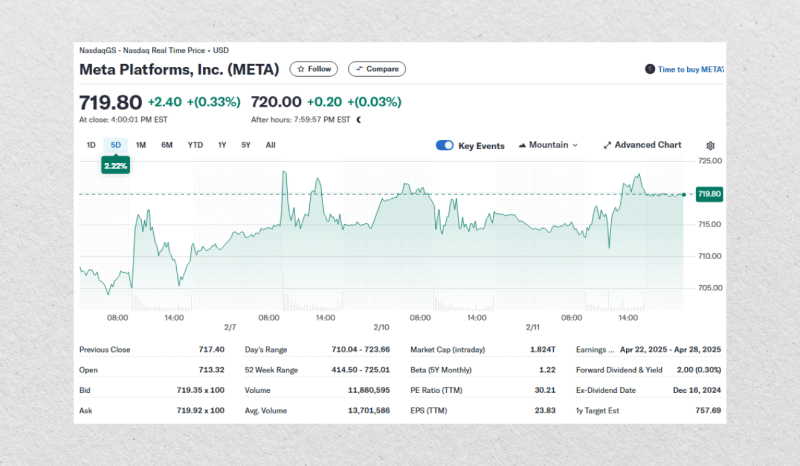

Meta Platforms, Inc. (META)

Meta has invested heavily in AI to enhance its core products, including Facebook, Instagram, and WhatsApp, while expanding into AI-powered virtual and augmented reality experiences. The company’s AI-driven recommendation algorithms have improved user engagement and advertising revenue, helping it achieve a 15% revenue growth in 2024, with total earnings reaching $117 billion.

Meta’s AI-powered metaverse initiatives also continue to evolve, integrating generative AI and virtual assistants. With its stock rising 1.72% to $458.82, Meta remains a strong AI stock to watch for long-term growth, particularly in AI-powered content creation and social media automation.

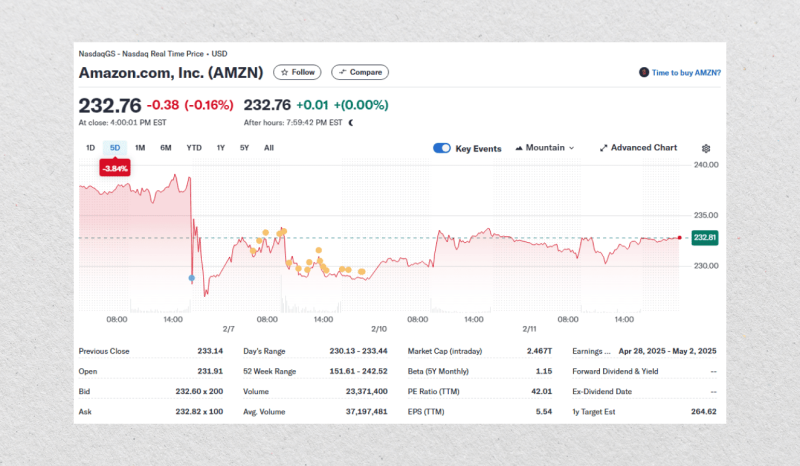

Amazon.com Inc. (AMZN)

Amazon has seamlessly integrated AI across its e-commerce, logistics, and cloud computing operations. Its AI-driven recommendation engines, warehouse automation, and AI-powered logistics systems have optimized efficiency and increased customer retention.

Moreover, Amazon Web Services (AWS) remains a dominant player in AI cloud computing, providing global machine learning services to enterprises.

The company’s strong AI integration contributed to steady revenue growth despite a 0.15% dip in stock price to $232.76. Amazon’s continued investment in AI-powered supply chain automation and AI-driven customer experiences ensures its competitive edge in multiple industries.

Conclusion

The AI industry is experiencing unprecedented growth, creating exciting investment opportunities for those who want to capitalize on cutting-edge innovations. Companies like NVIDIA, Microsoft, Meta, Amazon, and TSMC are at the forefront of AI advancements, making them some of the top AI companies to invest in 2025.

However, investing in AI stocks requires careful financial health analysis, as well as industry trends and regulatory landscapes. As AI continues to evolve, staying informed about the best AI companies to invest in will help investors navigate the market and seize long-term opportunities in this high-growth sector.

FAQ

What are the best AI companies to invest in for 2025?

Some top AI companies to invest in include NVIDIA, Microsoft, Meta, Amazon, AMD, and Palantir, leading AI innovations across various industries.

Why is AI a good investment in 2025?

AI is driving advancements in cloud computing, automation, healthcare, and semiconductor technology, making AI stocks attractive due to their high growth potential and increasing enterprise adoption, AI stocks are attractive.

What are the risks of investing in AI stocks?

AI stocks can be volatile due to high valuations, regulatory changes, and rapid technological shifts.

Which AI companies are leading in generative AI?

OpenAI (Microsoft), Alphabet (Google Gemini), and Adobe (Firefly AI) are leading generative AI innovations, driving growth in content creation and AI automation.

What sectors are benefiting most from AI investments?

AI is revolutionizing healthcare, finance, cybersecurity, autonomous vehicles, and cloud computing, making AI stocks diverse and profitable investment options.